Get the free CREDIT COMPLIANCE

Show details

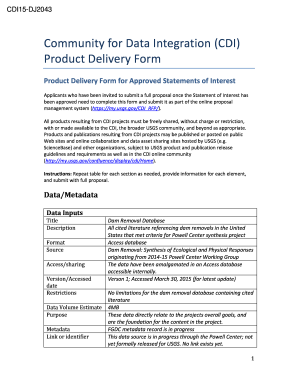

LEED-NC 2.2 Submittal Template ID Credit 2: LEED Accredited Professional (Responsible Individual) I, Brooke Bunkhouse (Company Name), from RATIO Architects, Inc. verify that the information provided

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit compliance

Edit your credit compliance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit compliance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit compliance online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit compliance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit compliance

How to Fill Out Credit Compliance:

01

Start by gathering all the necessary documents and information. This may include your personal identification, financial statements, credit history, and any relevant legal documents.

02

Familiarize yourself with the specific requirements and guidelines for credit compliance. These can vary depending on your country, industry, and organization. It is important to understand the regulations and expectations you need to comply with.

03

Carefully review the credit compliance form or checklist provided by your financial institution or regulatory body. This will outline the necessary information and steps you need to take to complete the credit compliance process.

04

Begin filling out the form or checklist, following the instructions provided. Be thorough and accurate when providing information, as any errors or omissions could result in non-compliance and potential penalties.

05

Pay close attention to any additional documentation or supporting evidence required for credit compliance. This may include bank statements, tax returns, financial records, or references. Make sure to gather and attach these documents as needed.

06

Double-check and review all the information you have entered to ensure accuracy and completeness. It can be helpful to have someone else review your credit compliance form or checklist to catch any mistakes or oversights.

07

Once you are confident that all the necessary information has been provided and the form is complete, submit it to the appropriate authority or institution responsible for credit compliance. Follow any additional instructions for submission, such as online portals, mailing addresses, or in-person submission procedures.

Who Needs Credit Compliance:

01

Banks and Financial Institutions: Banks and other financial institutions are required to comply with credit regulations to ensure the safety and integrity of the financial system. This includes following established credit guidelines, conducting proper due diligence, and monitoring credit risk.

02

Businesses and Organizations: Many businesses and organizations must comply with credit regulations when borrowing funds, seeking credit lines, or engaging in credit-related activities. Compliance ensures transparency, accountability, and fair practices in lending and borrowing.

03

Individual Borrowers: Individual borrowers may also need to comply with credit regulations, especially when applying for loans, mortgages, or credit cards. Following credit compliance guidelines helps individuals understand their financial responsibilities and protects both borrowers and lenders.

Overall, credit compliance is crucial for maintaining the integrity of the financial system, safeguarding consumer interests, and promoting fair lending practices. Whether you are a financial institution, a business, or an individual borrower, understanding and adhering to credit compliance requirements is essential for both legal and ethical reasons.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit compliance?

Credit compliance refers to the process of ensuring that an individual or organization adheres to the rules and regulations set forth by credit reporting agencies.

Who is required to file credit compliance?

Any individual or organization that engages in lending or credit transactions is required to file credit compliance.

How to fill out credit compliance?

Credit compliance can be filled out online through the designated portal provided by credit reporting agencies.

What is the purpose of credit compliance?

The purpose of credit compliance is to promote transparency and accountability in the lending and credit industry.

What information must be reported on credit compliance?

Credit compliance typically requires the reporting of financial data, credit information, and compliance with regulations.

How do I fill out the credit compliance form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign credit compliance. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit credit compliance on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share credit compliance from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit credit compliance on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute credit compliance from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your credit compliance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Compliance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.