MA PV 2022 free printable template

Show details

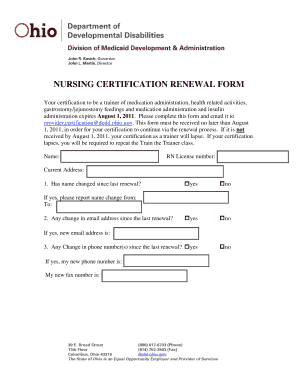

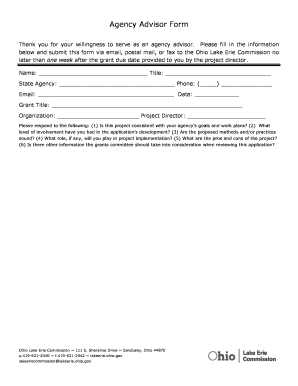

DETACH HERE2022 Form PV

Massachusetts Income Tax Payment Voucher

Payment for period end date (mm/dd/YYY) Tax type053Voucher type01ID type005Vendor code0001Name of taxpayerSocial Security numberAmount

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ma tax payment voucher

Edit your ma tax payment voucher form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ma tax payment voucher form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ma tax payment voucher online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ma tax payment voucher. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA PV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ma tax payment voucher

How to fill out MA PV

01

Obtain the MA PV form from the appropriate state department or website.

02

Read through the instructions provided with the form to understand the requirements.

03

Gather all necessary information such as personal identification details, contact information, and any relevant medical or financial data.

04

Fill out each section of the form, ensuring that all information is accurate and complete.

05

Review the completed form for any errors or missing information.

06

Sign and date the form as required.

07

Submit the form as instructed, either online, by mail, or in person, according to the guidelines provided.

Who needs MA PV?

01

Individuals applying for medical assistance in Massachusetts.

02

People seeking to enroll in state-sponsored health programs.

03

Residents of Massachusetts who are experiencing financial hardship and require aid.

Fill

form

: Try Risk Free

People Also Ask about

Why does my tax return have payment vouchers?

The IRS is modernizing its payment system. The Form 1040-V, Payment Voucher, is part of the modernization. If you have a balance due on your tax return, using the payment voucher will help the IRS process your payment more accurately and efficiently.

What is a voucher on tax return?

Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040 or 1040-NR.

What happens if you don't have cash to pay taxes?

If you don't qualify for an online payment plan, you may also request an installment agreement (IA) by submitting Form 9465, Installment Agreement RequestPDF, with the IRS. If the IRS approves your IA, a setup fee may apply depending on your income. Refer to Tax Topic No. 202, Tax Payment Options.

What is payment voucher give examples?

Any written documentation supporting the entries reported in the account books, indicating the transaction's accounting accuracy, can be referred to as a voucher. For example, a bill, invoice, receipt, salary and wages sheet, pay-in-slip counterfoil, cheque book counterfoil, or trust deed.

What are tax payment vouchers?

What Is Form 1040-V: Payment Voucher? Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order.

How do I pay my NY state taxes by check?

If you are paying New York State income tax by check or money order, you must include Form IT-201-V with your payment. Make your check or money order payable in U.S. funds to New York State Income Tax. Be sure to write the last four digits of your Social Security number (SSN), the tax year, and Income Tax on it.

Can I pay estimated taxes without a voucher?

To avoid penalties, the payment—by check or money order accompanied by the correct IRS voucher—must be postmarked by the due date. Or, online payments can be made without a voucher. For example, if you miss it by one day, you'll get a penalty.

Why am I getting estimated tax vouchers?

You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year. For example, you sold stock or took a large distribution from your retirement plan. You're not required to make estimated tax payments; we're just suggesting it based on the info in your return.

What does payment voucher mean?

Payment Vouchers are used to record payments owed to Vendors and to maintain payment history. Once posted, they can be added to Checks or Quick Checks for processing and printing checks.

Why do I have vouchers on my tax return?

You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year. For example, you sold stock or took a large distribution from your retirement plan. You're not required to make estimated tax payments; we're just suggesting it based on the info in your return.

What is a Massachusetts income tax payment voucher?

The purpose of the payment vouchers is to provide a means for paying any taxes due on income which is not subject to withhold- ing. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year.

What is a payment voucher?

A payment voucher is a way to record payments made to suppliers and maintain a history of payments that your business has made. Companies use vouchers to gather and file supporting documents that are required to approve and track payments of liabilities.

What is a 2022 Form 1040-ES payment voucher?

Purpose of This Package. Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

How does a tax voucher work?

Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. 1 The IRS has different filing centers that taxpayers can send their payments and 1040-V forms depending on where they live.

How do I make a check out to pay taxes?

If you choose to mail your tax payment: Make your check, money order or cashier's check payable to U.S. Treasury. Enter the amount using all numbers ($###. Do not use staples or paper clips to affix your payment to your voucher or return. Make sure your check or money order includes the following information:

Why am I being asked to pay estimated taxes?

If the amount of income tax withheld from your salary or pension is not enough, or if you receive income such as interest, dividends, alimony, self-employment income, capital gains, prizes and awards, you may have to make estimated tax payments.

Can I make estimated tax payments without a voucher?

To avoid penalties, the payment—by check or money order accompanied by the correct IRS voucher—must be postmarked by the due date. Or, online payments can be made without a voucher.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ma tax payment voucher directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ma tax payment voucher and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit ma tax payment voucher online?

With pdfFiller, it's easy to make changes. Open your ma tax payment voucher in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit ma tax payment voucher on an iOS device?

Create, modify, and share ma tax payment voucher using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is MA PV?

MA PV refers to the 'Massachusetts Payment Voucher', which is a form used by taxpayers to accompany their payments to the Massachusetts Department of Revenue.

Who is required to file MA PV?

Individuals and businesses in Massachusetts that owe taxes and are submitting a payment to the state are required to file the MA PV.

How to fill out MA PV?

To fill out the MA PV, taxpayers must provide their name, address, Social Security number or Federal Employer Identification Number (FEIN), the tax type for which the payment is being made, and the payment amount.

What is the purpose of MA PV?

The purpose of MA PV is to ensure that payments sent to the Massachusetts Department of Revenue are properly attributed to the correct taxpayer and the specific tax obligations.

What information must be reported on MA PV?

The information that must be reported on the MA PV includes the taxpayer's name, address, tax identification number, tax type, payment amount, and any relevant tax period related to the payment.

Fill out your ma tax payment voucher online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ma Tax Payment Voucher is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.