T. Rowe Price Form FMF4IECR 2015 free printable template

Show details

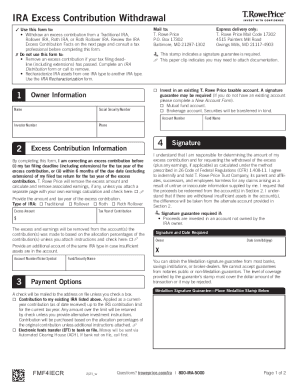

IRA Excess Contribution Withdrawal ? Se this form to: U A withdrawal an excess contribution from a Traditional IRA, W Rollover IRA, Roth IRA, or Roth Rollover IRA. Consult a tax advisor before completing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign T Rowe Price Form FMF4IECR

Edit your T Rowe Price Form FMF4IECR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your T Rowe Price Form FMF4IECR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing T Rowe Price Form FMF4IECR online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit T Rowe Price Form FMF4IECR. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

T. Rowe Price Form FMF4IECR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out T Rowe Price Form FMF4IECR

How to fill out T. Rowe Price Form FMF4IECR

01

Obtain T. Rowe Price Form FMF4IECR from the official T. Rowe Price website or customer service.

02

Begin by filling out your personal information, including your name, address, and account number.

03

Indicate the type of transaction you wish to perform on the form.

04

Provide details of the securities involved in the transaction.

05

Review the form to ensure that all information is accurate and complete.

06

Sign and date the form at the designated section.

07

Submit the completed form via mail, fax, or through the designated online portal.

Who needs T. Rowe Price Form FMF4IECR?

01

Individuals or entities looking to execute specific transactions related to their investments managed by T. Rowe Price.

02

Account holders who need to update or manage their investment accounts.

Fill

form

: Try Risk Free

People Also Ask about

How do you correct excess contributions?

You have a few options if you discover an excess contribution after you file your taxes: Contact your plan administrator and file an amended tax return. Carry the excess forward to the new tax year. Roth IRA option: Move the excess to a traditional IRA. Do nothing and pay 6% on the excess every year.

What is a 5428 form?

5428 (03-18) International Fuel Tax Agreement (IFTA) Address Change Request. Use this form to change the physical and/or mailing address on your online IFTA account. If additional space is needed for Part 2 and Part 3, use the back of this page.

How do I report 1099-R with excess contributions?

Form 1099-R - Excess 401k Contributions Excess contributions must be included as income for the year in which the contributions were made. If the excess contributions haven't already been claimed in that year, the return will need to be amended to include the excess distribution as income.

How do I report excess contributions?

You must include in your gross income the interest or other income that was earned on the excess contribution. Report it on your return for the year in which the excess contribution was made. Your withdrawal of interest or other income may be subject to an additional 10% tax on early distributions discussed in Pub.

How do I correct an excess 401k contribution?

How to Fix Excess 401(k) Contributions Notify your employer or plan administrator immediately. Calculate your excess contributions plus earnings. Get an accurate W-2. File your return, or an amended return. Add the excess contribution to your next return. Double-check your contributions going forward.

What is an excess contribution?

An excess contribution is generally one that exceeds the. IRA contribution limit. An excess contribution can occur. in an IRA for a variety of reasons including the following: • Contribution is more than the annual contribution limit.

How do I report excess 401k contribution on tax return?

You should report the full amount of your excess deferrals on line 7 of your individual tax return (Form 1040) for 2021, and you should report the allocable loss as a bracketed amount on the “Other Income” line (line 21) of your Form 1040 for 2022.

Is form 5498 a salary?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

How do I correct excess 401k contributions?

How to Fix Excess 401(k) Contributions Notify your employer or plan administrator immediately. Calculate your excess contributions plus earnings. Get an accurate W-2. File your return, or an amended return. Add the excess contribution to your next return. Double-check your contributions going forward.

Is removal of excess contribution taxable?

When you remove the excess contribution from your account, only the earnings portion (if any) is available for tax withholding. We won't withhold taxes from your original contribution amount or if you request the removal after the IRS tax-filing deadline has past.

What do I do if I received a form 5498?

Your IRA trustee or custodian is the one responsible for mailing Form 5498 to the IRS, along with a copy to you. You don't have to do anything with the form itself. Just keep it with your tax records.

How do I report excess contributions to my tax return?

You must include in your gross income the interest or other income that was earned on the excess contribution. Report it on your return for the year in which the excess contribution was made. Your withdrawal of interest or other income may be subject to an additional 10% tax on early distributions discussed in Pub.

What does excess contribution mean?

An excess contribution is generally one that exceeds the. IRA contribution limit. An excess contribution can occur. in an IRA for a variety of reasons including the following: • Contribution is more than the annual contribution limit.

How do I fix an excess IRA contribution?

You can either: Remove the excess within 6 months and file an amended return by October 15—if eligible, the excess plus your earnings can be removed by this date. Remove the excess once discovered, even after October 15. You'll need to reduce next year's contributions by the amount of the excess.

What is an excess contribution to an IRA?

Tax on excess IRA contributions An excess IRA contribution occurs if you: Contribute more than the contribution limit. Make a regular IRA contribution for 2019, or earlier, to a traditional IRA at age 70½ or older. Make an improper rollover contribution to an IRA.

How do I report a return of excess contribution?

You must include in your gross income the interest or other income that was earned on the excess contribution. Report it on your return for the year in which the excess contribution was made. Your withdrawal of interest or other income may be subject to an additional 10% tax on early distributions discussed in Pub.

What is considered excess contribution?

An excess contribution is generally one that exceeds the. IRA contribution limit. An excess contribution can occur. in an IRA for a variety of reasons including the following: • Contribution is more than the annual contribution limit.

Are excess contributions taxable?

Excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA. The tax can't be more than 6% of the combined value of all your IRAs as of the end of the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify T Rowe Price Form FMF4IECR without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your T Rowe Price Form FMF4IECR into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find T Rowe Price Form FMF4IECR?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the T Rowe Price Form FMF4IECR in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the T Rowe Price Form FMF4IECR electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your T Rowe Price Form FMF4IECR in seconds.

What is T. Rowe Price Form FMF4IECR?

T. Rowe Price Form FMF4IECR is a financial form used by T. Rowe Price to collect specific information related to investment accounts and transactions. It is typically involved in reporting investment income, gains, or distributions.

Who is required to file T. Rowe Price Form FMF4IECR?

Individuals or entities that hold investment accounts with T. Rowe Price and are subject to reporting requirements, such as tax reporting or compliance obligations, are required to file the T. Rowe Price Form FMF4IECR.

How to fill out T. Rowe Price Form FMF4IECR?

To fill out T. Rowe Price Form FMF4IECR, begin by entering your personal information, including name, address, and account details. Follow the instructions provided on the form to report specific income and transaction details as required.

What is the purpose of T. Rowe Price Form FMF4IECR?

The purpose of T. Rowe Price Form FMF4IECR is to facilitate accurate reporting of investment income and transactions for tax and regulatory purposes, ensuring compliance with applicable laws and guidelines.

What information must be reported on T. Rowe Price Form FMF4IECR?

The information that must be reported on T. Rowe Price Form FMF4IECR includes personal identification details, account numbers, types of investment income, distributions, capital gains, and other relevant financial data as stipulated by T. Rowe Price.

Fill out your T Rowe Price Form FMF4IECR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T Rowe Price Form fmf4iecr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.