MA Schedule C 2022 free printable template

Show details

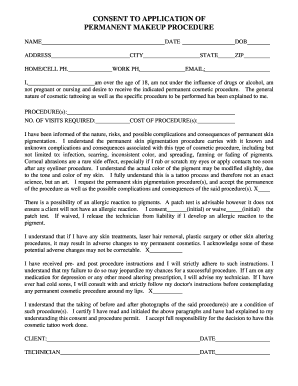

Ovals must be filled in completely. Example:If any line shows a loss, mark an X in box at left of the line. Schedule C Massachusetts Profit or Loss from BusinessFIRST NAME2022M. I.LAST ASOCIAL SECURITY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA Schedule C

Edit your MA Schedule C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA Schedule C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA Schedule C online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MA Schedule C. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA Schedule C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA Schedule C

How to fill out MA Schedule C

01

Gather all necessary documents including income statements and expense receipts related to your business.

02

Obtain a copy of the MA Schedule C form.

03

Fill out your business name and address in the appropriate sections.

04

Report your total income from your business on the form.

05

List all deductible expenses, such as supplies, equipment, and other business costs.

06

Calculate your net profit or loss by subtracting your total expenses from your total income.

07

Complete any additional sections as required based on your specific business activities.

08

Review your completed MA Schedule C for accuracy before submission.

09

File the completed MA Schedule C with your Massachusetts state tax return.

Who needs MA Schedule C?

01

Self-employed individuals reporting income from a sole proprietorship.

02

Freelancers or independent contractors who need to report their business income.

03

Small business owners who operate as a sole proprietorship.

04

Individuals who receive income from rentals or partnerships may also need to fill out this form.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate Massachusetts income tax?

The income tax rate in Massachusetts is 5.00%. That rate applies equally to all taxable income. Unlike with the federal income tax, there are no tax brackets in Massachusetts. State residents who would like to contribute more to the state's coffers also have the option to pay a higher income tax rate.

What is Massachusetts Schedule C?

You need to file a Schedule C if: You're a sole proprietor. You received a Form 1099-MISC or a Form 1099-K for self-employment income. You received a Form 1099-NEC for nonemployee compensation. You received a Form W-2, Wage and Tax Statement as a "Statutory Employee" (oval on Massachusetts Schedule C must be filled in)

What is Massachusetts Schedule B?

Schedule B Interest, Dividends and Certain Capital Gains and Losses 2022.

What is Schedule D in Massachusetts?

Schedule D Long-Term Capital Gains and Losses Excluding Collectibles and pre-1996 installment sales. 2021.

What is Massachusetts Statutory Schedule C?

Schedule C is provided to report income and deductions from each business or profession operated as a sole proprietor- ship. A copy of U.S. Schedule C (or Schedule F for farm income) and U.S. Form 4562 (Depreciation and Amortization) must be filed with the Mass. Schedule C.

What is Massachusetts Part C tax?

A taxpayer having any of those deductions remaining after applying such deductions against Part B income may apply these excess deductions against Part C (5%) income. The excess of these deductions over Part B and C income then may be offset against Part A income to the extent allowed by G.L. c.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MA Schedule C without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including MA Schedule C, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I fill out MA Schedule C on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MA Schedule C. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete MA Schedule C on an Android device?

Complete MA Schedule C and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is MA Schedule C?

MA Schedule C is a form used in Massachusetts for reporting income earned from self-employment or business activities.

Who is required to file MA Schedule C?

Individuals who earn income from self-employment or operate a business in Massachusetts are required to file MA Schedule C.

How to fill out MA Schedule C?

To fill out MA Schedule C, one must provide details of the business, income earned, and expenses incurred during the tax year, and then calculate the net income.

What is the purpose of MA Schedule C?

The purpose of MA Schedule C is to accurately report income and expenses from self-employment, ensuring that individuals comply with state tax obligations.

What information must be reported on MA Schedule C?

MA Schedule C requires reporting of business name, address, type of business, gross income, and expenses including cost of goods sold, advertising, and other operational costs.

Fill out your MA Schedule C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA Schedule C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.