SC DoR SC1065 2022 free printable template

Show details

1350SC 1065STATE OF SOUTH CAROLINA2022 PARTNERSHIP Returner.SC.golfer the year January 1 December 31, 2022, or fiscal tax year beginning2022 and endingNameLocation of business property: City and stateAddressCityFEIN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC1065

Edit your SC DoR SC1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR SC1065 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SC DoR SC1065. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR SC1065

How to fill out SC DoR SC1065

01

Begin by downloading the SC DoR SC1065 form from the official website.

02

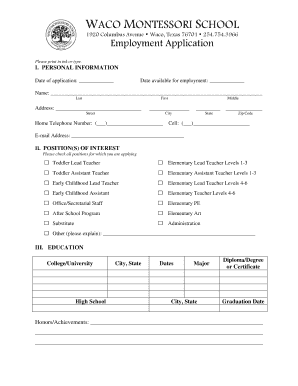

Fill in your personal information, including your name, address, and contact details.

03

Provide details of the income you received during the specified period.

04

Include any deductions or credits you are eligible for.

05

Review your entries for any errors or omissions.

06

Sign and date the form at the bottom.

07

Submit the completed form by the deadline, either electronically or via mail.

Who needs SC DoR SC1065?

01

Individuals or entities in South Carolina that are required to report income for tax purposes.

02

Business owners who need to document their financial activity for state tax compliance.

03

Tax preparers assisting clients in filing for South Carolina tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Where are partnership returns filed?

Form 1065 - Where to File U.S. Return of Partnership Income and Extensions And the total assets at the end of the tax year (Form 1065, page 1, item F) are:Use the following address:Any amountDepartment of the Treasury Internal Revenue Service Center Ogden, UT 84201-00113 more rows • Nov 25, 2020

Who must file South Carolina partnership return?

Partnership taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically. To file by paper, use the SC 1065 Partnership Return.

How do you form a partnership in South Carolina?

There are a few important steps to go through once the decision has been made to start a partnership in South Carolina. Step 1: Select a business name. Step 2: Register the business name. Step 3: Complete required paperwork. Step 4: Determine if you need an EIN, additional licenses or tax IDs.

Who is responsible for taxes in a general partnership?

General partnerships don't pay business income taxes, because they are pass-through entities. This means each owner reports their share of the partnership's income and losses on their personal tax return and pays the taxes ingly.

What is a composite taxpayer?

A Michigan Composite Individual Income Tax Return (Form 807) is a collective individual income tax filing for two or more participating nonresident members filed by the flow-through entity (FTE). This form is used to report and pay individual income tax under Part 1 of Public Act 281 of 1967, as amended.

How easy is it to form a partnership?

Easy Setup. Partnerships are formed by a private agreement between the partners, and don't need to register their existence with the state like corporations or limited liability companies. Partnerships don't require a written agreement, but it's a good idea to have one, nonetheless.

Does South Carolina have a pass through entity tax?

On May 17, 2021, South Carolina enacted Senate Bill 627, which permits pass-through entities to elect to pay South Carolina tax on active trade or business income at the entity level.

Who is required to file SC tax return?

ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

Who files composite return?

Composite return overview Simply stated, a composite return is filed by a pass-through entity and reports the state income of all non-resident owners as one group.

Who is responsible for filing of the partnership return?

The precedent partner is responsible to file Form P to declare all income, losses, expenses, profit, loss, and assets, based on the profit and loss account, and balance sheet of the partnership business. As is normal practice, all business records must be kept for a period of 7 years for audit purposes.

How are LLCs taxed in South Carolina?

The State of South Carolina, like almost every other state, has a corporation income tax. In South Carolina, the corporate tax generally is a flat 5% of the business's entire net income.

What is required to form a partnership?

A partnership must have two or more owners who share in the profits and losses of a business. Partnerships can form automatically without the submission of formation documents. All partnerships should have a written partnership agreement that spells out the rules and regulations of the business.

Does South Carolina have a PTE tax?

Only PTEs wholly owned by qualified owners are eligible to make the South Carolina PTE tax election. Unlike most states that have an elective PTE tax regime, South Carolina's S.B.

Who can file a South Carolina composite return?

A composite return is a single return filed by a partnership, S corporation, or Limited Liability Company (LLC) taxed as a partnership or S corporation on behalf of two or more nonresident participants.

Who files a partnership return?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Who must file a South Carolina tax return?

You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages. You are married filing jointly, age 65 or older and your gross income is greater than federal gross income filing requirement amount plus $30,000.

What is the passthrough entity tax?

New York City Pass-through Entity Tax (NYC PTET) The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021.

Who must file a SC corporate tax return?

Generally Corporate taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically.

Do seniors have to file taxes in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees.

Which states allow composite returns?

State Involvement States that do allow composite returns include: Alabama, Connecticut, Delaware, Idaho, Wisconsin, South Carolina, Massachusetts, Michigan, North Dakota, New Hampshire, Tennessee, Texas, Nebraska, Oklahoma, Utah, Arizona, New York and Vermont, as well as the District of Columbia.

What are the steps of forming partnership?

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

Do I have to register a partnership?

Each partner has to be registered with HMRC for Self Assessment. Your partnership must also be registered for Self Assessment. When the nominated partner registers the partnership they will automatically register themselves for Self Assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC DoR SC1065 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your SC DoR SC1065 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send SC DoR SC1065 to be eSigned by others?

Once your SC DoR SC1065 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit SC DoR SC1065 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing SC DoR SC1065 right away.

What is SC DoR SC1065?

SC DoR SC1065 is a form used in South Carolina for reporting income from partnership entities.

Who is required to file SC DoR SC1065?

Partnerships operating in South Carolina are required to file SC DoR SC1065 to report their income and distribute it to partners.

How to fill out SC DoR SC1065?

Fill out SC DoR SC1065 by providing the partnership's identifying information, reporting income, expenses, and the distribution of income to each partner.

What is the purpose of SC DoR SC1065?

The purpose of SC DoR SC1065 is to report income earned by partnerships for tax purposes and to inform partners of their share of income.

What information must be reported on SC DoR SC1065?

Information that must be reported includes partnership details, total income, deductions, and individual partners’ shares of income and deductions.

Fill out your SC DoR SC1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.