Get the free Trust to Trust Transfer

Show details

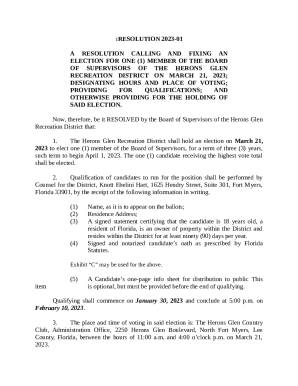

September 20, 2007,

Pennsylvania Realty Transfer Tax

No. RTT07007

Trust to Trust Transfer

Rule in Beyer Bros.

Living and Ordinary Trusts

ISSUES:

1. Is a document that is executed for consideration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust to trust transfer

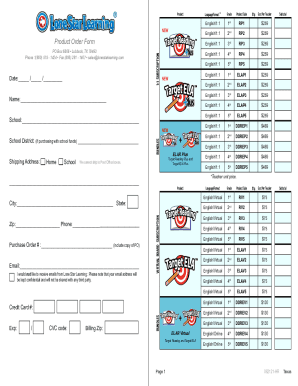

Edit your trust to trust transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust to trust transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust to trust transfer online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit trust to trust transfer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust to trust transfer

How to fill out trust to trust transfer:

01

Identify the trust involved: Start by determining the details of the trust from which you want to transfer assets and the trust to which you want to transfer them. This includes the names of the trusts, the trustees, and any beneficiaries involved.

02

Review the trust documents: Carefully review the trust documents of both trusts to understand the terms and conditions associated with the transfer. Look for any specific provisions related to transferring assets between trusts.

03

Consult with an attorney or financial advisor: Trust transfers can be complex, so it's advisable to seek professional assistance. Consult with an attorney or a financial advisor who specializes in estate planning or trusts to guide you through the process.

04

Prepare the necessary documents: Gather the required legal documents for the trust to trust transfer. These may include a trust transfer agreement, trustee resolutions, and any other relevant forms. Ensure that the documents adhere to the legal requirements and guidelines of your jurisdiction.

05

Complete the necessary paperwork: Fill out the required forms and paperwork accurately and completely. Provide all the necessary information, including the details of the trusts involved, the assets to be transferred, and any specific instructions or conditions associated with the transfer.

06

Obtain necessary signatures: Ensure that the trustees or authorized representatives of both trusts sign the transfer documents. This confirms their agreement and consent to the transfer.

07

Notify relevant parties: Inform the beneficiaries, trustees, and any other relevant parties about the trust to trust transfer. This enables them to understand the changes and how it may affect them.

Who needs trust to trust transfer:

01

Individuals with multiple trusts: Trust to trust transfers are typically needed by individuals who have set up multiple trusts for various purposes. These may include revocable living trusts, irrevocable trusts, or specialized trusts such as charitable trusts or special needs trusts.

02

Estate planners and attorneys: Professionals in the field of estate planning and trust administration often deal with trust to trust transfers. They assist clients in restructuring their trusts, updating beneficiary designations, or optimizing their estate plans for tax or asset protection purposes.

03

Beneficiaries and trustees experiencing changes: Trust to trust transfers may occur when there are changes in a beneficiary's circumstances or requirements. For example, if a beneficiary's needs change, such as requiring different types of assets, their trustees may facilitate a transfer between trusts to better align with their needs.

Overall, trust to trust transfers are necessary for individuals who need to restructure their estate plans, optimize tax strategies, or adapt to changing beneficiary requirements. Seeking professional advice and thoroughly understanding the trust documents involved are essential to ensure a successful transfer.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my trust to trust transfer in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your trust to trust transfer as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in trust to trust transfer?

The editing procedure is simple with pdfFiller. Open your trust to trust transfer in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the trust to trust transfer electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your trust to trust transfer in seconds.

What is trust to trust transfer?

Trust to trust transfer is the process of transferring assets from one trust to another trust.

Who is required to file trust to trust transfer?

The trustee of the original trust is required to file trust to trust transfer.

How to fill out trust to trust transfer?

To fill out trust to trust transfer, the trustee needs to complete the necessary forms and provide all required information about the transfer.

What is the purpose of trust to trust transfer?

The purpose of trust to trust transfer is to move assets between trusts for various reasons such as estate planning or asset protection.

What information must be reported on trust to trust transfer?

The information that must be reported on trust to trust transfer includes details of the assets being transferred, the value of the assets, and any tax implications.

Fill out your trust to trust transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust To Trust Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.