NY DTF IT-245 2022 free printable template

Show details

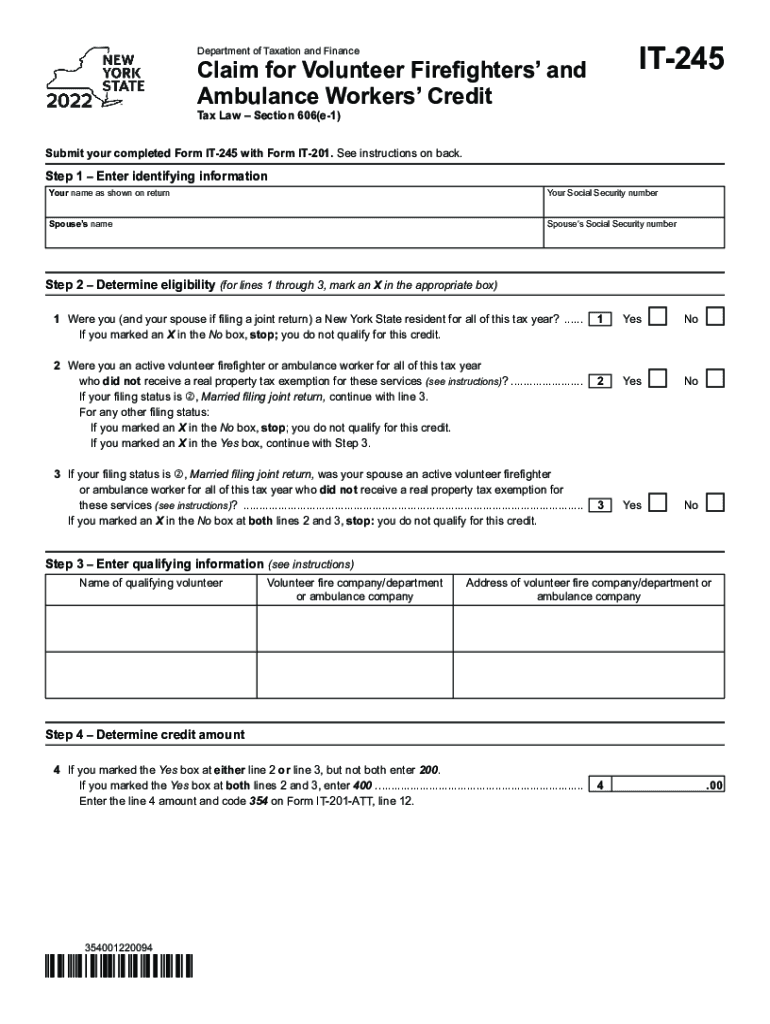

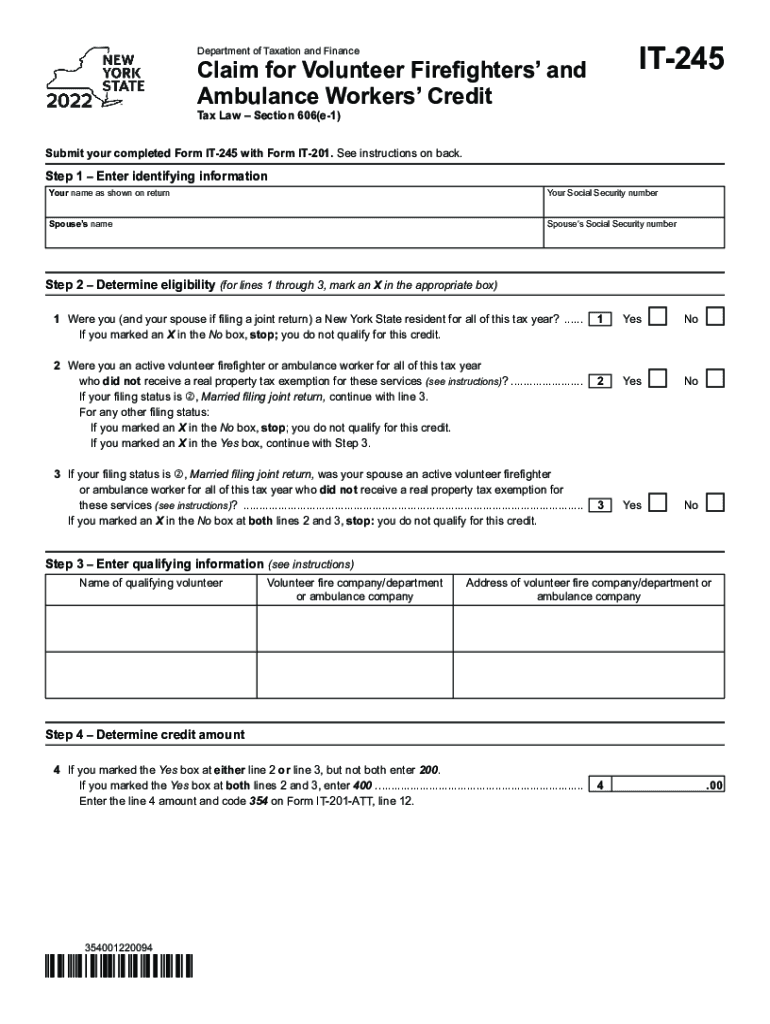

Department of Taxation and FinanceClaim for Volunteer Firefighters and

Ambulance Workers CreditIT245Tax Law Section 606(e1)Submit your completed Form IT245 with Form IT201. See instructions on back.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF IT-245

Edit your NY DTF IT-245 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF IT-245 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF IT-245 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY DTF IT-245. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-245 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF IT-245

How to fill out NY DTF IT-245

01

Download the NY DTF IT-245 form from the New York State Department of Taxation and Finance website.

02

Provide your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) in the appropriate section.

04

Report your total income as instructed on the form, including wages, interest, and dividends.

05

Fill in any adjustments as required, such as contributions to retirement accounts or education expenses.

06

Calculate your New York State tax liability based on the provided tax tables.

07

Claim any available credits or deductions that apply to your situation.

08

Review the completed form for accuracy.

09

Sign and date the form before submission.

10

Submit the completed form to the appropriate tax authority as specified in the instructions.

Who needs NY DTF IT-245?

01

Anyone who is a resident of New York State and received certain types of income, such as income from employment, must fill out NY DTF IT-245.

02

Individuals who are claiming refundable credits or deductions related to their New York State tax filings may also need this form.

03

Taxpayers who are required to report their New York State tax credits or have specific adjustments that impact their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

Are there any benefits to being a firefighter?

Benefits firefighters can receive include health and dental insurance coverage and disability payments should they be injured on the job. If they belong to labor unions, firefighters can also receive job security and negotiated wages.

Are volunteer firefighters allowed to leave work for a call in NY?

Volunteers are not excused from work for routine responses, such as individual fires. Volunteer firefighters and EMS workers must have provided their employers with written documentation detailing their membership in a fire department or volunteer ambulance corps.

Do you have to pull over for blue lights in New York State?

On Parkways and other controlled access highways with multiple lanes, when approaching an emergency vehicle that displays red or any combination of red, white or blue emergency lighting, or a hazard vehicle displaying flashing amber lighting, or a vehicle displaying blue or green lighting, drivers must move from the

Are firefighter pensions good?

The majority of states require firefighters to reach fifty-five with at least twenty-five years of active service to receive their defined benefits once they retire. The standard retirement benefit that a firefighter will receive monthly is about half of what the firefighter's base pay was while actively working.

What benefits do volunteer firefighters get in NY?

Volunteer firefighters enjoy tangible benefits, including free training and equipment, tax breaks and essential insurance coverage under the Volunteer Firefighter Benefits Law (VFBL) of New York State. Young volunteers can earn scholarships and tuition reimbursement for college.

Do NY volunteer firefighters get paid?

Volunteer firefighters freely volunteer their efforts as a way of serving and giving back to their community. They often do not receive monetary compensation from the fire department.

Does New York have volunteer firefighters?

The volunteer fire service isn't just a calling, it's a legacy that reaches back to the Volunteer Fire Department of the City of New York. In the centuries since, the volunteer fire service of the State of New York has become a community of first responders ready for any emergency.

Do you have to pull over for volunteer firefighters in NY?

ALBANY, N.Y. (WIVB) — New York's “Move-Over” law has been expanded. After Gov. Andrew Cuomo signed new legislation in 2016, the law now require drivers to slow down and move over a lane when volunteer firefighter vehicles or ambulances with green and blue flashing lights are headed toward an emergency.

Do volunteer firefighters get a pension in NY?

S8692 (ACTIVE) - Sponsor Memo amends the retirement and social security law by adding a new article 20-a which provides members of the volunteer fire service with the opportunity to earn credit in the state pension system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY DTF IT-245 online?

The editing procedure is simple with pdfFiller. Open your NY DTF IT-245 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the NY DTF IT-245 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NY DTF IT-245 in seconds.

How do I complete NY DTF IT-245 on an Android device?

Use the pdfFiller mobile app to complete your NY DTF IT-245 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NY DTF IT-245?

NY DTF IT-245 is a form used by taxpayers in New York State to report New York State unincorporated business tax (UBT) credits.

Who is required to file NY DTF IT-245?

Businesses operating as sole proprietorships, partnerships, or limited liability companies (LLCs) in New York City that meet certain thresholds are required to file NY DTF IT-245.

How to fill out NY DTF IT-245?

To fill out NY DTF IT-245, taxpayers need to provide information about their business income, applicable UBT credits, and total tax owed, following the instructions provided on the form.

What is the purpose of NY DTF IT-245?

The purpose of NY DTF IT-245 is to allow eligible businesses to claim credits against their New York City unincorporated business tax liability.

What information must be reported on NY DTF IT-245?

Taxpayers must report their business income, any UBT credits they are claiming, and other relevant tax information on NY DTF IT-245.

Fill out your NY DTF IT-245 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-245 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.