MD W-2 2022 free printable template

Show details

Your2022W2:

WhatYouNeedtoKnow! ComparingYourLastPayStubToYourW2

WhenyoucompareyourW2againstyourfinalpaystub,theamountsmaynotbethesame. Therein

a reason and it's to your benefit! Your pay stub represents

pdfFiller is not affiliated with any government organization

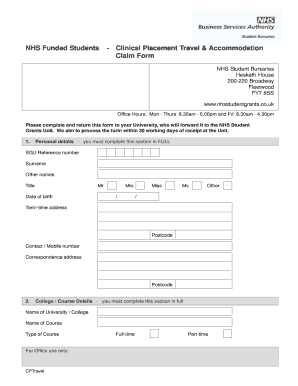

Get, Create, Make and Sign MD W-2

Edit your MD W-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD W-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD W-2 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MD W-2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD W-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD W-2

How to fill out MD W-2

01

Obtain the MD W-2 form from the Maryland State website or your employer.

02

Fill in your personal identification information including your name, address, and Social Security number.

03

Provide your employer's details including their name, address, and Employer Identification Number (EIN).

04

Enter your total wages earned in Maryland during the tax year.

05

Report any state income tax withheld from your paychecks.

06

Include any other applicable amounts such as non-wage compensation or retirement contributions.

07

Review all information for accuracy before submitting the form.

08

Submit the completed MD W-2 form to the Maryland Comptroller by the deadline.

Who needs MD W-2?

01

Employees who work in Maryland and receive wages must fill out an MD W-2.

02

Employers in Maryland must provide MD W-2 forms to their employees.

03

Any individuals needing to report income earned in Maryland for state tax purposes require an MD W-2.

Fill

form

: Try Risk Free

People Also Ask about

How much do I have to make to file taxes in Maryland?

Possibly. Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

Do I have to report W-2?

You must submit by mail or electronically Copy A of Form(s) W-2 to the SSA with the transmittal Form W-3, Transmittal of Wage and Tax Statements by the last day of January.

How do I get my W-2 from the state of Maryland?

In most cases, duplicate W-2s may be obtained through the use of our Payroll Online Service Center (POSC) via internet access. Employees unable to access POSC or unable to print a copy of their W-2 from POSC may request a copy directly from Central Payroll by calling 410-260-7964 or 888-674-0019.

Does Maryland require a state tax form?

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay. The State of Maryland has a form that includes both the federal and state withholdings on the same form.

Can I get my own W-2 online?

Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

How can I get a copy of my W-2 online?

Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

How do I get my W-2 from Maryland?

In most cases, duplicate W-2s may be obtained through the use of our Payroll Online Service Center (POSC) via internet access. Employees unable to access POSC or unable to print a copy of their W-2 from POSC may request a copy directly from Central Payroll by calling 410-260-7964 or 888-674-0019.

How do I get my W-2 from my old employer?

If your former employer does not act on your request for following up on your W-2 or you are unable to reach them, then it is time to reach out to the IRS. Provide the IRS with: Your name, address, Social Security number and phone number. Employer's name, address and phone number.

How can I get a copy of W-2 quickly?

The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

Do you still get a W-2 if you quit?

Even if you quit your job months ago, your ex-employer can still wait until Jan. 31 to send you a W-2 — unless you ask for it earlier, in which case the employer has 30 days to provide it.

Do I have to file W-2 with Maryland?

Maryland law requires that employers submit their annual Withholding reconciliation using the electronic format (to Bulk Upload or submit on media) if the total number of W2 statements meets or exceeds 25. We encourage all employers, regardless of the number of W2s, to file electronically.

Can I get access to my W-2 online?

Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

What happens if you dont report a W-2?

If you fail to meet the January 31 deadline but file the form within 30 days of the due date, the IRS can assess a penalty of $50 per Form W-2. If you file after 30 days but before August 1, the fine is $110 per form. If you don't file by August 1, the fine increases to $270 per W-2.

Who is exempt from Maryland state taxes?

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

Do you have to send W-2 to state?

Many states require W-2s to be filed with the state and many require their own annual reconciliation form, similar to the Federal W-3. Learn about the requirements for each state but make sure you verify your responsibilities by checking your state's website or speaking with your accountant or bookkeeper.

What happens if you don't file taxes in Maryland?

If you don't file by the due date of the tax return, you may have to pay a failure to file penalty. The penalty is 5% of the tax not paid by the due date for each month or part of a month that the return is late.

How can I get my W-2 without employer?

If you're unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.

Do I need to file Maryland tax return?

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MD W-2 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your MD W-2 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for signing my MD W-2 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your MD W-2 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit MD W-2 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign MD W-2 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is MD W-2?

MD W-2 is a state-specific wage and tax statement form used in Maryland to report an individual's wages, tips, and other compensation, as well as federal and state income taxes withheld.

Who is required to file MD W-2?

Employers who pay remuneration to employees in Maryland are required to file MD W-2 forms for each employee at the end of the year, reporting their earnings and tax withholdings.

How to fill out MD W-2?

To fill out MD W-2, gather the employee's information such as their name, address, Social Security number, total wages paid, and any state income taxes withheld. Complete the form using accurate figures and submit it to both the employee and the Maryland State Comptroller's office.

What is the purpose of MD W-2?

The purpose of MD W-2 is to provide a summary of an employee's earnings and the taxes withheld during the year, which is used for both federal and state income tax reporting and compliance.

What information must be reported on MD W-2?

MD W-2 must report the employee's total wages, tips, other compensation, federal income tax withheld, state income tax withheld, Social Security wages, and Medicare wages.

Fill out your MD W-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD W-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.