Get the free kansas schedule s

Show details

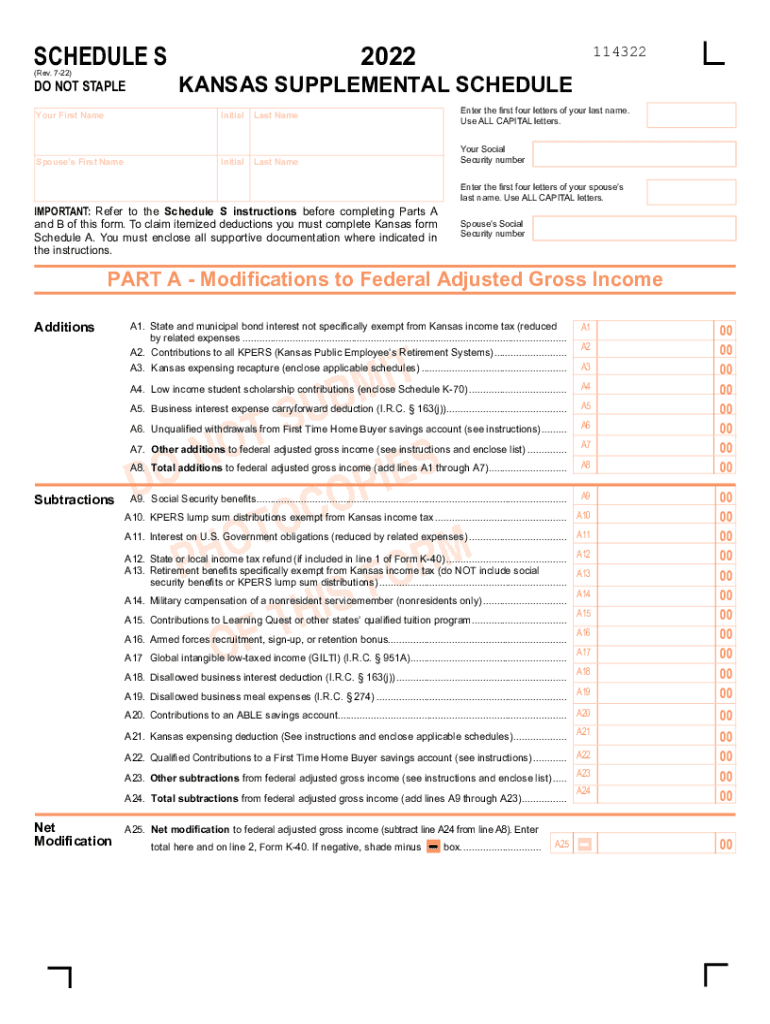

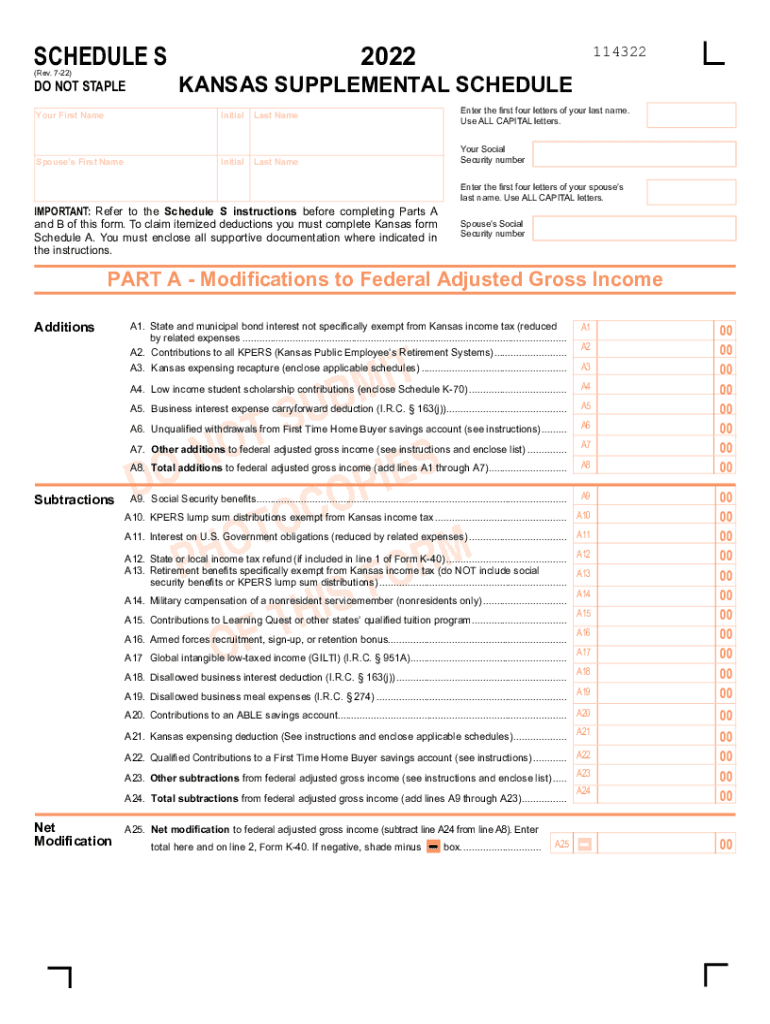

SCHEDULE S

(Rev. 722)DO NOT STAPLE2022114322KANSAS SUPPLEMENTAL Scheduler First NameInitialLast Espouses First NameInitialLast NameIMPORTANT: Refer to the Schedule S instructions before completing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kansas schedule s

Edit your kansas schedule s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas schedule s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas schedule s online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kansas schedule s. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kansas schedule s

How to fill out KS DoR Schedule S

01

Gather all relevant tax documents and income statements.

02

Obtain a copy of the KS DoR Schedule S form from the Kansas Department of Revenue website.

03

Begin by filling out your personal information at the top of the form, including your name, address, and Social Security number.

04

Locate the section for reporting your adjusted gross income and fill in the appropriate figures.

05

Complete the section for itemized deductions or standard deduction, depending on your situation.

06

If applicable, report any Kansas-specific income adjustments.

07

Review your filled form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs KS DoR Schedule S?

01

Individuals or businesses that have income sourced from Kansas and need to report it for state tax purposes.

02

Taxpayers who are required to calculate their Kansas taxable income and apply for deductions or credits as applicable.

03

Residents and non-residents with Kansas source income.

Fill

form

: Try Risk Free

People Also Ask about

What is s schedule?

Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.

What is considered Kansas source income?

Kansas source income includes all income earned while a Kansas resident; income from services performed in Kansas Kansas lottery, pari-mutuel, and gambling winnings; income from real or tangible personal property located in Kansas; income from a business, trade, profession or occupation operating in Kansas,

What is the standard deduction for seniors over 65 in 2022?

Example 2: Ellen is single, over the age of 65, and not blind. For 2022, she'll get the regular standard deduction of $12,950, plus one additional standard deduction of $1,750 for being a single filer over age 65. Her total standard deduction amount will be $14,700.

What retirement benefits are exempt from Kansas income tax?

Other common Kansas pension plan retirement benefits that are not taxable on the Kansas return are Kansas Police and Fireman's Retirement System Pensions, Kansas Teacher's Retirement Annuities, Kansas Highway Patrol pensions, Justices and Judges Retirement system, Board of Public Utilities and State Board of Regents.

What is Schedule S used for?

Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.

Can you take a standard deduction on federal itemize on Kansas?

Itemized Deductions. Individual taxpayers may choose to either itemize their individual nonbusiness deductions or claim a standard deduction. If your Kansas itemized deductions are greater than the Kansas standard deduction for your filing status, it will be to your advantage to complete and file Kansas Schedule A.

What is the standard deduction for KS?

For most taxpayers, the 2021 standard deduction amounts are: Single: $3,500. Married filing separately: $4,000. Head of household: $6,000.

What is the new standard deduction for 2022?

2022 Standard Deduction Amounts Filing Status2022 Standard DeductionSingle; Married Filing Separately$12,950Married Filing Jointly; Qualifying Widow(er)$25,900Head of Household$19,400 Dec 5, 2022

What are the Kansas tax brackets for 2022?

Individual Income Tax taxable income not over $30,000: 3.1 % (K.S.A. 79-32,110) taxable income over $30,000 but not over $60,000: $930 plus 5.25 % of excess over $30,000 (K.S.A. 79-32,110) taxable income over $60,000: $2,505 plus 5.7 % of excess over $60,000 (K.S.A. 79-32,110)

What is a Schedule S for Kansas?

These are items of income that are not taxed or included on your Federal return but are taxable to Kansas. Enter interest income received, credited, or earned by you during the taxable year from any state or municipal obligations such as bonds and mutual funds.

What is the standard deduction for individuals over 65?

Taxpayers who are at least 65 years old or blind can claim an additional standard deduction of $1,500 is allowed for 2023 ($1,850 if you're claiming the single or head of household filing status). As with the 2022 standard deduction, the additional deduction amount is doubled if you're both 65 or older and blind.

What is a supplemental schedule for taxes?

Supplemental wages These wages generally include commissions and bonuses, any severance payments upon termination of your employment, taxable prizes and awards, retroactive pay increases, reimbursements of nondeductible moving expenses, taxable fringe benefits and certain kinds of expense reimbursements and allowances.

Do I have to file a Québec tax return?

You may have to file an income tax return in Québec even if you are a resident of another province or a territory of Canada for tax purposes on December 31 of a particular year. For more information, see Your Tax Obligations as a Resident of Another Province or a Territory of Canada.

What is the tax schedule?

A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. These commonly include things like significant amounts of interest income, mortgage interest or charitable contributions.

What are the standard deduction amounts for Kansas?

Effective for tax years beginning after 2020, Kansas increases the standard deduction to: $3,500 for single taxpayers; $6,000 for heads of households; and. $8,000 for married taxpayers filing jointly.

Where can I pick up Québec tax forms?

Quebec corporate income tax forms Corporate tax forms are available from the Quebec Revenue Ministry website.

What is the Kansas standard deduction for 2022?

(2) For tax year years 2021 and 2022, and all tax years thereafter, the standard deduction amount of an individual, including husband and wife who are either both residents or who file a joint return as if both were residents, shall be as follows: Single individual filing status, $3,500; married filing status, $8,000;

What is the standard deduction for seniors this year?

For 2022, they'll get the regular standard deduction of $25,900 for a married couple filing jointly. They also both get an additional standard deduction amount of $1,400 per person for being over 65. They get one more $1,400 standard deduction because Susan is blind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the kansas schedule s form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign kansas schedule s and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete kansas schedule s on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your kansas schedule s. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete kansas schedule s on an Android device?

Use the pdfFiller mobile app to complete your kansas schedule s on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is KS DoR Schedule S?

KS DoR Schedule S is a tax form used in Kansas that reports specific information regarding non-resident income that is taxable in the state.

Who is required to file KS DoR Schedule S?

Non-residents who have income sourced from Kansas are required to file KS DoR Schedule S.

How to fill out KS DoR Schedule S?

To fill out KS DoR Schedule S, taxpayers must provide their personal information, report their Kansas-source income, and calculate the tax owed based on that income.

What is the purpose of KS DoR Schedule S?

The purpose of KS DoR Schedule S is to ensure that non-residents accurately report their income earned in Kansas and pay the appropriate state income tax.

What information must be reported on KS DoR Schedule S?

Taxpayers must report their name, address, non-resident status, Kansas-source income details, and any deductions or credits applicable to income earned in Kansas.

Fill out your kansas schedule s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Schedule S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.