OH Sutton Bank HSA Rollover Form 2012-2025 free printable template

Show details

Direct MSA to HSA Rollover I currently have a Medical Savings Account with another I certify that I have or will establish a Health Savings Account with Sutton Bank. Date // Name Date of Birth Street Address City St Zip Mailing Address City St Zip Soc. Sec. Number I authorize and direct for Acct the present MSA/HSA Custodian/Trustee to send as a transfer the assets of my account to Sutton Bank Attn Becky Harlan 595 Lexington Ave. You actually rec...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign formhsaauthority com enrollment form

Edit your formhsaauthority com enrollment form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your formhsaauthority com enrollment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing formhsaauthority com enrollment form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit formhsaauthority com enrollment form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out formhsaauthority com enrollment form

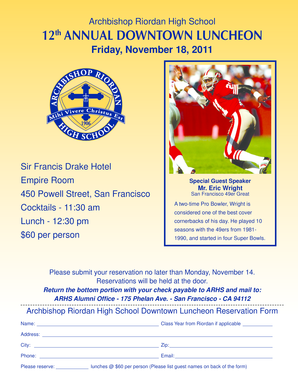

How to fill out Sutton Bank HSA form:

01

Obtain the Sutton Bank HSA form from the bank's website or visit a local branch to request a physical copy.

02

Begin by providing your personal information, such as your full name, address, social security number, and contact details.

03

Indicate whether you are opening a new HSA account or making changes to an existing one.

04

Fill in the required fields regarding your employer, if applicable, including their name and address.

05

Provide information about your chosen HSA contribution amount and select your desired investment options, if applicable.

06

Review the terms and conditions of the HSA account and ensure you understand the account fee structure and any potential penalties.

07

Sign and date the Sutton Bank HSA form to attest to the accuracy of the information provided.

08

Submit the completed form to Sutton Bank through their online portal, via mail, or by visiting a branch in person.

Who needs Sutton Bank HSA form:

01

Individuals who wish to open a Health Savings Account (HSA) with Sutton Bank.

02

Current HSA account holders who want to make changes or updates to their existing account.

03

Employees looking to enroll in an HSA through their employer, where Sutton Bank is the designated HSA provider.

04

Those who want to take advantage of the tax benefits and healthcare payment options provided by Sutton Bank's HSA program.

Fill

form

: Try Risk Free

People Also Ask about

How do I add my bank account to my HSA?

Connecting your bank account to your Health Savings Account Log into your account through the Consumer Portal, or on the HSA Central Mobile App. Under Accounts, find I Want To, then Reimburse Myself. In the Create Transaction section, select the Add Bank Account link.

How do you access your HSA account?

Access funds at an ATM, transfer funds to your bank account through the HSA online portal, or request a check from your HSA online.

How do I open an HSA account?

HSAs can be set up with banks or credit unions. You can ask your insurance company or your employer (if you get insurance through your job) for recommended places to set up your HSA. You can also start one with the bank where you have your regular checking and savings accounts.

How do I use my HSA card at an ATM?

To pay using a PIN (fee per PIN transaction may apply†), swipe your card, select debit on the keypad, and enter your PIN. To withdraw HSA funds from an ATM (fee per ATM withdrawal may apply†), be sure to select the “checking” option (not savings) when asked the type of account you are withdrawing from.

How do I withdraw money from my HSA card?

You can submit a withdrawal request form to receive funds (cash) from your HSA. If the cash is used to pay for ineligible purchases, it must be reported when you're filing your taxes. Once it's reported, it's subject to an income tax and treated as though it had never been in your tax-free HSA.

Can I take cash out of my HSA card?

Yes. You can withdraw funds from your HSA anytime. But keep in mind that if you use HSA funds for any reason other than to pay for a qualified medical expense, those funds will be taxed as ordinary income, and the IRS will impose a 20% penalty.

Do HSA debit cards have a PIN?

You can create or change a PIN online . Account owners can change the PIN on additional HSA debit cards but will not be allowed to change the PIN on another account owner's card. New and updated PINs can be used immediately after they have been successfully submitted. You can change your PIN once per day.

What happens if I use my HSA card at an ATM?

You can use your HSA card at an ATM to reimburse yourself for eligible expenses paid out-of-pocket. (A transaction fee may apply.

How do I set up an HSA account with Wells Fargo?

To open a Wells Fargo HSA, open the enrollment materials, print out the application portion, fill it out, and then return it to Wells Fargo. You will receive two HSA debit cards in about 7-10 days. For more information, please contact Wells Fargo directly at (866) 890-8309.

How do I set up an HSA account?

HSAs can be set up with banks or credit unions. You can ask your insurance company or your employer (if you get insurance through your job) for recommended places to set up your HSA. You can also start one with the bank where you have your regular checking and savings accounts.

Where is the best place to open an HSA account?

The 6 Best Health Savings Account (HSA) Providers of 2022 Best Overall: HealthEquity. Best for No Fees: Lively. Best for Families: The HSA Authority. Best for No Minimum Balance Requirement: HSA Bank. Best Investment Options: Fidelity. Best for Employers: Further.

How do I check my balance on my HSA debit card?

You can check your HSA balance by visiting the Member Website, where you will have secure, 24/7 access to your account balances and transaction history.

Can I open an HSA on my own?

Yes, you can open a health savings account (HSA) even if your employer doesn't offer one. But you can make current-year contributions only if you are covered by an HSA-qualified health plan, also known as a high-deductible health plan (HDHP).

Can I fund a health savings account on my own?

Yes. The HSA belongs to the individual not the employer and any eligible individual may open an HSA. As long as you are covered under a High Deductible Health Plan (HDHP) you may open and contribute to an HSA.

Can you open an HSA at any bank?

You can set up an HSA account with a bank, investment firm or other qualified financial institution. Many employers also offer access to HSA programs as part of their benefits packages.

Does HSA Bank have an app?

The HSA Bank app gives you the tools to take control of your health accounts. Safe and secure, the app offers real-time access for all your account needs, 24/7.

Can I open an HSA account online?

With HSA Bank there are no set up fees and an initial deposit is not required to open an account. It takes less than 10 minutes to complete the online application. One note, to open an account, you must have a valid email address. You may also be eligible for an HSA through your Employer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit formhsaauthority com enrollment form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your formhsaauthority com enrollment form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the formhsaauthority com enrollment form electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your formhsaauthority com enrollment form in minutes.

How do I fill out the formhsaauthority com enrollment form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign formhsaauthority com enrollment form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is OH Sutton Bank HSA Rollover Form?

The OH Sutton Bank HSA Rollover Form is a document used to facilitate the transfer of funds from one Health Savings Account (HSA) to another without incurring tax penalties.

Who is required to file OH Sutton Bank HSA Rollover Form?

Individuals who wish to transfer their HSA funds from one institution to another, using a rollover method, are required to file the OH Sutton Bank HSA Rollover Form.

How to fill out OH Sutton Bank HSA Rollover Form?

To fill out the OH Sutton Bank HSA Rollover Form, provide your personal information, details of the HSA accounts involved, the amount to be rolled over, and any necessary signatures as indicated on the form.

What is the purpose of OH Sutton Bank HSA Rollover Form?

The purpose of the OH Sutton Bank HSA Rollover Form is to ensure a systematic and tax-compliant process for transferring HSA funds between accounts, allowing account holders to manage their health savings efficiently.

What information must be reported on OH Sutton Bank HSA Rollover Form?

The information that must be reported on the OH Sutton Bank HSA Rollover Form includes the account holder's name, contact information, details of the current HSA, details of the receiving HSA institution, and the amount being rolled over.

Fill out your formhsaauthority com enrollment form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Formhsaauthority Com Enrollment Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.