Get the free Form CT-1 - irs

Show details

This document provides instructions for completing Form CT-1, which is used to report taxes imposed by the Railroad Retirement Tax Act (RRTA). It outlines filing requirements, compensation definitions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form ct-1 - irs

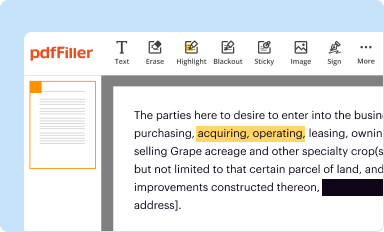

Edit your form ct-1 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

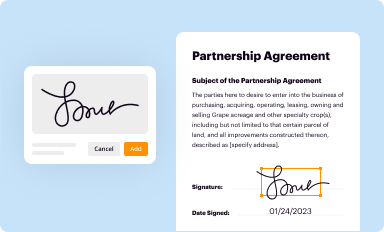

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ct-1 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

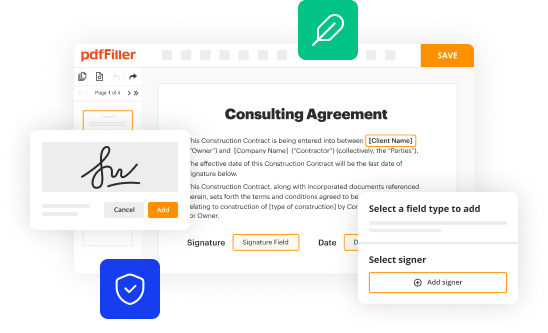

Editing form ct-1 - irs online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form ct-1 - irs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form ct-1 - irs

How to fill out Form CT-1

01

Download Form CT-1 from the official website.

02

Fill in your name, address, and contact information at the top of the form.

03

Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

04

Check the appropriate box to indicate the type of filing status.

05

Complete the income section, entering all relevant figures accurately.

06

Provide details of any deductions or credits you are claiming.

07

Include any required additional schedules or forms.

08

Review the form for completeness and accuracy.

09

Sign and date the form in the designated area.

10

Submit the completed form to the appropriate office as indicated in the instructions.

Who needs Form CT-1?

01

Individuals or businesses engaged in certain types of taxable activities.

02

Taxpayers who have earned income that qualifies under the specific guidelines outlined in the form.

03

Employers needing to report wages or compensation paid to employees.

Fill

form

: Try Risk Free

People Also Ask about

What is a CT k1?

A pass-through entity (PE) must furnish Schedule CT K-1, Member's Share of Certain Connecticut Items, to all members. General Instructions for PEs. A PE must complete Part 1 for resident noncorporate members, nonresident noncorporate members, and members that are pass-through entities.

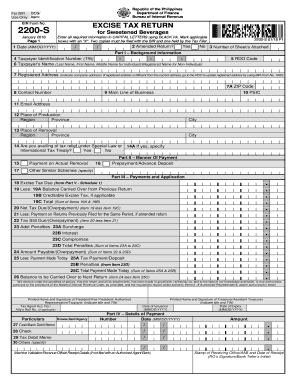

What is a CT-1 tax form?

Form CT-1 is filed annually by railroad employers to report their taxable compensation, calculate the tax liability, and reconcile the amount of taxes paid throughout the year.

What is IRS Form 1?

Schedule 1 (Form 1040), Additional Income and Adjustments to Income. Have additional income, such as unemployment compensation, prize or award money, gambling winnings. Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses.

What is a CT-1 payer?

Railroad (Form CT-1) Choose this if you are a railroad employer filing Form W-2 for employees covered under the Railroad Retirement Tax Act (RRTA).

What is a CT-1 form?

Each system unit and local lodge unit must file an annual tax return, Form CT-1, Employer's Annual Railroad Retirement Tax Return, with the Internal Revenue Service (IRS).

What is a CT-1 payer?

Railroad (Form CT-1) Choose this if you are a railroad employer filing Form W-2 for employees covered under the Railroad Retirement Tax Act (RRTA).

What is a CT Q-1 form?

Connecticut Titled Vehicles with a model year over 20 years prior to the current year are non-titled and not required. For registration of a non-titled vehicle, the registration from the last owner and a Supplemental Assignment of Ownership (form Q-1) and/or Bill of Sale (form H-31) is needed.

Who needs to file Form CT 1?

Every charitable corporation, unincorporated association and trustee holding assets for charitable purposes or doing business in California, unless exempt, is required to register with the Attorney General within thirty days after receipt of assets (cash or other forms of property).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form CT-1?

Form CT-1 is a tax form used by employers to report and pay the tax on certain railroad retirement and unemployment insurance taxes.

Who is required to file Form CT-1?

Employers required to report and pay railroad retirement taxes, specifically for employees who work in the railroad industry, must file Form CT-1.

How to fill out Form CT-1?

To fill out Form CT-1, employers need to provide information about their business, employee wages subject to railroad retirement taxes, and the total tax owed. Specific instructions are provided with the form to assist in its completion.

What is the purpose of Form CT-1?

The purpose of Form CT-1 is to enable employers in the railroad industry to report their payroll information and to remit any taxes due on railroad retirement and unemployment compensation.

What information must be reported on Form CT-1?

Information that must be reported on Form CT-1 includes the employer's identification details, total compensation paid to employees, and the amounts of taxes owed for the railroad retirement and unemployment insurance.

Fill out your form ct-1 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct-1 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.