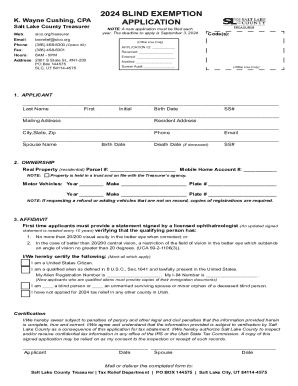

CO DR0021W 2022 free printable template

Show details

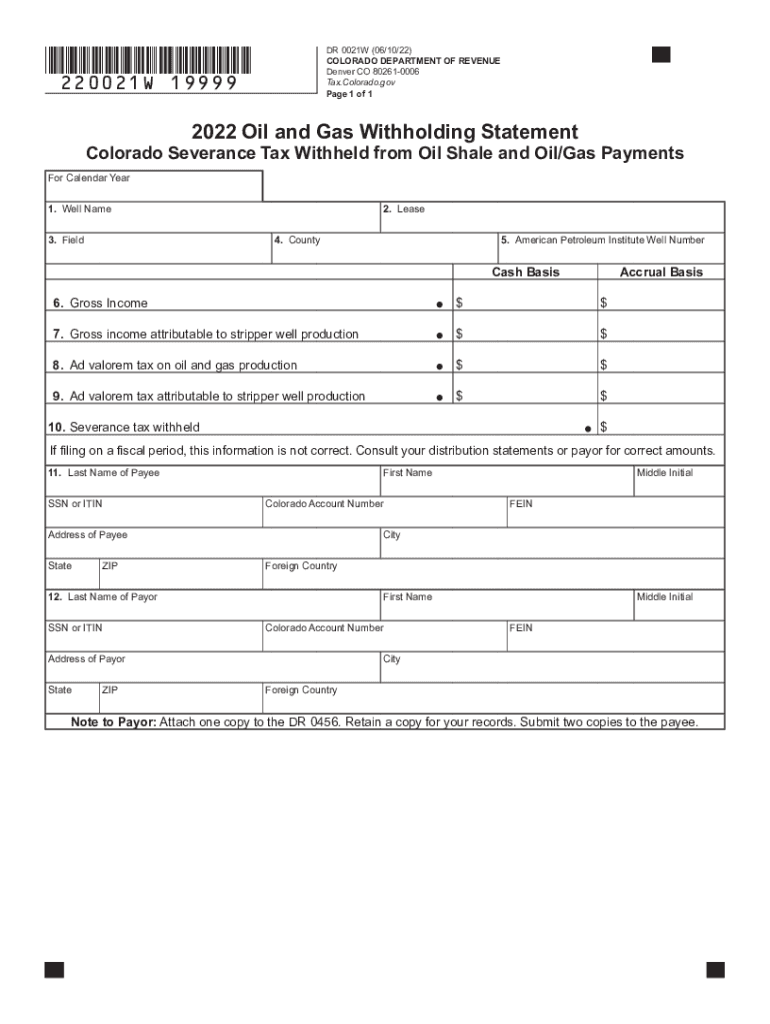

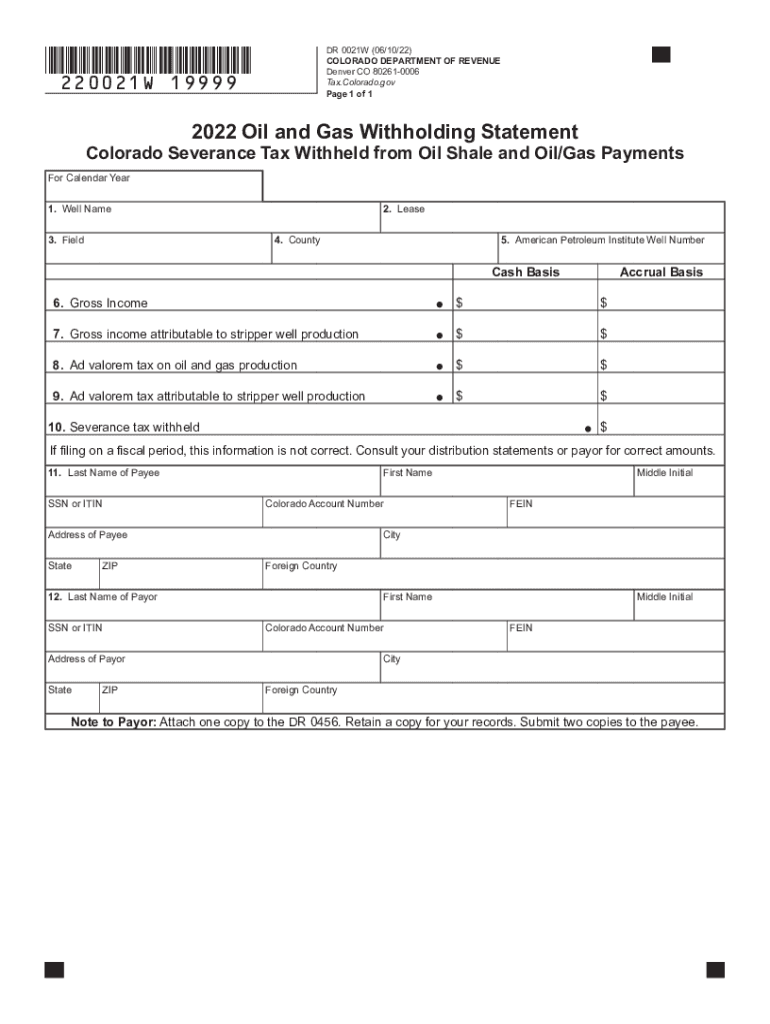

DO NOT SEND DR 0021W 06/10/22 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0006 Tax. Colorado. gov Instructions for Producers and First Purchasers Preparing DR 0021W for Severance Taxpayers See form on Page 2 Box 1-5 Enter the information requested. Line 6 Line 7 Enter the total gross income before 1 withholding ad valorem etc. made to the interest owner on both a cash basis and accrual basis. For cash basis report all payments made during the year even if they are for prior period...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR0021W

Edit your CO DR0021W form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR0021W form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DR0021W online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CO DR0021W. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR0021W Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DR0021W

How to fill out CO DR0021W

01

Gather necessary personal and financial information required for the CO DR0021W form.

02

Begin filling out the form by providing your name and contact details accurately.

03

Fill in your Social Security number or Employer Identification Number, as applicable.

04

Complete the sections related to income and expenses as required, making sure to provide accurate figures.

05

If applicable, provide details about any dependents or additional contributors to your financial situation.

06

Review your entries carefully to ensure all information is correct and complete.

07

Sign and date the form where indicated.

Who needs CO DR0021W?

01

Individuals or families applying for certain types of assistance, such as income-based programs.

02

Taxpayers who need to report specific financial information for eligibility purposes.

03

Anyone seeking to comply with state or federal requirements that necessitate completion of CO DR0021W.

Fill

form

: Try Risk Free

People Also Ask about

What is a Colorado Form dr21w?

What is a Colorado DR21-W form? The Colorado DR21-W is provided to interest owners who own an interest on a well where severance taxes were withheld and remitted to the state. The owner will receive a DR21-W on a lease by lease basis.

Does Colorado have an extension form?

Colorado offers an automatic six-month extension to file your income tax return if you cannot submit your return by the April 15 due date. This means that you can file your return by October 15. While there is an extension to file, there is not an extension to the payment due date.

Does Colorado have a state tax withholding form?

DR 0004. Colorado Employee Withholding Certificate – This form gives employees the option to adjust their Colorado wage withholding ing to their specific tax situation. If an employee does not submit this form, the employer will calculate their withholding based on their federal withholding certificate, form W-4.

What is form 7004 or 4868?

Most businesses use Form 7004 to file for an extension, but others need to file Form 4868. Here's the breakdown: Partnerships, multi-member LLCs, C corporations, & S corporations file Form 7004. Form 7004 is due for C corps and S corps on March 15, 2023, and April 18, 2023 for partnerships and multi-member LLCs.

Do I have to file a Colorado severance tax return?

You must complete and file a Colorado Oil & Gas Severance Tax Return (DR 0021) annually. The return and your payment are due on the 15th day of the fourth month after the close of the taxable year.

What is the form for a Colorado extension?

You must pay at least 90% of your tax liability with Form DR 0158-I by April 18 and the remainder by October 17 to avoid delinquent payment penalties. To calculate any tax due with Form DR 0158-I, visit Menu Path: Personal > 2022 Extension > Start your 2022 Extension.

Is there a state tax form for Colorado?

These 2021 forms and more are available: Colorado Form 104 – Personal Income Tax Return for Residents. Colorado Form 104PN – Personal Income Tax Return for Nonresidents and Part-Year Residents. Colorado Form 104CR – Individual Credit Schedule.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CO DR0021W from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including CO DR0021W. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute CO DR0021W online?

Easy online CO DR0021W completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out CO DR0021W on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your CO DR0021W. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is CO DR0021W?

CO DR0021W is a form used for reporting specific financial information to the Colorado Department of Revenue.

Who is required to file CO DR0021W?

Individuals or businesses that meet certain income thresholds or tax obligations as specified by the Colorado Department of Revenue are required to file CO DR0021W.

How to fill out CO DR0021W?

To fill out CO DR0021W, provide accurate financial data as required, including income and deductions, and follow the instructions on the form carefully.

What is the purpose of CO DR0021W?

The purpose of CO DR0021W is to ensure accurate reporting of income and tax liability for compliance with state tax laws in Colorado.

What information must be reported on CO DR0021W?

CO DR0021W requires information on income, deductions, tax credits, and any other financial details pertinent to the tax filing for individuals or businesses in Colorado.

Fill out your CO DR0021W online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO dr0021w is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.