NY 579-GCT 2022 free printable template

Show details

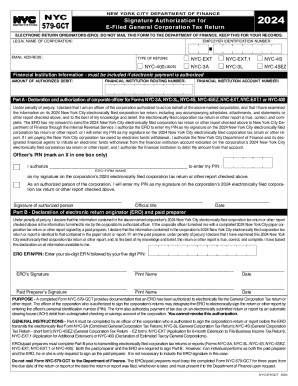

NYC579GCTNEW YORK CITY DEPARTMENT OF FINANCE2022Signature Authorization for Filed General Corporation Tax ReturnELECTRONIC RETURN ORIGINATORS (ERO): DO NOT MAIL THIS FORM TO THE DEPARTMENT OF FINANCE.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY 579-GCT

Edit your NY 579-GCT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY 579-GCT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY 579-GCT online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY 579-GCT. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY 579-GCT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY 579-GCT

How to fill out NY 579-GCT

01

Obtain the NY 579-GCT form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Enter the tax year for which you are filing the form.

04

Complete the sections regarding your income and any deductions you are claiming.

05

Provide detailed explanations and calculations as required by specific sections of the form.

06

Review the filled out form for accuracy and completeness.

07

Sign and date the form before submitting it.

08

Submit the completed form to the designated tax office or through the appropriate electronic filing method.

Who needs NY 579-GCT?

01

Anyone who is required to report and pay New York State income tax on their incomes, including residents, non-residents, and part-year residents.

02

Taxpayers who have specific deductions or credits related to their income that need to be reported.

03

Individuals who have business income or are involved in business activities subject to state tax.

Fill

form

: Try Risk Free

People Also Ask about

What is Form NYC 579 EMP?

PURPOSE - A completed Form NYC-579-EMP provides documentation that an ERO has been authorized to electronically file Form NYC-1127. The employee may designate the ERO to electronically sign the Form NYC-1127 by entering the employeeʼs personal identification number (PIN).

What is the NYC-1127 wage and tax statement?

Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. This form calculates the City waiver liability, which is the amount due as if the filer were a resident of NYC.

What is the NYC efile authorization form?

Form TR-579-IT must be completed to authorize an ERO to e-file a personal income tax return and to transmit bank account information for the electronic funds withdrawal.

What is the GCT tax rate in NYC?

GCT Tax Rates Entire net income base — 8.85 percent of entire net income. Total capital base — 0.15 percent of business and investment capital. There are numerous variables to consider with this method.

What is tax base in business?

The tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

What is the business income base tax in NY?

Fixed dollar minimum tax for general business taxpayers For a corporation with New York State receipts of:TaxNot more than $100,000$25More than $100,000 but not over $250,000$75More than $250,000 but not over $500,000$175More than $500,000 but not over $1,000,000$5008 more rows • Jan 9, 2023

What is the LLC income tax rate in NY?

For New York limited liability companies, limited liability partnerships, and general partnerships, corporate income tax is referred to simply as a “filing fee.”Entire Net Income. Federal Taxable IncomeENI Tax Rate$290,000 or less6.5%more than $290,000 but not more than $390,0007.1%More than $390,0004.35%

What is the GCT rate in NYC?

GCT Tax Rates Entire net income base — 8.85 percent of entire net income. Total capital base — 0.15 percent of business and investment capital.

How is NYC GCT calculated?

GCT Tax Rates Entire net income base — 8.85 percent of entire net income. Total capital base — 0.15 percent of business and investment capital. Alternative tax base — 8.85 percent of 15 percent of net income + the amount of compensation paid to any individual who owned more than 5 percent of the payer's capital stock.

What is the tax rate for S Corp franchise in NY?

Generally, corporations operating in New York incur a tax rate of 6.5 percent if their federal taxable income is $290,000 or less. This is with the exception of a few New York manufactures that have qualified for a flat 6.5 percent rate regardless.

How is NYS capital base tax calculated?

The tax rate on the capital base is . 1875% for tax years beginning on or after January 1, 2021 and before January 1, 2024, and 0% for tax years beginning on or after January 1, 2024.

How do you calculate base tax rate?

The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings (or income earned) before taxes. Tax expense is usually the last line item before the bottom line—net income—on an income statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY 579-GCT?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the NY 579-GCT in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit NY 579-GCT in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NY 579-GCT and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit NY 579-GCT on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit NY 579-GCT.

What is NY 579-GCT?

NY 579-GCT is the New York State General Corporation Tax Return, which is used by corporations to report their income, deductions, and tax liability to the state.

Who is required to file NY 579-GCT?

Corporations that conduct business in New York State and are subject to the General Corporation Tax are required to file NY 579-GCT.

How to fill out NY 579-GCT?

To fill out NY 579-GCT, a corporation needs to gather financial information such as revenue, expenses, and tax credits, and then follow the instructions provided in the form to report this information accurately.

What is the purpose of NY 579-GCT?

The purpose of NY 579-GCT is to assess the tax liability of corporations operating in New York and ensure compliance with state tax laws.

What information must be reported on NY 579-GCT?

NY 579-GCT requires the reporting of income, expenses, tax credits, and other relevant financial information related to the corporation's operations within the state.

Fill out your NY 579-GCT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY 579-GCT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.