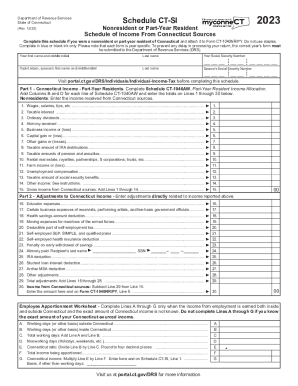

CT DRS Schedule CT-SI 2022 free printable template

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

How to fill out CT DRS Schedule CT-SI

About CT DRS Schedule CT-SI 2022 previous version

What is CT DRS Schedule CT-SI?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about CT DRS Schedule CT-SI

What should I do if I notice an error after submitting my connecticut schedule?

If you discover an error after filing your connecticut schedule, you can submit an amended return to correct the mistake. Make sure to indicate that the submission is an amended schedule and provide necessary documentation to support the changes. It's also advisable to retain a copy of the original and the amended forms for your records.

How can I verify the status of my connecticut schedule submission?

To verify the status of your connecticut schedule submission, you can access the state’s online portal where you filed. This platform typically provides updates regarding processing status and any issues that may have arisen during e-filing. Be sure to have your confirmation number handy for quicker access.

Are there any common errors that lead to e-file rejections for connecticut schedules?

Common e-file rejections for connecticut schedules often stem from discrepancies in personal information, such as name or Social Security number mismatches. Ensuring that all data matches IRS records can significantly reduce these errors. Additionally, checking for incomplete fields or incorrect formatting can help avoid rejections.

What should I do if I receive a notice about my connecticut schedule after filing?

If you receive a notice regarding your connecticut schedule, carefully review the correspondence for specific details on the required action. Typically, you may need to respond with additional documentation or clarification. Prompt responses are crucial to resolve any issues effectively and prevent further complications.

Can I e-file my connecticut schedule using mobile devices?

Yes, you can e-file your connecticut schedule using mobile devices, provided that the software or application you are using is compatible with mobile platforms. Ensure that your device meets any specific technical requirements outlined by the e-filing system to facilitate a smooth submission process.