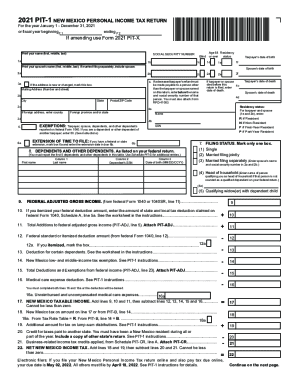

NM TRD PIT-1 2022 free printable template

Instructions and Help about NM TRD PIT-1

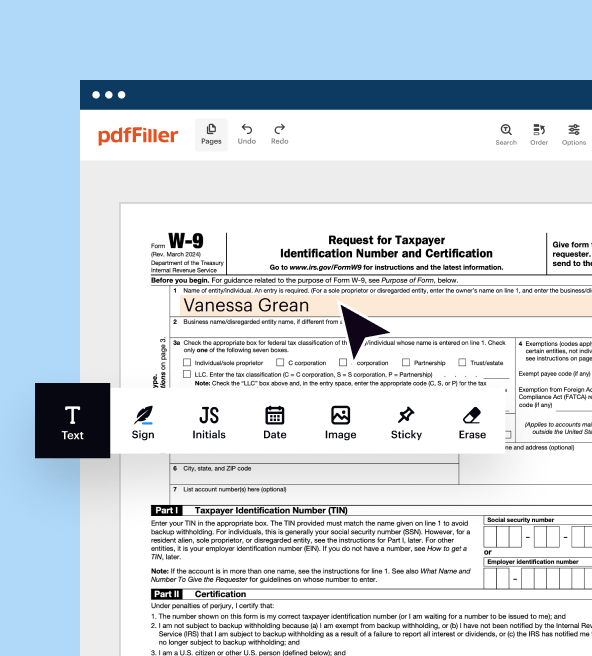

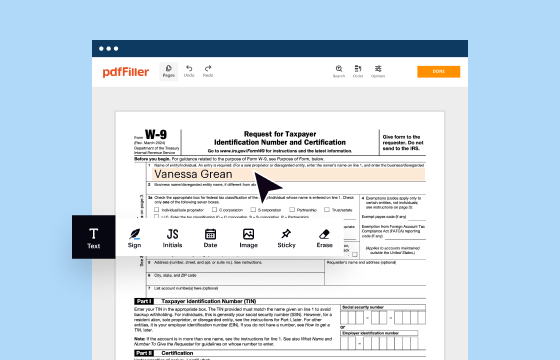

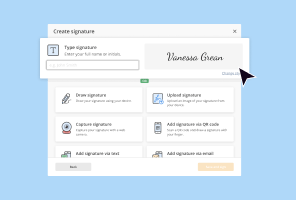

How to edit NM TRD PIT-1

How to fill out NM TRD PIT-1

About NM TRD PIT-1 2022 previous version

What is NM TRD PIT-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

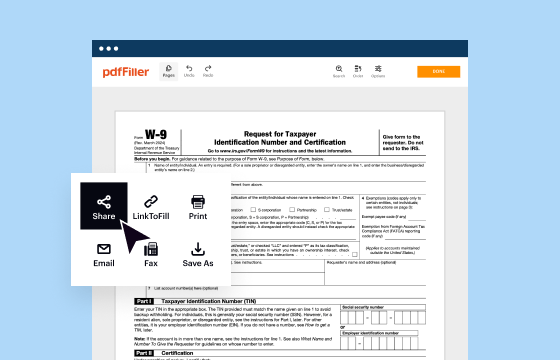

Is the form accompanied by other forms?

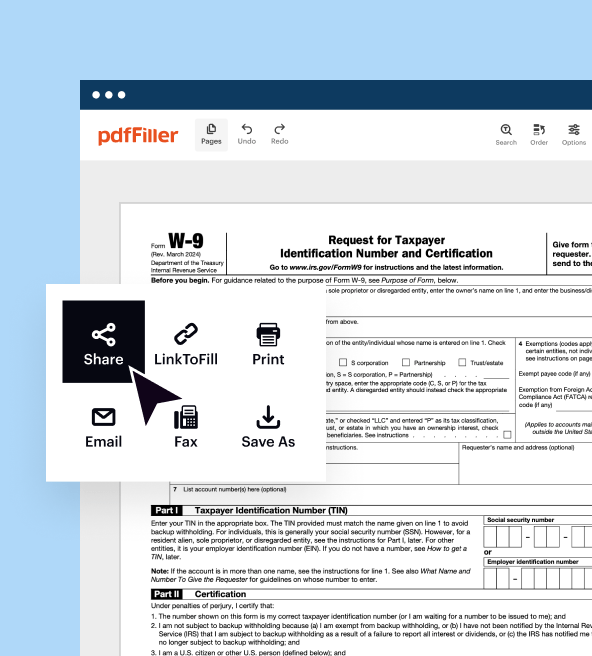

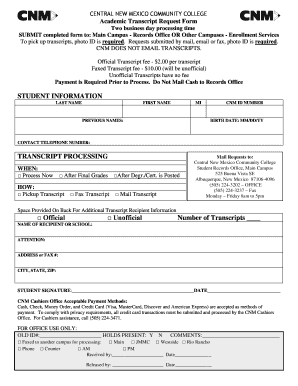

Where do I send the form?

FAQ about NM TRD PIT-1

How can I correct mistakes after filing my NM TRD PIT-1?

To correct mistakes on your NM TRD PIT-1 after submission, you need to file an amended return. This process allows you to adjust any incorrect information. Ensure to indicate clearly that it is an amendment, and provide all necessary corrected details.

How can I verify the status of my NM TRD PIT-1 submission?

You can verify the status of your NM TRD PIT-1 by checking the online portal provided by the New Mexico Taxation and Revenue Department. Look for confirmation of receipt and processing updates, which should help you track any ongoing issues.

What should I do if I receive a notice regarding my NM TRD PIT-1?

If you receive a notice related to your NM TRD PIT-1, it’s important to read it carefully and understand its requirements. Gather the necessary documentation, and follow the instructions outlined in the notice for addressing any concerns or discrepancies.

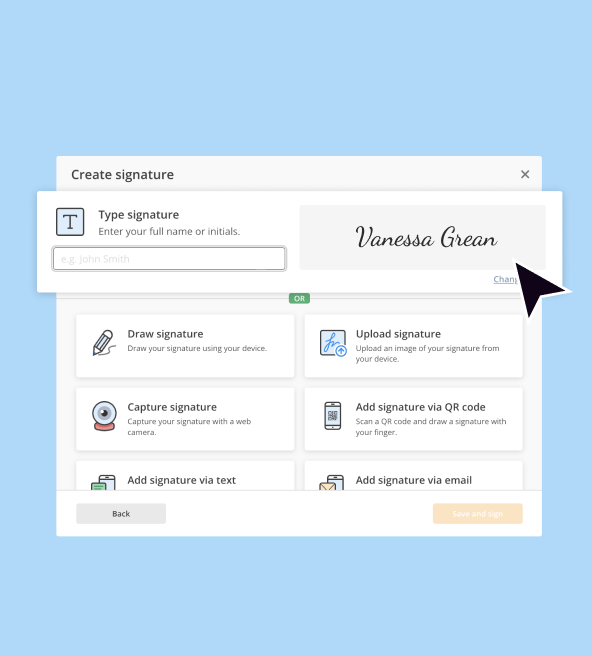

Are e-signatures accepted for filing the NM TRD PIT-1?

Yes, e-signatures are accepted for the NM TRD PIT-1 when e-filing. Ensure that your e-signature complies with the state’s requirements for authenticity and security to avoid processing delays.

What common errors should I be aware of when filing the NM TRD PIT-1?

Some common errors when filing the NM TRD PIT-1 include incorrect Social Security numbers, math mistakes, and missing signatures. Double-checking these details before submission can help prevent complications and the need for amendments.

See what our users say