Get the free Defined Contribution Retirement Program Forms - nd

Show details

This document outlines the various forms and procedures related to enrollments, waivers, beneficiary designations, and changes for the Defined Contribution Retirement Program under NDPERS. It provides

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign defined contribution retirement program

Edit your defined contribution retirement program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your defined contribution retirement program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit defined contribution retirement program online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit defined contribution retirement program. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

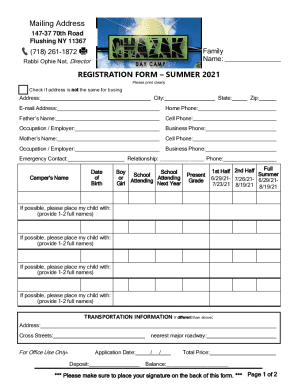

How to fill out defined contribution retirement program

How to fill out Defined Contribution Retirement Program Forms

01

Gather necessary personal information, including your Social Security number and contact information.

02

Review the sections of the form carefully to understand what information is required.

03

Fill out your personal details accurately in the designated fields.

04

Provide information about your employment history, including employer name and dates of employment.

05

Indicate your contribution percentage or amount you wish to contribute to the retirement program.

06

Include any additional requirements, such as beneficiaries or investment choices.

07

Review your completed form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the completed form according to the instructions provided, whether online or via mail.

Who needs Defined Contribution Retirement Program Forms?

01

Individuals who are employed and wish to participate in a retirement savings program.

02

Employees whose employer offers a Defined Contribution Retirement Program.

03

Anyone looking to save for retirement through structured contributions.

04

Employees seeking tax-advantaged retirement savings options.

Fill

form

: Try Risk Free

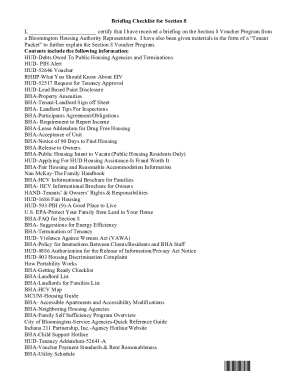

People Also Ask about

What is the most popular defined contribution retirement plan?

How do I know if my pension is defined benefit or defined contribution? Check your pension paperwork, or just ask your provider or employer. As a rule, if you set up your pension yourself it can't be a DB pension, but if an employer set it up for you it might be.

What is an example of a defined contribution retirement plan?

Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans.

What is an example of a defined contribution plan?

The 401(k) plan is the most popular form of defined contribution plan, although states and local governments may also sponsor other types of DC plans, such as 401(a), 403(b), and 457 plans.

What are the disadvantages of a defined contribution pension plan?

The main disadvantage of a defined contribution pension is it's a finite pot of money that can run out (unless you use it to buy an annuity).

Where can I get pension forms?

Online; or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

Can you withdraw money from a defined contribution plan?

A 401(k) is classified as a defined contribution plan while a pension is a defined benefit plan. A defined contribution plan allows employees and employers (if they choose) to contribute funds regularly to a long-term account. The employee chooses how to invest the money from a selection provided by the employer.

How do I know if I have a DB or DC pension?

Defined contribution plans, like 401(k) and 403(b) plans, are popular retirement plans in the U.S. Employees put in part of their salary, and employers might match it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

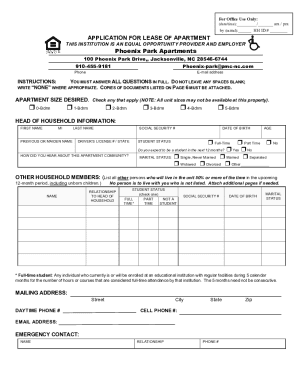

What is Defined Contribution Retirement Program Forms?

Defined Contribution Retirement Program Forms are documents used to manage and report contributions made to retirement plans where the amount contributed is defined, but the benefits received at retirement depend on contributions and investment performance.

Who is required to file Defined Contribution Retirement Program Forms?

Employers and plan administrators who sponsor defined contribution retirement plans are required to file these forms to report contributions, distributions, and other relevant information to regulatory authorities.

How to fill out Defined Contribution Retirement Program Forms?

To fill out Defined Contribution Retirement Program Forms, one must provide information such as the plan's details, contribution amounts, participant information, and any distributions made during the reporting period as per the guidelines set by the relevant regulatory body.

What is the purpose of Defined Contribution Retirement Program Forms?

The purpose of Defined Contribution Retirement Program Forms is to ensure compliance with federal regulations, track contributions and distributions, and provide transparency in how retirement funds are managed and allocated.

What information must be reported on Defined Contribution Retirement Program Forms?

Information that must be reported includes participant contributions, employer contributions, account balances, distributions made during the year, and any investment gains or losses associated with the retirement funds.

Fill out your defined contribution retirement program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Defined Contribution Retirement Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.