Get the free Pennsylvania Mortgage Broker License Amendments - mortgage nationwidelicensingsystem

Show details

This document provides instructions for Pennsylvania mortgage brokers regarding the necessary steps for submitting amendments to their license applications. It includes requirements for notifying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pennsylvania mortgage broker license

Edit your pennsylvania mortgage broker license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pennsylvania mortgage broker license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

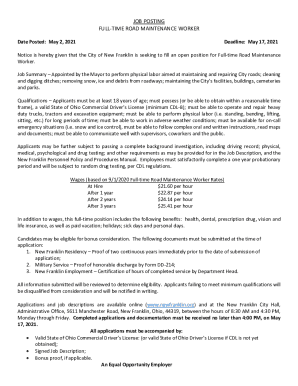

How to edit pennsylvania mortgage broker license online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pennsylvania mortgage broker license. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pennsylvania mortgage broker license

How to fill out Pennsylvania Mortgage Broker License Amendments

01

Obtain the Pennsylvania Mortgage Broker License Amendment application form from the Pennsylvania Department of Banking and Securities website.

02

Fill in the required personal and business information accurately in the application form.

03

Provide details of any changes that need to be amended, such as business structure, address, or contact information.

04

Prepare any supporting documentation as required, such as proof of new business location or updated insurance coverage.

05

Review the completed application form thoroughly to ensure all information is correct and all necessary documents are included.

06

Submit the application form and supporting documents to the Pennsylvania Department of Banking and Securities either online, by mail, or in person, along with the required fee.

07

Wait for confirmation and any further instructions from the Department regarding the status of the amendment.

Who needs Pennsylvania Mortgage Broker License Amendments?

01

Any individual or entity that is currently licensed as a mortgage broker in Pennsylvania and needs to make changes to their existing license.

02

Businesses that have undergone structural changes, such as a change in ownership or corporate structure, must file an amendment.

03

Mortgage brokers who have changed their business address or any of their business contact information.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum record keeping requirement for mortgage licensees in Pennsylvania?

All records shall be preserved and kept available for investigation or examination by the department for a period of four years, unless otherwise determined by the department. The department shall have free access to and authorization to examine records maintained by the licensee.

What is the minimum net worth requirement for a mortgage broker in PA?

Pennsylvania has net worth requirement for the Mortgage Lender and Mortgage Servicer License of $250K, where as the Broker does not require a net worth amount to be met/maintained.

What is the total license cost for a mortgage loan originator license in PA?

Pennsylvania Frequently Asked Questions NMLS Fees Pennsylvania License/Registration Fee $200 Credit Report $15 FBI Criminal Background Check $36.25 Total License Cost $275.251 more row

What is the basic source of income for a mortgage broker?

Mortgage brokers can work independently or belong to a brokerage. They typically earn a commission of around 1%-2% of the loan value, which the borrower or the lender can pay.

What is the minimum net worth requirement for FHA?

Call Report must demonstrate the Mortgagee has: $1,000,000 minimum adjusted net worth at all times. $200,000 minimum liquid assets at all times.

What is the minimum surety bond for a mortgage broker in PA?

Mortgage brokers in Pennsylvania must also meet the following ongoing requirements: Complete 16 hours of continuing education every two years. Maintain a surety bond of at least $10,000.

What is the minimum net worth requirement for a mortgage broker in Pennsylvania?

Pennsylvania has net worth requirement for the Mortgage Lender and Mortgage Servicer License of $250K, where as the Broker does not require a net worth amount to be met/maintained.

How to get a mortgage license in PA?

Pennsylvania Mortgage License Requirements Complete a Criminal Background Check (CBC). Authorize a credit report through the NMLS. Fulfill all state and federal education requirements as designated by Pennsylvania. Take and pass a National Test. Tax Certification.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pennsylvania Mortgage Broker License Amendments?

Pennsylvania Mortgage Broker License Amendments refer to changes or updates in the licensing requirements for mortgage brokers operating in Pennsylvania, which may include alterations to regulations, forms, or conditions related to mortgage brokerage activities.

Who is required to file Pennsylvania Mortgage Broker License Amendments?

Mortgage brokers, mortgage lenders, and other entities or individuals involved in the mortgage industry in Pennsylvania who hold a mortgage broker license are required to file Pennsylvania Mortgage Broker License Amendments to remain compliant with state law.

How to fill out Pennsylvania Mortgage Broker License Amendments?

To fill out Pennsylvania Mortgage Broker License Amendments, applicants must complete the designated forms provided by the Pennsylvania Department of Banking and Securities, ensuring all required information is accurately entered and submitted alongside any necessary documentation.

What is the purpose of Pennsylvania Mortgage Broker License Amendments?

The purpose of Pennsylvania Mortgage Broker License Amendments is to ensure that mortgage brokers keep their licensing information current, comply with state regulations, and uphold industry standards for transparency and consumer protection.

What information must be reported on Pennsylvania Mortgage Broker License Amendments?

Information that must be reported on Pennsylvania Mortgage Broker License Amendments includes changes in business structure, ownership, contact information, financial condition, and any updates relevant to the broker's operations or compliance status.

Fill out your pennsylvania mortgage broker license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pennsylvania Mortgage Broker License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.