KY W-1 - Louisville 2022 free printable template

Show details

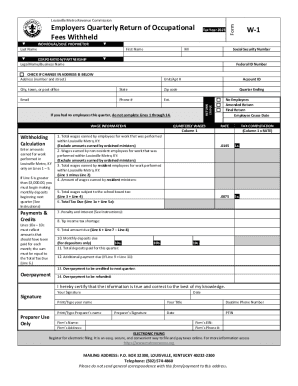

Louisville Metro Revenue CommissionEmployers Quarterly Return of Occupational Fees Withheld

INDIVIDUAL/ SOLE PROPRIETOR

Last name

CORPORATION/ PARTNERSHIP

Legal name/ Business nameForm2022First nameAccount

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY W-1 - Louisville

Edit your KY W-1 - Louisville form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY W-1 - Louisville form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY W-1 - Louisville online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY W-1 - Louisville. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY W-1 - Louisville Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY W-1 - Louisville

How to fill out KY W-1 - Louisville

01

Obtain the KY W-1 form from the Kentucky Department of Revenue website or local office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide your Social Security number and other identification information as required.

04

Complete the income section, detailing all sources of income as specified on the form.

05

Include any additional information or documentation requested, such as deductions or credits.

06

Review the form for accuracy and completeness before submitting.

07

Submit the completed form to the appropriate local tax authority or the Kentucky Department of Revenue.

Who needs KY W-1 - Louisville?

01

Individuals or businesses who are required to report income in Louisville, Kentucky.

02

Residents of Kentucky seeking to comply with state income tax regulations.

03

Taxpayers who have income from various sources that need to be documented for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What forms do I need from my employer to file taxes?

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck.

Does Jefferson County KY have a local tax?

The minimum combined 2022 sales tax rate for Jefferson County, Kentucky is 6%.

Does Louisville Ky have local income tax?

Resident employees-Employees who work and live in Louisville Metro, Kentucky, are subject to a tax rate of 2.2% (. 0220).

Does Jefferson County have a local income tax?

0.35% Residents of Jefferson County pay a flat county income tax of 0.35% on earned income, in addition to the Indiana income tax and the Federal income tax. Nonresidents who work in Jefferson County also pay a local income tax of 0.35%, the same as the local income tax paid by residents.

What is a W-2 form who provides it and when should an employee receive it?

Form W-2. Employers must complete, file electronically or by mail with the Social Security Administration (SSA), and furnish to their employees Form W-2, Wage and Tax StatementPDF showing the wages paid and taxes withheld for the year for each employee.

What IRS forms do new employees need to fill out?

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

Does Kentucky have a local income tax?

Kentucky Tax Rates, Collections, and Burdens Kentucky has a flat 5.00 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Kentucky has a 5.00 percent corporate income tax rate. Kentucky has a 6.00 percent state sales tax rate and does not levy any local sales taxes.

What are the 3 tax forms?

The 13 Most Common Tax Forms Form 1040, U.S. Individual Income Tax Return. Form 1040-SR, U.S. Tax Return for Seniors. Form W-2, Wage and Tax Statement. Form W-4, Employee's Withholding Certificate. Form W-4P, Withholding Certificate for Pension or Annuity Payments. Form 1099-MISC, Miscellaneous Income.

What states allow local income tax?

States with local income tax Alabama. Arkansas. California. Colorado. Delaware. Indiana. Iowa. Kentucky.

Does Kentucky have a state withholding form?

If you meet any of the four exemptions you are exempted from Kentucky withholding. However, you must complete this form and file it with your employer before withholding can be stopped. You will need to maintain a copy of the K-4 for your permanent records.

Does Louisville have local income tax?

The City of Louisville imposes a local tax of 2% on all income earned while resident and or working within the city limits. A reduced credit of 60% for taxes paid to other municipalities, which shall not exceed a maximum of one and two-tenths percent (1.2%) of the taxpayer's taxable income in such other municipality.

Do I have to file a KY local tax return?

Do I need to file a Kentucky tax return? A. No, you do not have a filing requirement with Kentucky because your modified gross income is not greater than $12,880; however, you will need to file a return to claim a refund of any Kentucky income tax withheld.

Are employers required to withhold local taxes in Kentucky?

Like most states, Kentucky has certain taxes that companies must pay. Kentucky does not levy local taxes, however, so you only need to be concerned with state taxes.

Do I have to file a Ky local tax return?

Do I need to file a Kentucky tax return? A. No, you do not have a filing requirement with Kentucky because your modified gross income is not greater than $12,880; however, you will need to file a return to claim a refund of any Kentucky income tax withheld.

Does Jefferson County Kentucky have an income tax?

There are two basic tax rates that apply to wages earned within the City and County. 1. Employees who live in Louisville and Jefferson County, Ky. are subject at a combined rate of 2.2%.

What is a w1 form?

W-1. The form W-1, Return of Income Tax Withheld on Wages, was the original form used to report Federal income tax withholding.

What states don't have local income tax?

Which Are the Tax-Free States? As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Can I file my Kentucky state taxes online?

Kentucky is now offering KY File, a new way to file your current year return free of charge. It allows you to: Select the Kentucky income tax forms and schedules that you need. Fill in your tax information online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KY W-1 - Louisville without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your KY W-1 - Louisville into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my KY W-1 - Louisville in Gmail?

Create your eSignature using pdfFiller and then eSign your KY W-1 - Louisville immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit KY W-1 - Louisville straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing KY W-1 - Louisville, you can start right away.

What is KY W-1 - Louisville?

KY W-1 - Louisville is a state tax form used in Kentucky for reporting various employee wages and withholding tax information for the City of Louisville.

Who is required to file KY W-1 - Louisville?

Employers who have employees working in Louisville and are subject to local income tax withholding are required to file the KY W-1 form.

How to fill out KY W-1 - Louisville?

To fill out KY W-1, employers need to provide information such as the business name, address, federal employer identification number, employee details, total wages paid, and the amount of taxes withheld.

What is the purpose of KY W-1 - Louisville?

The purpose of KY W-1 - Louisville is to report employee wages and taxes withheld to the city authorities, ensuring compliance with local tax laws.

What information must be reported on KY W-1 - Louisville?

KY W-1 requires reporting the employer's name and address, the employee's name and social security number, total wages paid, and the amount of local taxes withheld.

Fill out your KY W-1 - Louisville online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY W-1 - Louisville is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.