Get the free Voluntary Petition

Show details

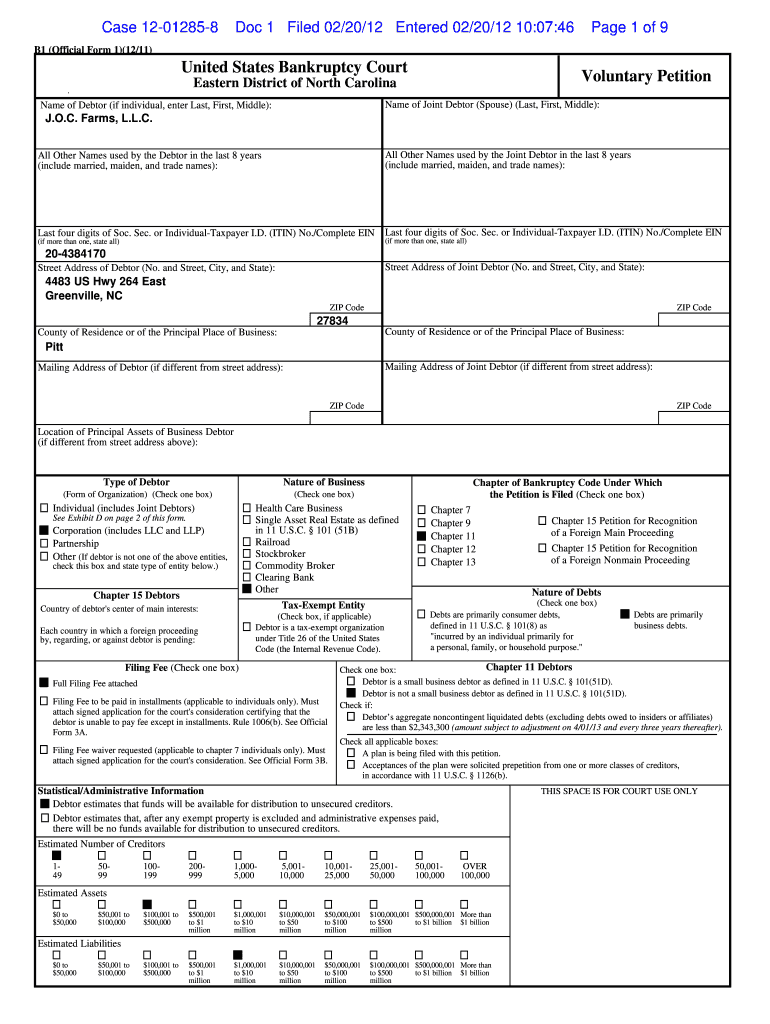

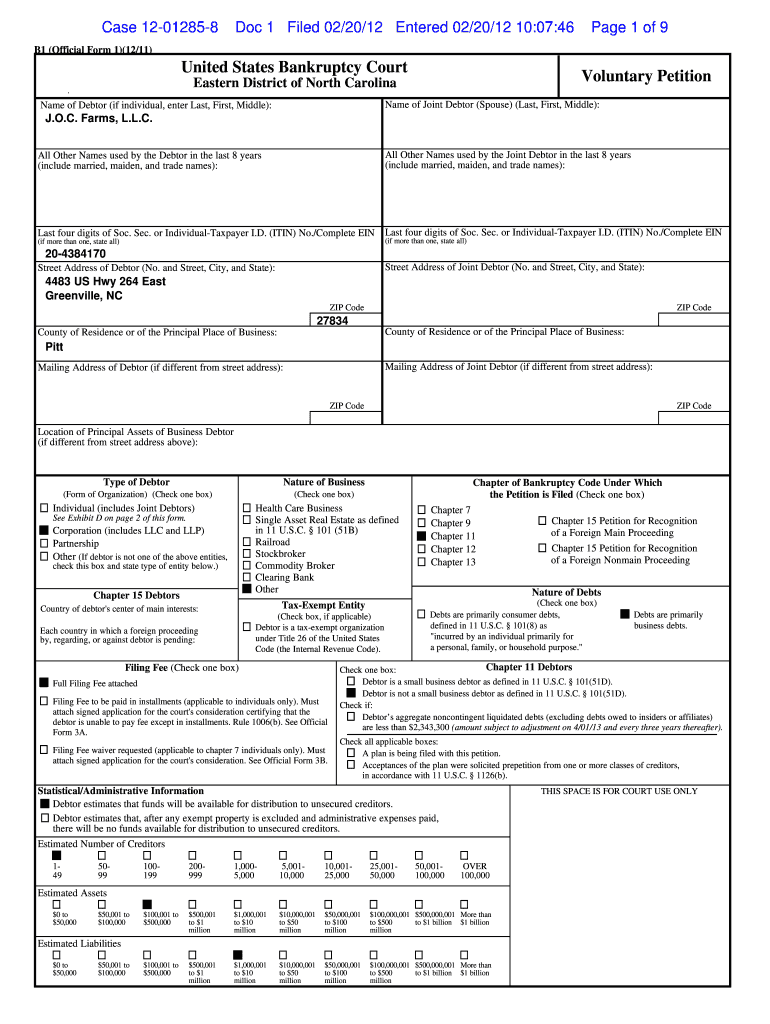

This document is a voluntary petition filed under the United States Bankruptcy Code for the debtor J.O.C. Farms, L.L.C. It includes details related to the debtor's identification, business type, chapter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary petition

Edit your voluntary petition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary petition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit voluntary petition online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit voluntary petition. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary petition

How to fill out Voluntary Petition

01

Begin by gathering all necessary financial documents, including income statements, debts, and assets.

02

Obtain the correct Voluntary Petition form from your local bankruptcy court or its website.

03

Fill in the personal information section, including your name, address, and social security number.

04

Complete the section detailing your debts, including secured and unsecured debts.

05

List your income sources and fill out your monthly income information.

06

Provide information about your assets, including real estate, vehicles, and personal property.

07

Include information about any recent financial transactions or transfers of property.

08

Review the petition thoroughly for accuracy and completeness.

09

Sign and date the Voluntary Petition.

10

File the petition with the bankruptcy court and pay the required filing fee.

Who needs Voluntary Petition?

01

Individuals or businesses facing insurmountable debt may need to file a Voluntary Petition.

02

Anyone seeking bankruptcy protection to reorganize or eliminate their debts.

03

Those who want to stop foreclosure proceedings or creditor harassment.

04

Individuals needing to eliminate unsecured debts such as credit card debt or medical bills.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a voluntary petition and an involuntary petition?

A petition may be a voluntary petition, which is filed by the debtor, or it may be an involuntary petition, which is filed by creditors that meet certain requirements.

Who can file an involuntary petition?

A petitioning creditor is qualified to file an involuntary petition if they hold a claim against the debtor that is not contingent as to liability or the subject of a bona fide dispute regarding the liability or its amount, ing to the Bankruptcy Code.

What is an involuntary petition?

A petitioning creditor is qualified to file an involuntary petition if they hold a claim against the debtor that is not contingent as to liability or the subject of a bona fide dispute regarding the liability or its amount, ing to the Bankruptcy Code.

What is a voluntary petition in Chapter 7?

A voluntary petition is a more common filing and allows the debtor to choose the type of bankruptcy and the applicable chapter. In contrast, an involuntary petition is filed when the debtor is unable to pay its debts, and its creditors seek to force the debtor into bankruptcy. Overview of Bankruptcy Chapters.

What is the difference between voluntary and involuntary petition?

Voluntary bankruptcy is a bankruptcy proceeding commenced by the debtor ; bankruptcy instituted by an adjudication upon a debtor's petition. Involuntary bankruptcy, on the other hand, is a bankruptcy case initiated by a debtor's creditors .

What is the difference between a voluntary petition and an involuntary petition?

Voluntary Petition vs. Involuntary Petition A voluntary petition is a bankruptcy filing initiated by the debtor, while an involuntary petition is filed by the debtor's creditors. A voluntary petition is a more common filing and allows the debtor to choose the type of bankruptcy and the applicable chapter.

Why would an unsecured creditor want to file an involuntary petition against a debtor?

This is typically initiated when creditors have determined that the debtor is unable to meet their financial obligations in repaying the debts to the creditors, and bankruptcy is the best option to recover those debts.

What is an involuntary proceeding?

When a creditor has made several attempts to collect a debt, but there has been no response from the debtor, they may have no choice but to sue them into bankruptcy.

What is a voluntary petition?

A Voluntary Petition is a document that initiates the filing of a bankruptcy proceeding, setting forth basic information regarding the debtor(s), including name(s), address(es), chapter under which the case is filed, and estimated amount of assets and liabilities.

Who can file an involuntary petition?

A petitioning creditor is qualified to file an involuntary petition if they hold a claim against the debtor that is not contingent as to liability or the subject of a bona fide dispute regarding the liability or its amount, ing to the Bankruptcy Code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Voluntary Petition?

A Voluntary Petition is a legal document filed by an individual or business entity to initiate a bankruptcy proceeding. It serves as a formal request to the court to allow the filer to declare bankruptcy voluntarily.

Who is required to file Voluntary Petition?

An individual or business that is unable to meet its debt obligations and seeks relief under bankruptcy laws is required to file a Voluntary Petition.

How to fill out Voluntary Petition?

To fill out a Voluntary Petition, one must complete the required forms provided by the bankruptcy court, including personal information, a list of debts, assets, and income, and any other specific details required by the court.

What is the purpose of Voluntary Petition?

The purpose of a Voluntary Petition is to formally request bankruptcy relief and to provide a structured way to address and resolve financial difficulties under the protection of the court.

What information must be reported on Voluntary Petition?

The Voluntary Petition must report personal information, a list of creditors, details of assets and liabilities, income sources, and any other financial details relevant to the bankruptcy case.

Fill out your voluntary petition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Petition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.