Get the free This Tax Increment Financing Agreement (this Agreement) is made and entered into as of

Show details

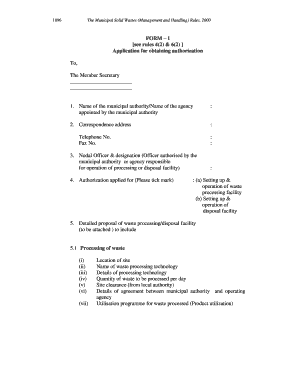

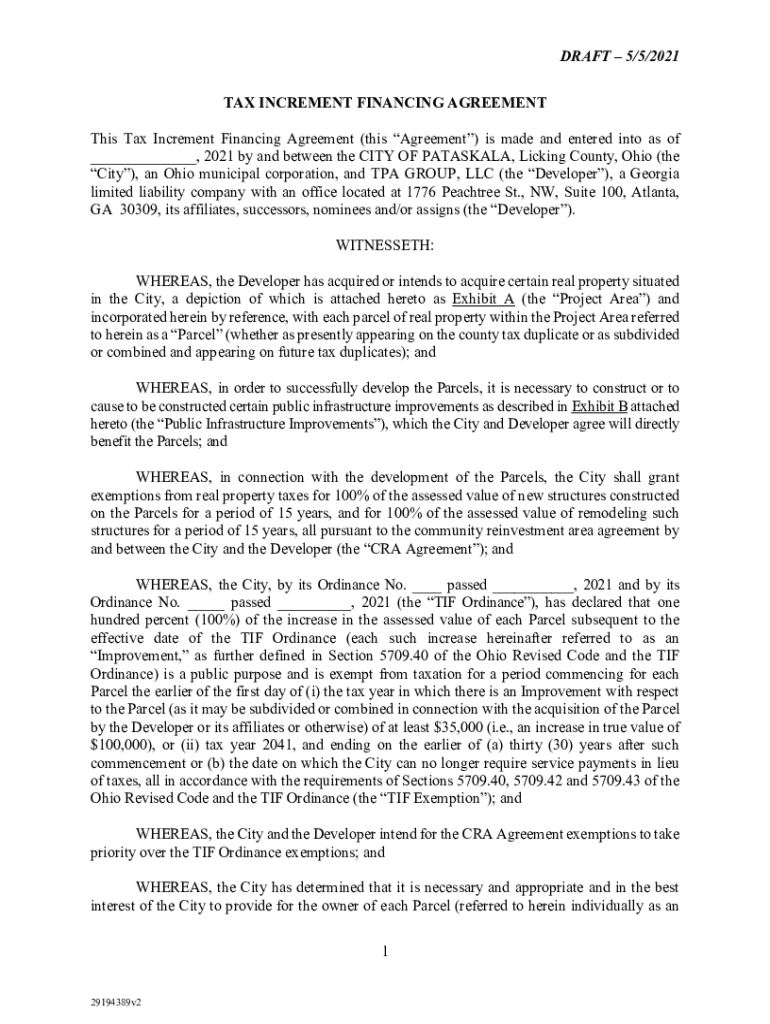

DRAFT 5/5/2021 TAX INCREMENT FINANCING AGREEMENT This Tax Increment Financing Agreement (this Agreement) is made and entered into as of ___, 2021 by and between the CITY OF KATAKANA, Licking County,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign this tax increment financing

Edit your this tax increment financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your this tax increment financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing this tax increment financing online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit this tax increment financing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out this tax increment financing

How to fill out this tax increment financing

01

Gather all necessary financial information and documents required for the tax increment financing application

02

Complete the application form accurately with all relevant details

03

Submit the completed application along with supporting documents to the appropriate government authority or agency for review and approval

04

Adhere to any deadlines or guidelines provided by the governing body overseeing the tax increment financing process

05

Monitor the progress of the application and respond promptly to any requests for additional information or clarification

Who needs this tax increment financing?

01

Local governments looking to stimulate economic development in specific areas

02

Businesses or developers seeking financial assistance for infrastructure improvements or redevelopment projects

03

Community organizations focused on revitalizing blighted or underdeveloped neighborhoods

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit this tax increment financing from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your this tax increment financing into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit this tax increment financing on an Android device?

You can edit, sign, and distribute this tax increment financing on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete this tax increment financing on an Android device?

On Android, use the pdfFiller mobile app to finish your this tax increment financing. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is this tax increment financing?

Tax increment financing is a tool used by cities to stimulate economic development in a specific area by capturing and redirecting the incremental increase in property taxes generated by the project to fund additional improvements within that area.

Who is required to file this tax increment financing?

Property owners or developers who are implementing a project within a designated TIF district are required to file tax increment financing.

How to fill out this tax increment financing?

The tax increment financing form typically requires information about the project, the expected increase in property taxes, the proposed improvements, and how the funds will be used to spur economic development in the designated area.

What is the purpose of this tax increment financing?

The purpose of tax increment financing is to promote economic growth and investment in blighted or underdeveloped areas by using the additional property tax revenue generated by the project to fund improvements and attract further development.

What information must be reported on this tax increment financing?

Information such as the project details, estimated increase in property taxes, proposed improvements, budget allocation, and the intended use of the funds must be reported on the tax increment financing form.

Fill out your this tax increment financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

This Tax Increment Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.