RiverSource Life Insurance 45010 2020-2025 free printable template

Show details

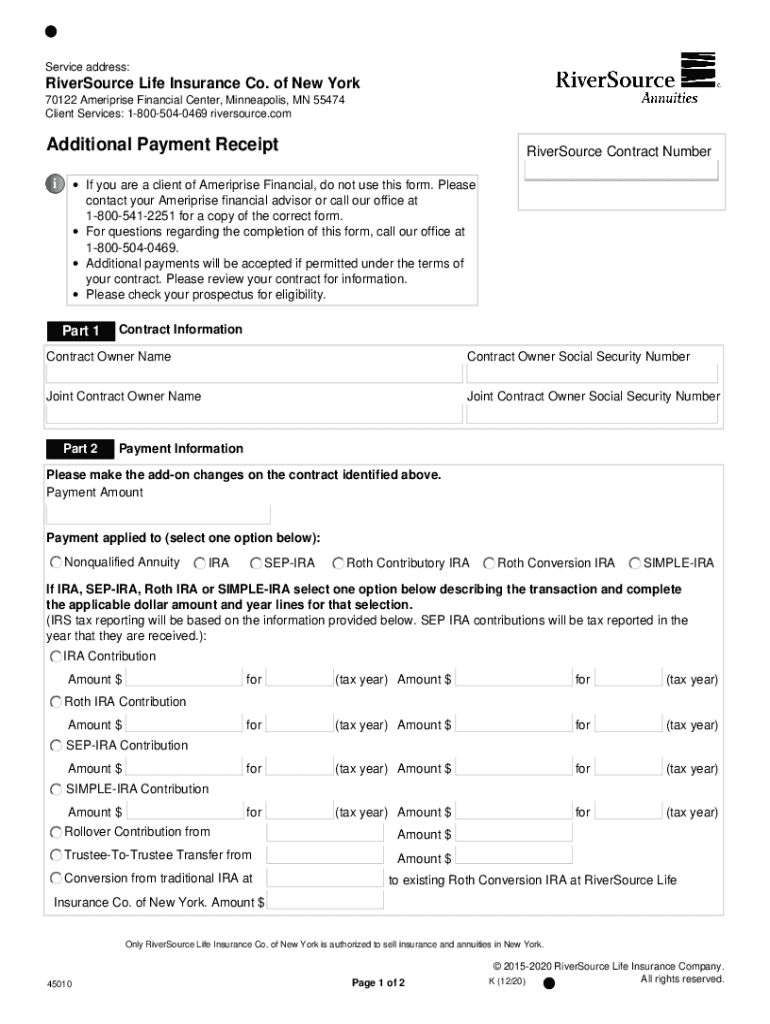

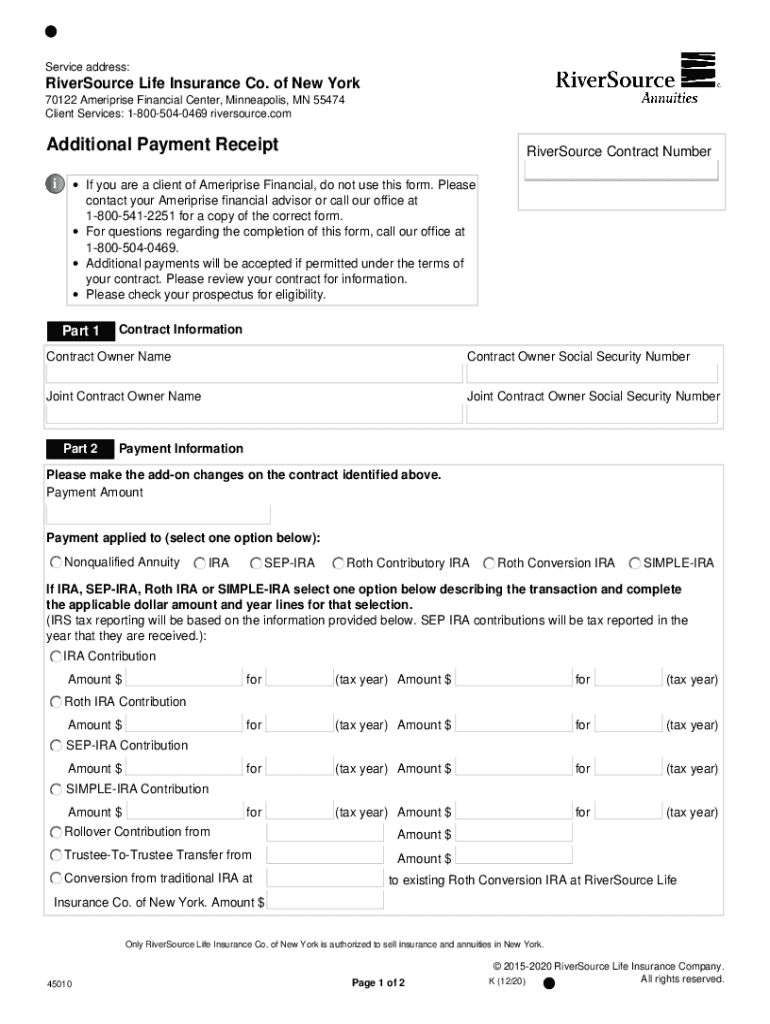

Service address:RiverSource Life Insurance Co. of New York 70122 Ameriprise Financial Center, Minneapolis, MN 55474 Client Services: 18005040469 riversource.comAdditional Payment ReceiptRiverSource

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 45010 additional payment receipt

Edit your 45010 additional payment receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 45010 additional payment receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 45010 additional payment receipt online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 45010 additional payment receipt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RiverSource Life Insurance 45010 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 45010 additional payment receipt

How to fill out 45010 additional payment receipt

01

Obtain the 45010 additional payment receipt form from the relevant authority or website.

02

Fill in the taxpayer's name and address in the designated fields.

03

Enter the tax identification number (TIN) in the appropriate section.

04

Indicate the type of payment being made on the form.

05

Specify the payment amount you are submitting.

06

Provide the period for which the payment is being made.

07

Include any reference number, if applicable, to link the payment to prior correspondence.

08

Review the form for accuracy and completeness.

09

Sign and date the receipt as required.

10

Submit the completed form along with the payment to the designated office or online portal.

Who needs 45010 additional payment receipt?

01

Taxpayers who need to make an additional payment towards their taxes.

02

Individuals or businesses that have been notified by the tax authority of an outstanding payment.

03

Those who are filing an amended tax return that requires additional payments.

04

People seeking to rectify any discrepancies in their tax filings or payment records.

Fill

form

: Try Risk Free

People Also Ask about

What is considered proof of payment?

A receipt or bank statement is the most common way to provide proof of payment. Receipt copies can be obtained from the seller either online or in person. If you need to use a bank statement, access it through your online bank account.

What is the document for receiving payment?

A receipt is a written document acknowledging a payment that has been made. A receipt is commonly issued after an invoice has been paid and includes transaction details, such as payment method.

What is proof of payment in form?

A receipt or bank statement is the most common way to provide proof of payment. Receipt copies can be obtained from the seller either online or in person. If you need to use a bank statement, access it through your online bank account.

Is a receipt a proof of payment?

What is a receipt? A receipt is a document issued by a business to its customer after the customer has paid for items or services. It acts as a proof of payment for both your business and the customer.

What is evidence of proof of payment?

a credit or debit card statement. a lay-by agreement. a receipt or reference number (for phone or internet payments) a warranty card showing the supplier's or manufacturer's details, date and amount of the purchase.

What is an example of a proof of transaction?

confirmation or receipt number provided for a telephone or internet transaction. warranty card showing the supplier's or manufacturer's details and the date or amount of the purchase. serial or production number linked with the purchase on the supplier's or manufacturer's database. credit card statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 45010 additional payment receipt for eSignature?

Once you are ready to share your 45010 additional payment receipt, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find 45010 additional payment receipt?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 45010 additional payment receipt and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in 45010 additional payment receipt without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 45010 additional payment receipt, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is 45010 additional payment receipt?

The 45010 additional payment receipt is a document used for reporting and processing additional payments made to a tax obligation, typically in the context of federal or state tax filings.

Who is required to file 45010 additional payment receipt?

Individuals or entities who have made additional payments towards their tax liabilities may be required to file the 45010 additional payment receipt to ensure proper crediting of those payments.

How to fill out 45010 additional payment receipt?

To fill out the 45010 additional payment receipt, provide required details such as taxpayer identification information, payment amount, payment date, and any relevant tax periods that the payment applies to.

What is the purpose of 45010 additional payment receipt?

The purpose of the 45010 additional payment receipt is to document additional payments made towards tax liabilities and ensure accurate record-keeping and crediting of such payments by tax authorities.

What information must be reported on 45010 additional payment receipt?

The 45010 additional payment receipt must report information including taxpayer name, taxpayer identification number, payment amount, payment method, tax year or period, and any other specifics required by the tax authority.

Fill out your 45010 additional payment receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

45010 Additional Payment Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.