Get the free 1098-T Tax Form - USC Student Financial Services

Show details

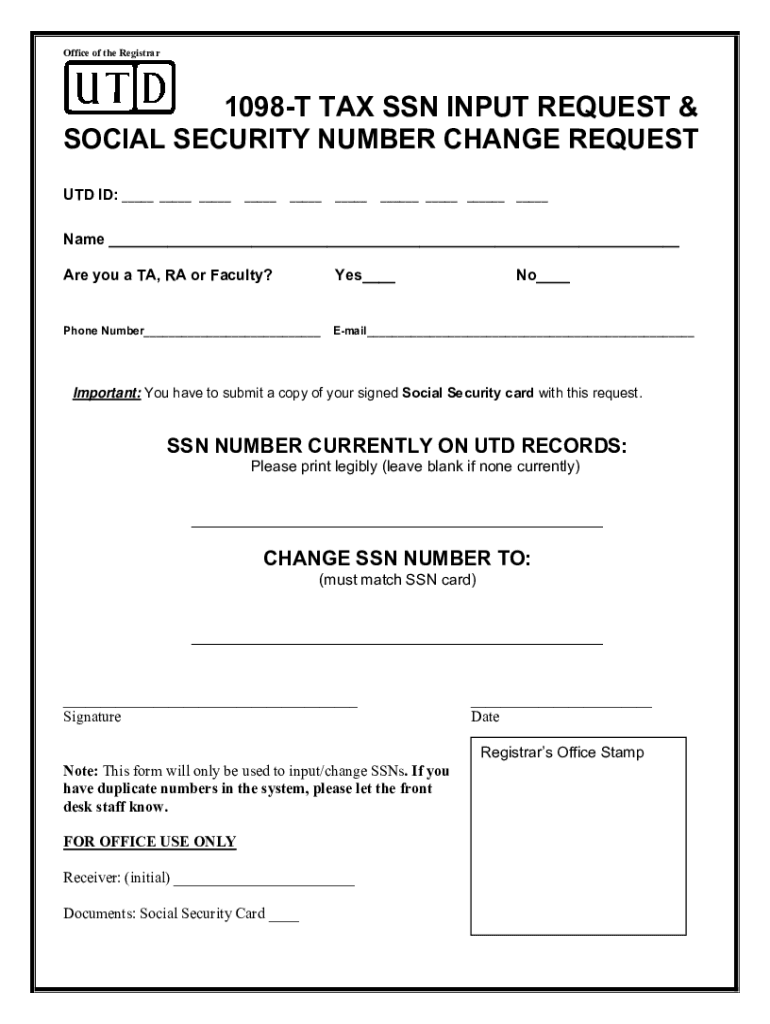

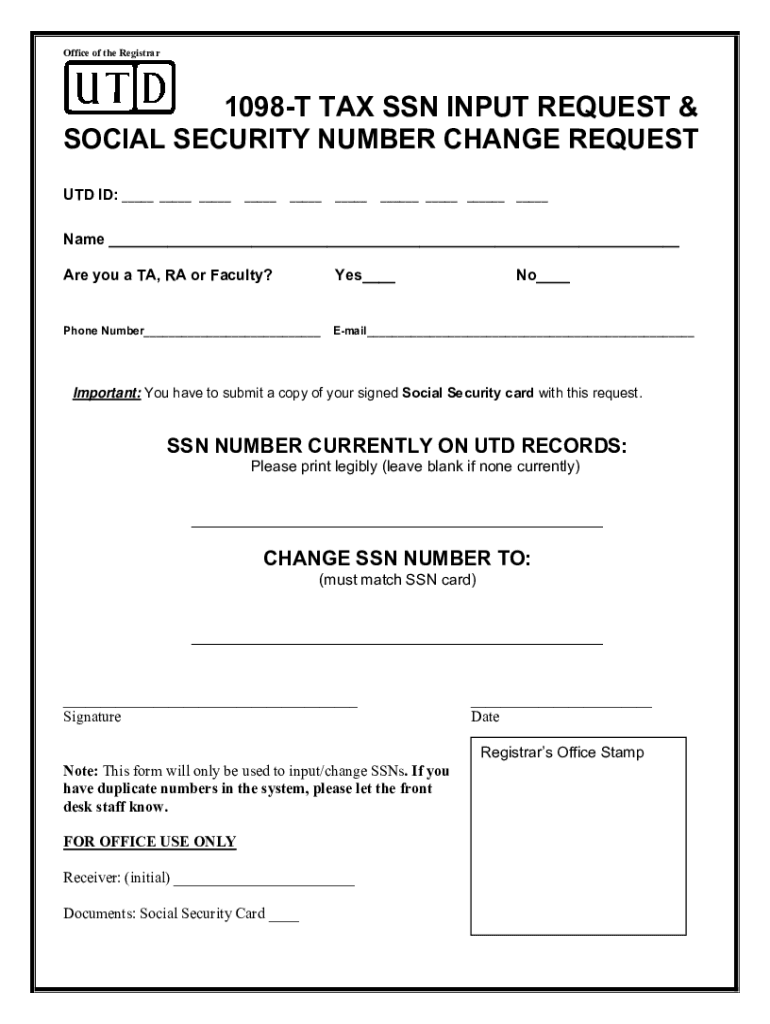

Office of the Registrar1098T TAX SSN INPUT REQUEST & SOCIAL SECURITY NUMBER CHANGE REQUEST UT DID: ______ _______________ ___ ______Name ___ Are you a TA, RA or Faculty?Yes___No___Phone Number___Email___Important:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1098-t tax form

Edit your 1098-t tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1098-t tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1098-t tax form online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1098-t tax form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1098-t tax form

How to fill out 1098-t tax form

01

Gather all necessary information such as Social Security number, income statements, and payment receipts.

02

Fill in the student's personal information including name, address, and Social Security number.

03

Report the amount of qualified tuition and related expenses paid during the tax year.

04

Include any scholarships or grants received during the tax year.

05

Submit the completed 1098-T form with your tax return.

Who needs 1098-t tax form?

01

Students who paid qualified tuition and related expenses to an eligible educational institution during the tax year.

02

Parents or guardians who are claiming education tax benefits on behalf of a student.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 1098-t tax form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 1098-t tax form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get 1098-t tax form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 1098-t tax form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete 1098-t tax form online?

pdfFiller makes it easy to finish and sign 1098-t tax form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is 1098-t tax form?

The 1098-T tax form is used by educational institutions to report information about their students to the IRS as required by the Taxpayer Relief Act of 1997.

Who is required to file 1098-t tax form?

Educational institutions are required to file the 1098-T tax form for students who paid qualified tuition and related expenses during the tax year.

How to fill out 1098-t tax form?

The educational institution will typically fill out the 1098-T tax form with the required information and provide a copy to the student for their tax records.

What is the purpose of 1098-t tax form?

The purpose of the 1098-T tax form is to help students and families determine eligibility for education-related tax benefits such as the American Opportunity Credit or the Lifetime Learning Credit.

What information must be reported on 1098-t tax form?

The 1098-T tax form must report the amount of qualified tuition and related expenses paid by the student during the tax year, as well as any scholarships or grants received.

Fill out your 1098-t tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1098-T Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.