IRS 941-V 2022 free printable template

Show details

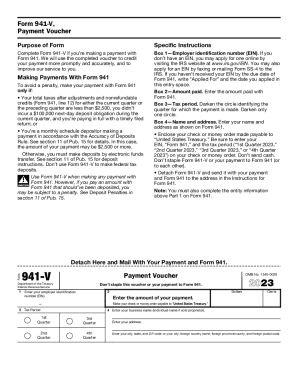

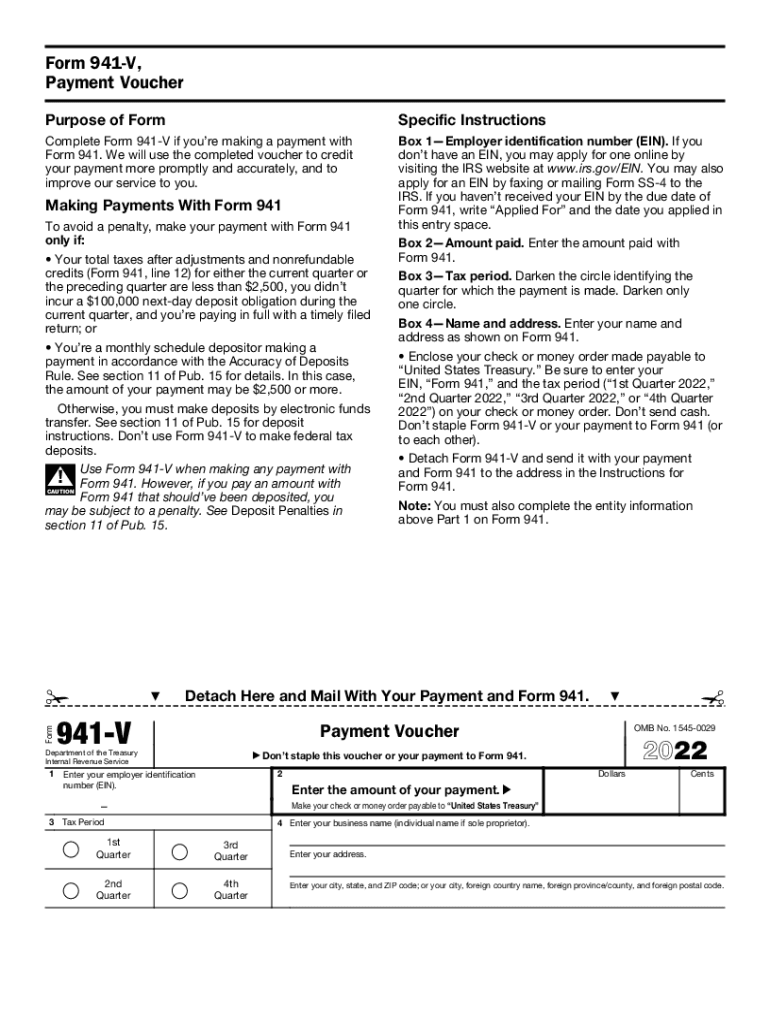

Don t use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with Form 941. Form 941-V Payment Voucher Purpose of Form Specific Instructions Complete Form 941-V if you re making a payment with Form 941. Don t send cash. Don t staple Form 941-V or your payment to Form 941 or to each other. Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Note You must also complete the entity information above Part 1 on Form 941. NW...IR-6526 Washington DC 20224. Don t send Form 941 to this address. Instead see Where Should You File in the Instructions for Form 941. Form 941 Rev. 6-2022 Privacy Act and Paperwork Reduction Act Notice. We ask for the information on Form 941 to carry out the figure and collect the right amount of tax. See Deposit Penalties in section 11 of Pub. 15. Form Detach Here and Mail With Your Payment and Form 941. However if you pay an amount with CAUTION Form 941 that should ve been deposited you may be...subject to a penalty. Enter your employer identification number EIN. Making Payments With Form 941 Dollars Cents Enter the amount of your payment. We will use the completed voucher to credit your payment more promptly and accurately and to improve our service to you. Box 2 Amount paid* Enter the amount paid with Box 3 Tax period. Darken the circle identifying the quarter for which the payment is made. See section 11 of Pub. 15 for details. In this case the amount of your payment may be 2 500 or...more. Otherwise you must make deposits by electronic funds transfer. See section 11 of Pub. 15 for deposit instructions. Make your check or money order payable to United States Treasury 3 Tax Period 4 Enter your business name individual name if sole proprietor. 1st Quarter 3rd Enter your address. 2nd 4th Enter your city state and ZIP code or your city foreign country name foreign province/county and foreign postal code. Subtitle C Employment Taxes of the Internal Revenue Code imposes employment...taxes on wages and provides for income tax withholding. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner or provide false or fraudulent information you may be subject to penalties. You re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or its instructions must be retained as...long as their contents may become material in the administration of any Internal Revenue law. Generally tax returns and return information are confidential as required by section 6103. However section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example we may disclose your tax information to the Department of Justice for civil and criminal litigation and to cities states the District of Columbia and U*S*...commonwealths and possessions for use in administering their tax laws.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941-V

How to edit IRS 941-V

How to fill out IRS 941-V

Instructions and Help about IRS 941-V

How to edit IRS 941-V

To edit the IRS 941-V tax form, you can use tools that allow direct editing of PDF documents. Utilizing pdfFiller, you can easily edit fields, add necessary information, and ensure compliance with tax regulations before submission.

How to fill out IRS 941-V

Filling out the IRS 941-V form requires accurate information to ensure timely tax payments. The form should include details such as your business name, Employer Identification Number (EIN), and the amount being paid. Follow these steps for correct completion:

01

Enter your business name as registered with the IRS.

02

Include your EIN prominently on the form.

03

Indicate the payment amount in the specified section.

04

Sign and date the form before submission.

About IRS 941-V 2022 previous version

What is IRS 941-V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 941-V 2022 previous version

What is IRS 941-V?

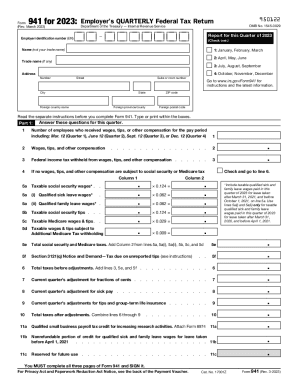

IRS 941-V is a payment voucher form that accompanies Form 941, the Employer's Quarterly Federal Tax Return. It facilitates the payment of federal income tax withheld and Social Security and Medicare taxes due for the quarter.

What is the purpose of this form?

The purpose of IRS 941-V is to provide a structured way for employers to submit their tax payments for withheld income taxes and payroll taxes related to their employees. This ensures that payments are processed correctly and on time by the Internal Revenue Service (IRS).

Who needs the form?

Employers who report employment taxes using Form 941 must file IRS 941-V when sending any related tax payments. This includes businesses with employees whose wages are subject to federal withholding, Social Security, and Medicare taxes.

When am I exempt from filling out this form?

Employers are exempt from filing IRS 941-V if they have no employment tax liabilities for the quarter. Additionally, if they are currently not required to file Form 941 due to specific exemptions or if they have stopped paying wages altogether, they do not need to use this form.

Components of the form

The IRS 941-V form consists of several key sections including the business name, Employer Identification Number (EIN), the amount being submitted for payment, and instructions on where to send the payment. Accurate completion of these components is crucial to ensure proper processing by the IRS.

What are the penalties for not issuing the form?

Failure to issue IRS 941-V when required can lead to penalties from the IRS. This may include fines for late payment or improper remittance. It's crucial for employers to adhere to deadlines to avoid unnecessary financial repercussions.

What information do you need when you file the form?

When filing IRS 941-V, you need to gather essential information such as your business name, EIN, the payment amount, and the quarter for which the payment is being made. Ensuring this information is accurate and complete will speed up processing and prevent potential issues.

Is the form accompanied by other forms?

IRS 941-V is typically submitted alongside Form 941. While Form 941 reports the employment tax details for the quarter, 941-V specifically addresses the payment related to those taxes. Ensure proper attachment to avoid confusion during submission.

Where do I send the form?

The IRS 941-V form should be sent to the address specified in the Form 941 instructions. The submission address can vary based on your location and whether or not you are sending a payment, so check the latest IRS guidelines for accuracy.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It is good to have a form to fill out but with w2 it is very laborious doing one at a time

so far I am able to figure everything out and it is working for me.

See what our users say