PA PA 564A 2019-2026 free printable template

Show details

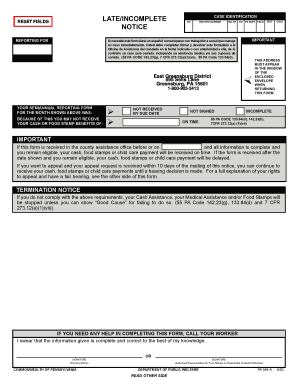

LATE / INCOMPLETE NOTICECORECORDCASE IDENTIFICATION CASHMASNAPDISTCSLDRESET Si necessity UN formulation en Español, communiqués con SU trabajador inmediatamente. Taine Que completer, firmer y revolver

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA PA 564A

Edit your PA PA 564A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA PA 564A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA PA 564A online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA PA 564A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA 564A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA PA 564A

How to fill out PA PA 564A

01

Obtain the PA PA 564A form from the appropriate state website or local office.

02

Fill out your personal information, including your full name, address, and contact details.

03

Indicate the type of assistance you are applying for by checking the appropriate boxes.

04

Provide detailed information regarding your household members, including their names and relationships.

05

Complete the financial information section, including income sources and amounts for all household members.

06

Review the application for any missing information or errors.

07

Sign and date the form where indicated.

08

Submit the completed form through the specified method (online, mail, or in-person) as directed.

Who needs PA PA 564A?

01

Individuals or families seeking assistance programs in Pennsylvania.

02

Residents of Pennsylvania who require financial support or benefits.

03

Those who have experienced changes in financial circumstances and need to report this for continued eligibility.

Fill

form

: Try Risk Free

People Also Ask about

What documents are needed to apply for Medicaid in PA?

A copy of applicant's Social Security card. Health Insurance Information: Copies of Medical Insurance card(s) including Medicare and any supplemental health care and/or prescription drug coverage for applicant. Invoices for these policies demonstrating the premium costs and frequency of payment.

How long can you get cash assistance in PA?

Remember, you may still keep health care coverage, food stamps, and other support services after cash assistance ends. An adult may receive cash assistance for only five years total in a lifetime.

Who qualifies for cash assistance in PA?

To be eligible for cash assistance, your income must be below the cash grant size: $205 a month for a single person, $316 a month for two people, $403 a month for a family of three. Pennsylvania also has a limit on savings of $250 for an individual or $1,000 for more than one person.

Do I qualify for welfare in PA?

Eligibility. The gross monthly income limit for an individual is no more than $1,533 per month. For an elderly or disabled individual, the gross monthly income amount is typically no more than $1,916 per month. Monthly income eligibility limits increase with the size of the family.

How long does it take to get approved for Medicaid in PA?

It should not take longer than 45 days if all necessary documentation needed to determine your eligibility for the Medical Assistance program is given to the county assistance office. What must I verify? All financial (income and resources) information given on your application must be verified.

What is the income limit for food stamps in PA 2023?

2023, your gross monthly income has to be within 130% of the federal poverty level — $1,473 for an individual, $3,007 for a family of four. Your net monthly income must fall within 100% — $1,133 for one, $2,313 for a household of four. In most cases, you must meet both limits to be eligible for SNAP.

What is the income limit for welfare in PA?

Income requirements beginning October 1, 2022: Household SizeMaximum Gross Monthly Income1$2,2662$3,0523$3,8404$4,6267 more rows

What is the highest income for food stamps?

For fiscal year 2023 (Oct. 1, 2022 – Sept. 30, 2023), a two-member household with a net monthly income of $1,526 (100% of poverty) might qualify for SNAP. It's important to keep in mind that a variety of allowable deductions, including those for excess medical expenses, can help you meet the net income test.

How do I get approved for Medicaid in PA?

How to Apply Online: Using the COMPASS website, you can apply for MA and many other services that can help you make ends meet. Telephone: Call the Consumer Service Center for Health Care Coverage at 1-866-550-4355. In-Person: You can contact your local county assistance office (CAO).

How much cash assistance will I get in PA for family of 4?

A person can receive TANF (Temporary Assistance for Needy Families) for a total of 60 months in a lifetime.How much money will I get? Number of Persons in Budget GroupMaximum Benefit Amount449755896670Each additional person833 more rows

Who is eligible for cash assistance?

Cash Assistance may be provided to needy families with dependent children. Eligibility for the Cash Assistance program is based on citizenship; qualified noncitizen resident status; Arizona residency; limits on resources and monthly income eligibility guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PA PA 564A directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your PA PA 564A and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify PA PA 564A without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including PA PA 564A. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an eSignature for the PA PA 564A in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your PA PA 564A and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is PA PA 564A?

PA PA 564A is a tax form used in Pennsylvania for reporting certain types of income and tax liabilities related to partnerships and pass-through entities.

Who is required to file PA PA 564A?

Partnerships and certain pass-through entities that generate income in Pennsylvania are required to file PA PA 564A.

How to fill out PA PA 564A?

To fill out PA PA 564A, taxpayers need to provide detailed information about the partnership's income, deductions, and tax credits, in accordance with the instructions provided by the Pennsylvania Department of Revenue.

What is the purpose of PA PA 564A?

The purpose of PA PA 564A is to ensure that partnerships report their income accurately for state tax purposes and to facilitate the assessment of tax liabilities for the members of the partnership.

What information must be reported on PA PA 564A?

Information that must be reported on PA PA 564A includes the partnership's total income, expenses, specific deductions, credit information, and other financial details as required by Pennsylvania tax regulations.

Fill out your PA PA 564A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA 564a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.