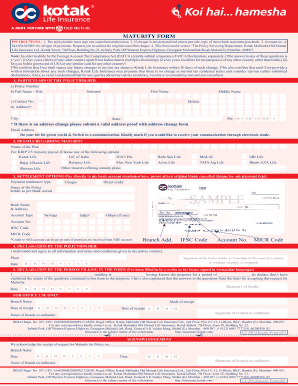

India Kotak Life Insurance Maturity Form 2022-2025 free printable template

Show details

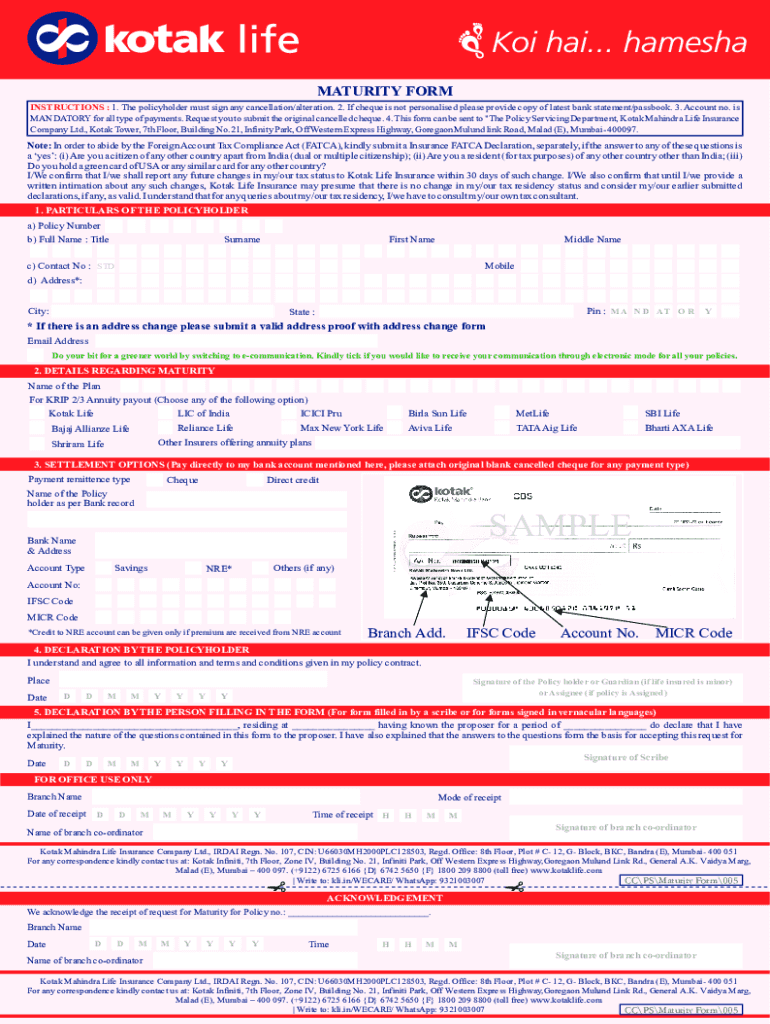

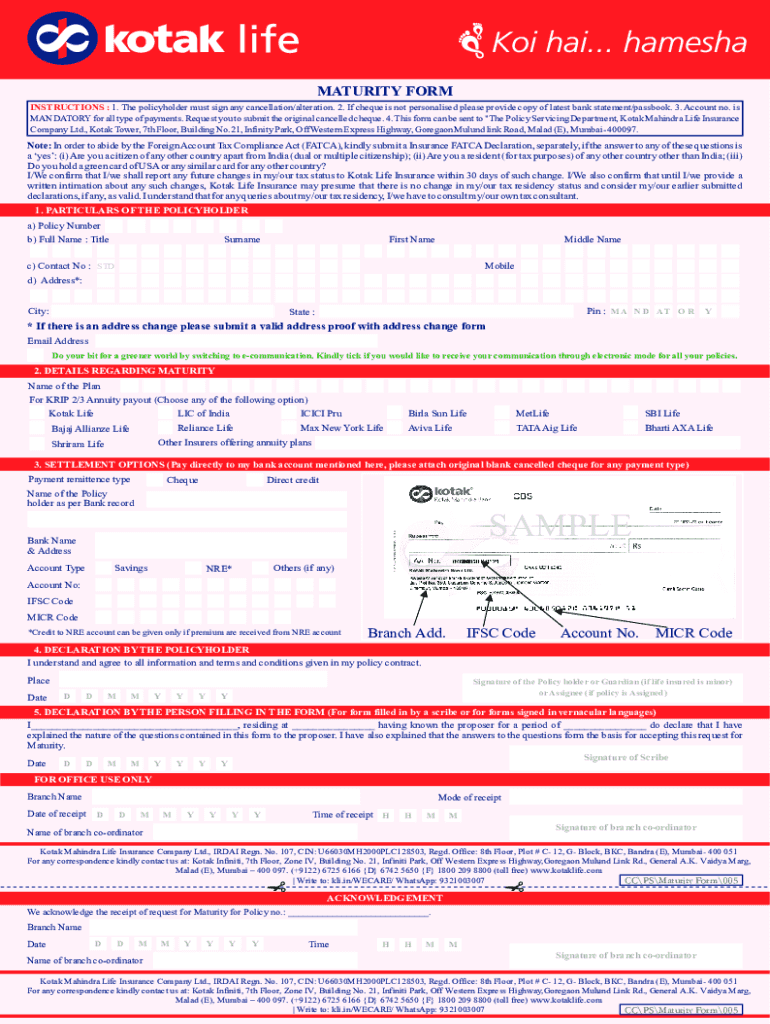

MATURITY FORM INSTRUCTIONS : 1. The policyholder must sign any cancellation/alteration. 2. If check is not personalized please provide copy of the latest bank statement/passbook. 3. Account no. is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kotak life insurance maturity

Edit your kotak life insurance maturity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kotak life insurance maturity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kotak life insurance maturity online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit kotak life insurance maturity. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India Kotak Life Insurance Maturity Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kotak life insurance maturity

How to fill out India Kotak Life Insurance Maturity Form

01

Obtain the Kotak Life Insurance Maturity Form from the official website or nearest branch.

02

Fill in your policy number in the designated field.

03

Provide your personal details including name, address, and contact information.

04

Attach relevant identification documents such as Aadhar card or PAN card.

05

Specify the details of the bank account where the maturity amount should be credited.

06

Sign and date the form at the required sections.

07

Submit the completed form along with the necessary documents to your nearest Kotak Life Insurance branch.

Who needs India Kotak Life Insurance Maturity Form?

01

Policyholders of Kotak Life Insurance whose policies have matured.

02

Beneficiaries or nominees of deceased policyholders to claim the maturity amount.

03

Individuals seeking to make a claim on their life insurance policy after the policy period ends.

Fill

form

: Try Risk Free

People Also Ask about

What does maturity mean in insurance?

The maturity benefit is a lump-sum payment made by the insurance provider when the policy has reached its expiration date. It simply implies that if your insurance policy has a 15-year term, you, the insured, will get a payout at the end of those 15 years.

What is maturity claim?

The claim for which a policyholder/life insured can apply for after surviving the complete policy term is called maturity claim.

How do I claim maturity on my insurance?

Maturity Claims: The policyholder is requested to return the Discharge Form duly completed along with the Policy Document, NEFT Mandate Form (Bank A/c Particulars with supporting proof), KYC requirements etc. .

How do I claim life insurance from Kotak?

Call on toll free number 1800 209 8800(8:00 am to 10:00pm)

What happens when life insurance policy matures?

The maturity benefit is a lump-sum payment made by the insurance provider when the policy has reached its expiration date. It simply implies that if your insurance policy has a 15-year term, you, the insured, will get a payout at the end of those 15 years.

What is the difference between death claim and maturity claim?

The death benefit is an amount that the insurance company provides to the nominee on the unforeseen demise of the life assured on the other hand the maturity benefit amount is an amount which the insurance company has to pay to the policy holder in the of their life insurance policy being matured.

What is the meaning of maturity claim?

Maturity Claims: 1) In case of Endowment type of Policies, amount is payable at the end of the policy period. The Branch Office which services the policy sends out a letter informing the date on which the policy monies are payable to the policyholder at least two months before the due date of payment.

How is surrender value of Kotak Life Insurance calculated?

Special surrender value can be calculated using a simple formula which is: (Paid-up value + accrued bonuses) X surrender value factor An obvious question that arises here is, what is paid up value? It is nothing but the basic sum assured X (number of premiums paid/number of premiums payable).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my kotak life insurance maturity directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your kotak life insurance maturity and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I edit kotak life insurance maturity on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign kotak life insurance maturity on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit kotak life insurance maturity on an Android device?

You can edit, sign, and distribute kotak life insurance maturity on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is India Kotak Life Insurance Maturity Form?

The India Kotak Life Insurance Maturity Form is a document that policyholders need to fill out when their life insurance policy matures. It is used to initiate the process of claiming the maturity benefit.

Who is required to file India Kotak Life Insurance Maturity Form?

The policyholder or the nominee of the policy is required to file the India Kotak Life Insurance Maturity Form to claim the maturity benefits upon the completion of the policy term.

How to fill out India Kotak Life Insurance Maturity Form?

To fill out the India Kotak Life Insurance Maturity Form, the policyholder must provide personal details such as name, policy number, address, and contact information, along with supporting documents such as identity proof and policy documents.

What is the purpose of India Kotak Life Insurance Maturity Form?

The purpose of the India Kotak Life Insurance Maturity Form is to formalize the request for maturity benefits from the insurance company and to ensure that all necessary information is submitted for the processing of the claim.

What information must be reported on India Kotak Life Insurance Maturity Form?

The information that must be reported on the India Kotak Life Insurance Maturity Form includes the policyholder's personal details, policy number, amount due, and bank account details for the disbursement of the maturity amount, along with any necessary documentation.

Fill out your kotak life insurance maturity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kotak Life Insurance Maturity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.