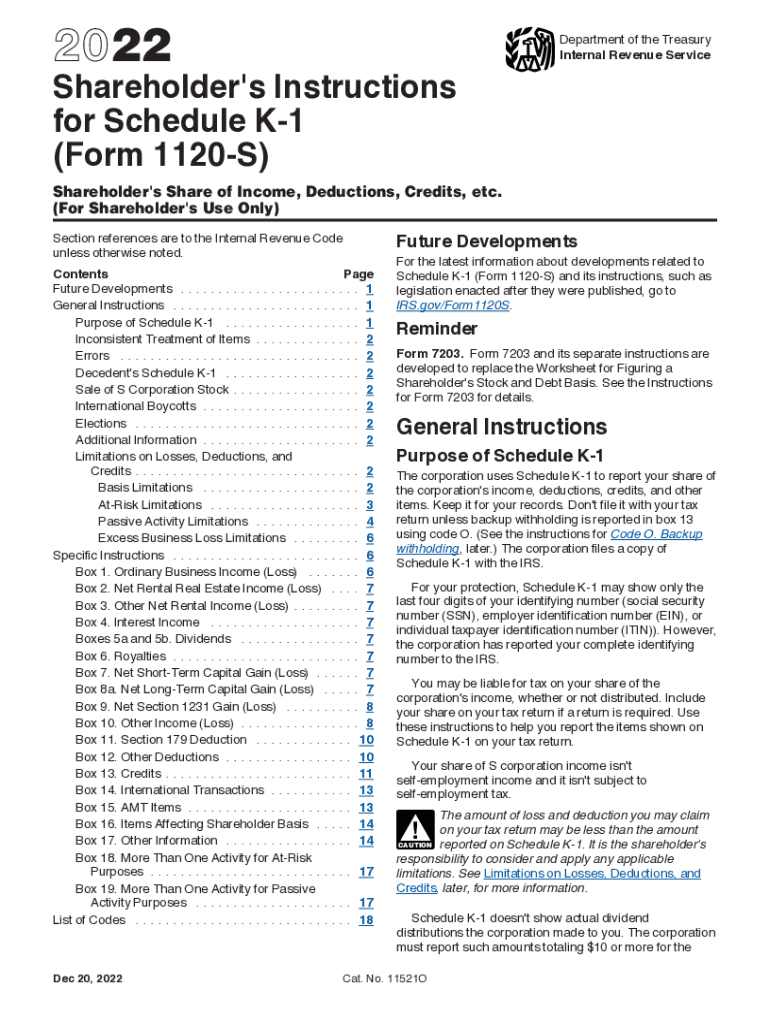

Who Needs Instructions for Schedule K-1?

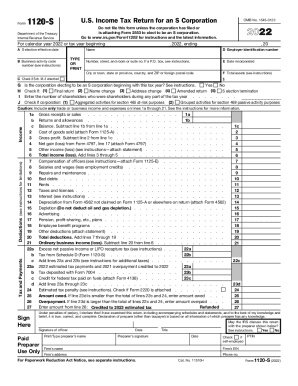

All those who must file Form 1120-S can benefit from looking at this file. Form 1120S is for the businesses that elect to be taxed as S corporations. They must provide their shareholders with information about changes in the corporation’s income, deductions or credits. All instructions have been carefully prepared by IRS officials and updated according to the changes for the 2017 tax year. They contain a section-by-section guide, mailing addresses, online resources for submitting and due dates.

What are these Instructions for?

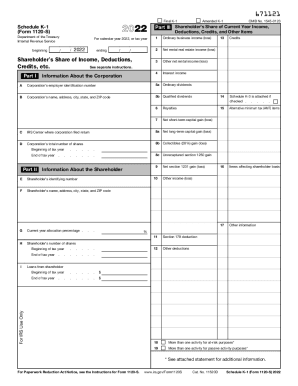

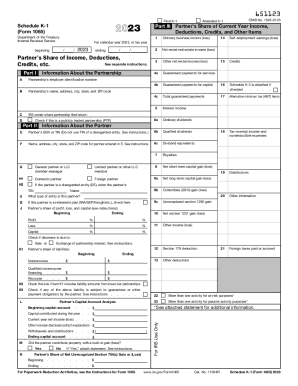

These instructions provide a guide for correctly filling out Schedule K-1, Shareholder’s Share of Income, Deductions, Credits etc. There are 16 pages to answer any question you might have on the issue of income reduced by any tax paid by the corporation.

What Else do I Need to Know?

There are samples of Schedule K-1 to Form 1120-S. You can find them through your filler account. To start browsing in the filler library, click Add new document and then Search document. Once you find it, you can fill it out in your account.

When were these Instructions Updated?

These instructions were updated according to IRS requirements for 2017.

Do I Fill out these Instructions?

You don’t need to write anything on these instructions. They are designed for your convenience. You can highlight important sections, put sticky notes on them and share valuable information found in this form with your colleagues.

Where do I Send them?

You don’t have to attach these instructions to anything or send them anywhere. They are meant for personal use only.