Get the free Application for a Letter of Credit

Show details

This document serves as an application for a Letter of Credit, outlining the necessary details of the member institution, the type of letter of credit requested, associated fees, and the supporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for a letter

Edit your application for a letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for a letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

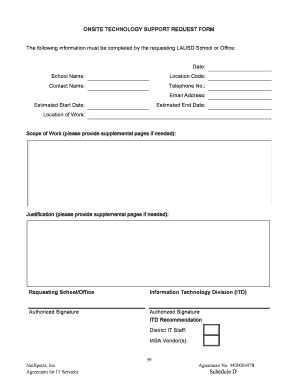

Editing application for a letter online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for a letter. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

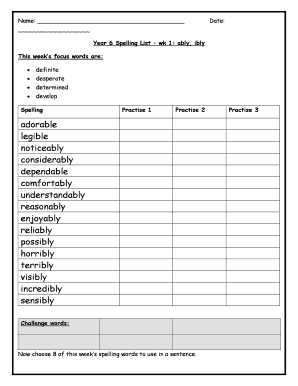

How to fill out application for a letter

How to fill out Application for a Letter of Credit

01

Gather required information, including details of the buyer and seller.

02

Specify the amount and currency of the Letter of Credit.

03

Include a description of the goods or services involved.

04

State the terms of shipment, including mode of transportation and delivery dates.

05

Indicate any specific documents needed, such as invoices, bills of lading, or inspection certificates.

06

Review and confirm the terms and conditions of the Letter of Credit.

07

Submit the completed application form to your bank.

Who needs Application for a Letter of Credit?

01

Importers and exporters involved in international trade.

02

Businesses looking to secure payment in transactions.

03

Banks that are facilitating trade finance.

04

Exporters needing assurance of payment.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a credit application letter?

The letter should be well-written, concise, and clearly articulate the reasons why you need the credit account, how you intend to use the credit, and how you plan to pay it back. A poorly written letter can undermine your credibility and decrease your chances of being approved for a credit account.

What are the disadvantages of a letter of credit?

Acquiring a letter of credit can be expensive due to high fees charged by banks. These fees can increase the overall cost of the transaction for both buyers and sellers. For small businesses or transactions with tight profit margins, these additional costs may be a financial burden.

What is an LC at sight example?

Example of an LC at sight After providing the complete price, the manufacturer requests an advance payment as security before starting manufacturing. The importer does not, however, want to take the chance of making an advance payment and later not receiving goods.

What is an example of a letter of credit?

What Is an Example of a Letter of Credit? Consider an exporter in an unstable economic climate, where credit may be more difficult to obtain. A bank could offer a buyer a letter of credit, available within two business days, in which the purchase would be guaranteed by the bank's branch.

What is LC with an example?

A Letter of Credit, commonly known as LC, is a formal document issued by a bank or financial institution. Its primary purpose is to ensure payment on behalf of the buyer to the seller in a business transaction. It acts as a safety net that guarantees the seller will receive payment for their goods or services.

What is LC in simple words?

What is a Letter of Credit? A Letter of Credit (LC) is a financial instrument used in international trade to provide payment security. It guarantees that the seller will receive payment from the buyer, as long as the seller fulfils the agreed-upon terms and conditions.

How to fill a letter of credit application form?

Issuing Bank Contact the issuing bank and obtain the letter of credit form. Fill out the form with the necessary information, such as the applicant and the beneficiary. Submit the form to the issuing bank, along with any other requested documents. Wait for the issuing bank to approve the letter of credit.

What are some examples of LC?

The most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for a Letter of Credit?

An Application for a Letter of Credit is a document that a buyer submits to a bank to request the issuance of a letter of credit, which serves as a guarantee of payment to a seller.

Who is required to file Application for a Letter of Credit?

Typically, the buyer or importer is required to file the Application for a Letter of Credit with their bank to facilitate international trade transactions.

How to fill out Application for a Letter of Credit?

To fill out the application, the buyer must provide details such as the parties involved, the transaction amount, descriptions of the goods, payment terms, and any specific instructions or conditions.

What is the purpose of Application for a Letter of Credit?

The purpose is to request the bank to issue a letter of credit that ensures the seller receives payment upon fulfilling the conditions outlined in the credit.

What information must be reported on Application for a Letter of Credit?

Information that must be reported includes the applicant's details, beneficiary’s information, transaction details, payment amount, terms of delivery, and any specific requirements for documentation.

Fill out your application for a letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For A Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.