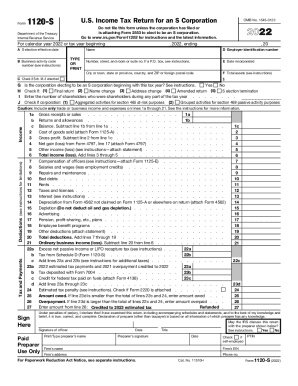

IRS Instructions 1120S 2022 free printable template

Get, Create, Make and Sign IRS Instructions 1120S

Editing IRS Instructions 1120S online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 1120S Form Versions

How to fill out IRS Instructions 1120S

How to fill out IRS Instructions 1120S

Who needs IRS Instructions 1120S?

Instructions and Help about IRS Instructions 1120S

Hi this is John with PDF tax calm were looking on the screen here at form 1120s the US income tax return for S corporations this PDF file that were looking at was downloaded from IRS gov, so it is the official government form however it's been enhanced in several ways as you can see the most obvious one is these yellow navigation buttons so for example if I was to go over here and click on this one to go to 1125 a that's where it would take me and then to get back to the page 1 I could either scroll up all the way to page 1 or I could just click on the navigation page button which would take me to this navigation page, and then I can click on page 1, and I'm back where I started now the yellow buttons they're visible on the screen but if you print out the paper copy they won't print on the paper copy so if you wanted to file this form as your tax return you can do that so let's start out here to show that you how this works with the business activity code I'm going to go over to the instructions for this form 1120s and again these instructions can be found on iron and the one that I want is highlighted in yellow here for me 7 2 2 5 1 3, so I can enter that right here like that, and then I am ready to put in some numbers for this business we've created a hypothetical pizza restaurant so lets go through this and well show you how this works I'm going to use some nice round numbers here for my sales 750000 dollars now you can see that that carries down automatically for you for your totals, so this is a self calculating form so let's enter some more numbers to continue here lets go back to the 1125 a which is the cost of goods sold and cost of goods sold is the cost of all the things that are used in this business to make the pizza for the example the dough and the cheese and the pepperoni and all the toppings and whatever soft drinks are sold during the year those would all be part of inventory cost and the first thing were going to enter is the beginning inventory 80000 beginning inventory is what whatever was left over at the end of the year and of the prior year that wasn't used to make pizza, so it's sitting in the restaurant there and inventory available to be used this year to make pizza and then that 80000 will become part of the cost of goods sold so were starting out with a 80000 and were going to say that during the year we purchased three hundred thousand dollars worth of all those ingredients that I just mentioned, and they too will be part of cost of goods sold now the labor would be the salaries of all the employees that actually make the pizza and were going to say that that is one hundred and eighty thousand dollars, so our total comes down to five hundred and sixty thousand dollars, but we need to subtract out the inventory at the end of the year obviously the inventory at the end of the year wasn't used to make pizza sitting still sitting in the restaurant, and so we can't include that as part of our cost that was sold so if we...

People Also Ask about

When should form 1120 be filed?

Who must file a form 1120?

What is IRS form 1120 used for?

What is the difference between 1040 and 1120?

What is the purpose of 1120?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS Instructions 1120S online?

How do I edit IRS Instructions 1120S on an Android device?

How do I complete IRS Instructions 1120S on an Android device?

What is IRS Instructions 1120S?

Who is required to file IRS Instructions 1120S?

How to fill out IRS Instructions 1120S?

What is the purpose of IRS Instructions 1120S?

What information must be reported on IRS Instructions 1120S?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.