HI TA-2 2022-2026 free printable template

Show details

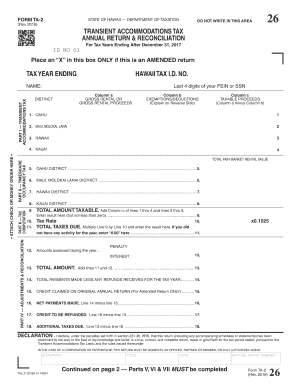

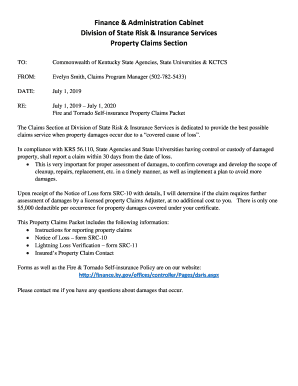

Clear Form TA2STATE OF HAWAII DEPARTMENT OF TAXATION(Rev. 2022)ID NO 01DO NOT WRITE IN THIS AREATRANSIENT ACCOMMODATIONS TAX

ANNUAL RETURN & RECONCILIATION26For Tax Years Ending After December 31,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hawaii form transient accommodations tax

Edit your hawaii transient return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI TA-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI TA-2 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI TA-2. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI TA-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI TA-2

How to fill out HI TA-2

01

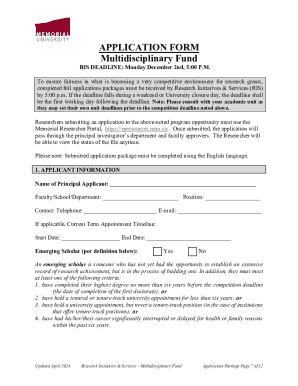

Obtain the HI TA-2 form from the relevant authority.

02

Read the instructions carefully to understand the requirements.

03

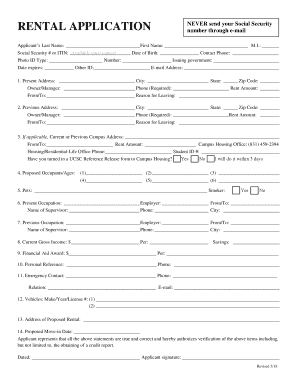

Fill in your personal information, including your full name, address, and contact details.

04

Provide any necessary identification numbers such as Social Security Number or tax identification number.

05

Complete sections relevant to your specific situation, ensuring to follow any guidelines provided.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as directed, either by mail or electronically.

Who needs HI TA-2?

01

Individuals applying for assistance or benefits under the HI TA program.

02

Persons who are required to provide verification of their eligibility for health benefits.

03

Applicants seeking financial aid for healthcare-related expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the Maui transient accommodation tax?

Effective November 1, 2021, the MCTAT is levied at a rate of 3 percent on every taxpayer that has taxable gross rental proceeds and/or total fair market rental value attributable to the County of Maui. The MCTAT is imposed in addition to the State TAT, which is currently levied at a rate of 10.25 percent.

What is Maui transient accommodations tax?

Effective Nov 1, 2021, Maui County has implemented its Transient Accommodations Tax of 3%. This new MCTAT is in addition to the State of Hawaii TAT of 10.25% and GET of 4.1666%.

What is the get tat tax in Hawaii?

Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

What is Hawaii's transient occupancy tax upon check in?

All guestroom and suite rates are subject to the prevailing Hawaii State General Excise Tax at 4.712%, Hawaii Transient Accommodations Tax at 10.25% and Oahu Transient Accommodations Tax at 3% (combined rate of 17.962%).

What is the transient accommodation tax in Maui?

Effective November 1, 2021, the MCTAT is levied at a rate of 3 percent on every taxpayer that has taxable gross rental proceeds and/or total fair market rental value attributable to the County of Maui. The MCTAT is imposed in addition to the State TAT, which is currently levied at a rate of 10.25 percent.

What is the transient accommodations tax in Hawaii?

Beginning January 1, 2022, the HCTAT is levied at a rate of 3 percent on every taxpayer that has taxable gross rental proceeds and/or total fair market rental value attributable to the County of Hawai'i.

What is the tat tax in Hawaii County?

Beginning January 1, 2022, the HCTAT is levied at a rate of 3 percent on every taxpayer that has taxable gross rental proceeds and/or total fair market rental value attributable to the County of Hawai'i.

What is the difference between TA 1 and TA 2?

Use Form TA-1, the periodic tax return, to report and pay your TAT for the period. Periodic returns must either be filed monthly, quarterly, or semiannually. Use Form TA-2, the annual tax return and reconciliation, to summarize the TAT gross rental proceeds and the taxes paid for the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send HI TA-2 for eSignature?

Once you are ready to share your HI TA-2, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete HI TA-2 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your HI TA-2. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit HI TA-2 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like HI TA-2. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is HI TA-2?

HI TA-2 is a tax form used in Hawaii for reporting certain tax-related information.

Who is required to file HI TA-2?

Individuals or entities that engage in business activities subject to certain taxes in Hawaii are required to file HI TA-2.

How to fill out HI TA-2?

To fill out HI TA-2, gather all relevant financial information for the reporting period and follow the instructions provided on the form, ensuring all sections are completed accurately.

What is the purpose of HI TA-2?

The purpose of HI TA-2 is to collect information necessary for the proper assessment and collection of taxes in Hawaii.

What information must be reported on HI TA-2?

The form requires reporting of income, deductions, and other financial data pertaining to the tax obligations of the filer in Hawaii.

Fill out your HI TA-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI TA-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.