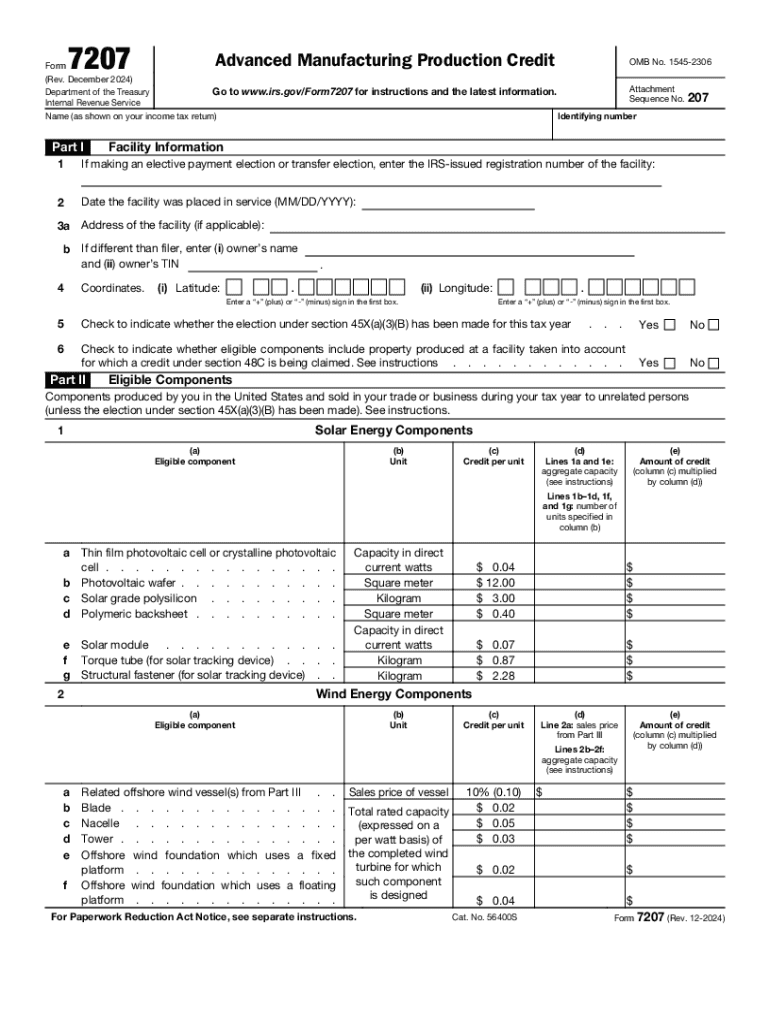

IRS 7207 2024 free printable template

Get, Create, Make and Sign form 7207 instructions

Editing IRS 7207 online

Uncompromising security for your PDF editing and eSignature needs

IRS 7207 Form Versions

How to fill out IRS 7207

How to fill out form 7207 january 2023

Who needs form 7207 january 2023?

A Comprehensive Guide to Form 7207 January 2023 Form

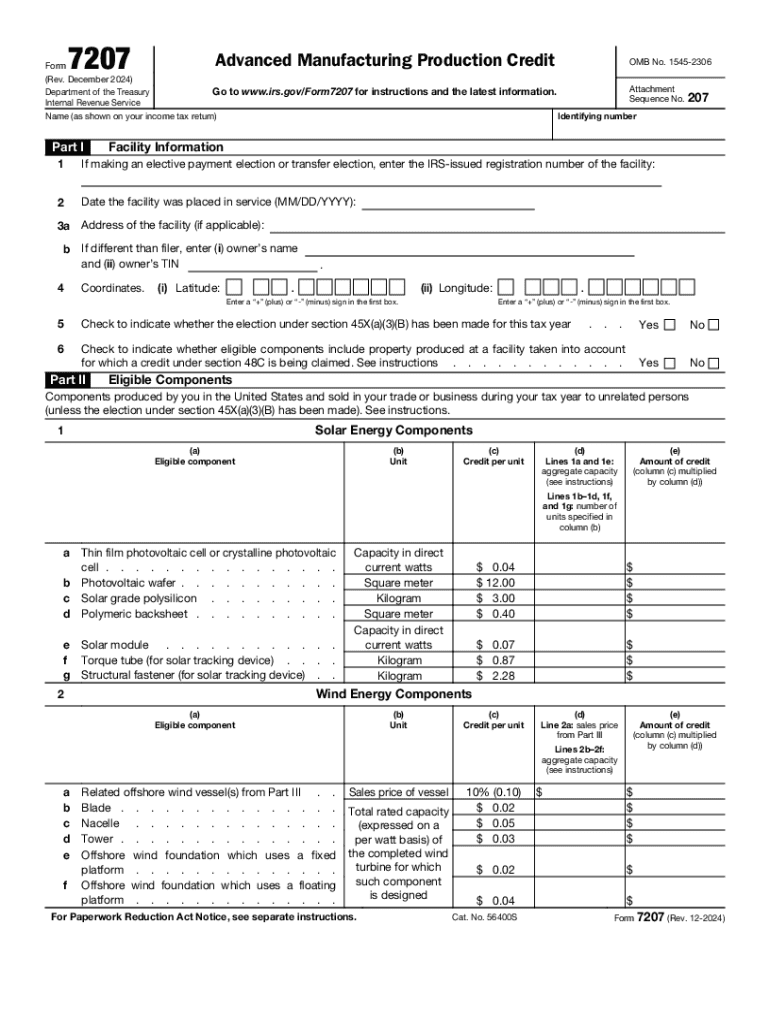

Purpose of Form 7207

Form 7207 is an essential document used for reporting various tax credits related to certain activities and investments. The form serves as an important tool for taxpayers, particularly businesses, seeking to claim credit for their qualified investments in specific business activities. The January 2023 version includes updated provisions that reflect recent legislative changes and tax reforms, thus ensuring compliant and accurate reporting. Understanding the purpose and details of this form is vital for anyone looking to maximize potential tax credits.

Key changes in this version of Form 7207 include adjustments to the eligibility criteria and the types of credits available. For instance, modifications have been made to clarify the definitions of qualifying activities. The changes aim to streamline the filing process, making it easier for filers to understand what is required. Overall, Form 7207 is intended for businesses and individuals who have made significant investments and wish to leverage available tax incentives.

Who should consider using Form 7207?

Filings of Form 7207 are primarily relevant for businesses and individuals engaged in specific manufacturing or development activities. This includes manufacturers aiming to utilize tax credits linked to advancements and improvements in manufacturing processes. Organizations that participate in certain incentive programs or initiatives may also find themselves required to file this form. The criteria for filing often connect to engagement in qualified activities that are designed to stimulate economic growth.

Scenarios that may trigger the necessity for Form 7207 include situations where a taxpayer has implemented new manufacturing practices or invested in compliance improvements. Moreover, businesses participating in federal or state initiatives aimed at fostering economic development are likely candidates for filing. Understanding tax implications involves recognizing potential savings linked to the credits available through the form, ultimately benefiting the organization’s financial landscape.

Key benefits of using Form 7207

Utilizing Form 7207 presents several benefits for taxpayers and businesses. One of the key advantages is the streamlined filing process that facilitates easier submission and tracking of tax credits. The form was designed with user-friendliness in mind, aiming to minimize the hassle associated with tax reporting. This is particularly valuable for organizations that may be overwhelmed by documentation requirements, as the form organizes necessary information efficiently.

Another critical benefit is the enhanced accuracy that comes from using Form 7207. By following the updated guidelines, filers are better equipped to reduce errors, which can lead to audit triggers or missed credits. Additionally, there are potential tax savings associated with properly utilizing this form. Claiming tax credits can offer significant financial advantages, making it imperative for eligible businesses to take full advantage of Form 7207.

Eligibility criteria for filing Form 7207

Eligibility to file Form 7207 generally revolves around participation in qualifying activities that necessitate reporting for tax credits. Key eligibility requirements include the nature of the business activities undertaken. For instance, businesses engaged in manufacturing, technology development, or environmental compliance may find themselves falling under the eligible applicant category. However, understanding that not all activities qualify is crucial, as filing incorrectly could lead to complications.

Several factors may affect eligibility; these include the size of the business, the volume of investments made, and compliance with specific regulations linked to the qualifying activities. Specific scenarios that could qualify applicants for filing might include having engaged in innovative practices that meet the department's criteria or reported advancements in manufacturing efficiency. Recognizing these parameters is key to effectively leveraging Form 7207.

Special criteria and schedules related to Form 7207

Filing Form 7207 may require attachments of additional schedules or related forms, depending on the specifics of the tax credits being claimed. This could include accompanying documentation that outlines compliance with income thresholds or the specifics of any claimed credits. Understanding which schedules to include is essential as failure to do so can delay processing or lead to rejection.

Unique considerations may also arise depending on the nature of the reported activities. For example, businesses claiming credits for investments in manufacturing improvements may need to provide detailed evidence of their eligible activities. It’s crucial for applicants to research which specific schedules apply to their situation thoroughly. By ensuring the appropriate documentation accompanies Form 7207, applicants can significantly enhance their chances of a smooth filing experience.

How to complete Form 7207: A step-by-step guide

Filing Form 7207 effectively requires a systematic approach. Step 1 involves gathering all necessary information, which includes current financial statements, documentation of activities qualifying for credits, and any previous filings that may impact your current submission. It's advisable to keep detailed records as they can facilitate smoother completion of the form.

Step 2 focuses on filling out the form itself. It’s essential to pay attention to each section, ensuring that all required fields are accurately completed. For instance, inputting the correct business type and credit amounts is critical. Helpful tips include referring to the instructions provided with the form and checking for common pitfalls, such as miscalculating your credits.

In Step 3, a thorough review of your submission is crucial. Creating a checklist of all filed information can help ensure accuracy before submission. Finally, in Step 4, you can submit Form 7207 via online platforms or traditional paper routes. Each submission method has its deadlines, and understanding these timelines will help prevent filing issues, allowing for efficient processing and confirmation.

Common mistakes to avoid when filing Form 7207

Many mistakes can occur during the filing of Form 7207, and being aware of these is vital for a successful submission. One frequent error is omitting required information, such as failing to report all eligible activities, which could significantly impact the credits claimed. Another common mistake relates to misunderstanding the instructions, leading to incorrect filings that trigger audits or additional information requests.

Furthermore, the importance of verifying eligibility cannot be overstated. Misclassifying the business type or the nature of the investments can lead to complications. Ensuring thorough documentation is also essential to support claims made on Form 7207, as neglecting to provide adequate supporting evidence can create problems down the line.

Considerations when filing Form 7207

Maximizing the benefits associated with Form 7207 entails strategic considerations throughout the filing process. One key tip is staying updated with changes in tax regulations that could affect who qualifies for specific credits. These updates can occur frequently, and being informed allows filers to make better decisions about their eligibility.

Another significant consideration is preparing for potential audits or inquiries related to the filing. Keeping well-organized records not only simplifies the filing process but also provides a solid foundation in case of eventual follow-ups from tax authorities. Businesses should consult with tax professionals to ensure they fully understand their situation and how best to navigate potential complexities when utilizing Form 7207.

Post-filing actions: What to expect after submitting Form 7207

Once Form 7207 is submitted, filers can anticipate a specific timeline for processing and receiving confirmation. Acknowledgment of receipt usually occurs within a few weeks, particularly for electronic submissions. It is essential to monitor the status of your submission post-filing, especially if further documentation is requested by tax authorities.

If issues arise after filing, such as receiving requests for additional information, responding promptly is critical. Keeping an open line of communication and maintaining an organized record of submitted material can significantly reduce complications. Understanding these post-filing actions helps in navigating potential hurdles with more confidence.

Leveraging pdfFiller for a seamless document management experience

Utilizing pdfFiller enhances the process of completing and submitting Form 7207 significantly. The platform offers tools that simplify editing, signing, and managing documents, ensuring that users can work efficiently and effectively. With pdfFiller, businesses can collaborate on form completion in real-time, fostering a seamless communication channel among team members.

In addition to interactive tools, the cloud-based platform enables users to access and manage their documents from virtually anywhere. This is particularly beneficial for businesses dealing with multiple submissions and needing to maintain compliance records conveniently. By adopting pdfFiller, organizations not only enhance their filing experience but also ensure the most up-to-date versions of forms are utilized.

FAQs about Form 7207

Several common inquiries frequently arise regarding Form 7207. Users often wonder about the specific credits available and the eligibility criteria for each. Clarifying misconceptions about what qualifies as an eligible activity is crucial for those preparing to file. Additional questions may relate to documentation requirements, with many looking for clarity on what supporting evidence needs to be included during the submission.

Furthermore, aspects of the filing process can also provoke questions, particularly regarding deadlines or the status of submissions post-filing. Having a comprehensive understanding of these issues helps consumers navigate the complexities associated with Form 7207, ensuring they maximize potential benefits while remaining compliant.

Related forms and documents

Filing Form 7207 often aligns with other forms that may be required based on individual circumstances or business activities. Forms such as the 1065 for partnerships or specific state-required documentation often accompany it in more complex filings. Being aware of these related forms allows filers to prepare adequately, assisting in a more comprehensive and organized tax filing experience.

Navigating the tax landscape can be complicated, and by understanding these related forms, taxpayers can take a holistic approach to their tax submissions. Visiting the pdfFiller platform can provide links and resources to assist users in managing these interconnected documents effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the IRS 7207 electronically in Chrome?

How do I complete IRS 7207 on an iOS device?

How do I fill out IRS 7207 on an Android device?

What is form 7207 january 2023?

Who is required to file form 7207 january 2023?

How to fill out form 7207 january 2023?

What is the purpose of form 7207 january 2023?

What information must be reported on form 7207 january 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.