Get the free Audit Guide - usda

Show details

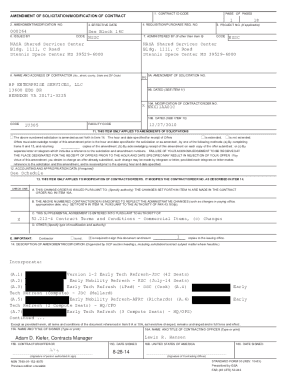

This audit guide is provided for nonfederal auditors to assist in conducting audits of Multi-State Food Processors participating in the Food Distribution Program. It outlines the purpose, background,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit guide - usda

Edit your audit guide - usda form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit guide - usda form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing audit guide - usda online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit audit guide - usda. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit guide - usda

How to fill out Audit Guide

01

Review the Audit Guide requirements thoroughly.

02

Gather all necessary financial documents and records.

03

Fill in the required sections step by step, ensuring to provide accurate information.

04

Provide supporting evidence for any claims made within the guide.

05

Double-check all entries for accuracy and completeness.

06

Submit the completed Audit Guide according to the specified submission guidelines.

Who needs Audit Guide?

01

Businesses undergoing financial audits.

02

Accountants preparing for audits.

03

Compliance officers ensuring adherence to regulations.

04

Financial institutions requiring audit checks.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between an audit plan and an audit program?

Key differences between Audit Plan and Audit Programme Purpose: An audit plan outlines the overall goals and objectives of an audit, while an audit program outlines the specific steps and procedures that will be used to achieve those goals.

What are the 5 C's of audit?

Audit team reports frequently adhere to the rule of the “Five C's” of data sharing and communication, and a thorough summary in a report will include each of these elements. The “Five C's” are criteria, condition, cause, consequence, and corrective action.

What is an audit program guide?

An audit program is a set of directions that the auditor and its team members need to follow for the proper execution of the audit. After preparing an audit plan, the auditor allocates the work and prepares a program which contains steps that the audit team needs to follow while conducting an audit.

What is the role of a guide during the audit?

Bridge Between Auditors and Auditee: Guides serve as a bridge between the auditors and the auditee's organization. They facilitate effective communication by conveying the auditors' needs, expectations, and any specific requirements to the auditee.

What are the 4 C's of auditing?

These features can be referred to as the four C's of internal audit and they stand for: Compliance, Cybersecurity, Competitiveness and Culture.

What are the 5 C's of audit?

Audit team reports frequently adhere to the rule of the “Five C's” of data sharing and communication, and a thorough summary in a report will include each of these elements. The “Five C's” are criteria, condition, cause, consequence, and corrective action.

What is the main purpose of the audit program?

Having an audit program in place helps businesses maintain an effective system of internal controls, obtain objective insights on operations, identify risks of fraud and misappropriation of assets, and lastly, ensure compliance with relevant laws or regulations.

What is an audit technique guide?

Audit technique guides (ATGs) and technical guides (TGs) offer techniques and methods and technical information (law) to help IRS agents work cases involving specific types of exempt organizations (EOs).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Audit Guide?

The Audit Guide is a comprehensive document that outlines the standards, procedures, and requirements for conducting audits in a specific field or organization.

Who is required to file Audit Guide?

Organizations and individuals involved in financial reporting or regulatory compliance, such as public companies and auditors, are typically required to file the Audit Guide.

How to fill out Audit Guide?

To fill out the Audit Guide, follow the provided instructions carefully, enter all required information accurately, and ensure that all necessary supporting documents are included.

What is the purpose of Audit Guide?

The purpose of the Audit Guide is to provide a standardized framework for auditing processes, ensuring consistency, quality, and compliance with applicable regulations and standards.

What information must be reported on Audit Guide?

The information that must be reported on the Audit Guide includes audit objectives, procedures performed, findings, conclusions, and any recommendations made during the audit.

Fill out your audit guide - usda online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Guide - Usda is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.