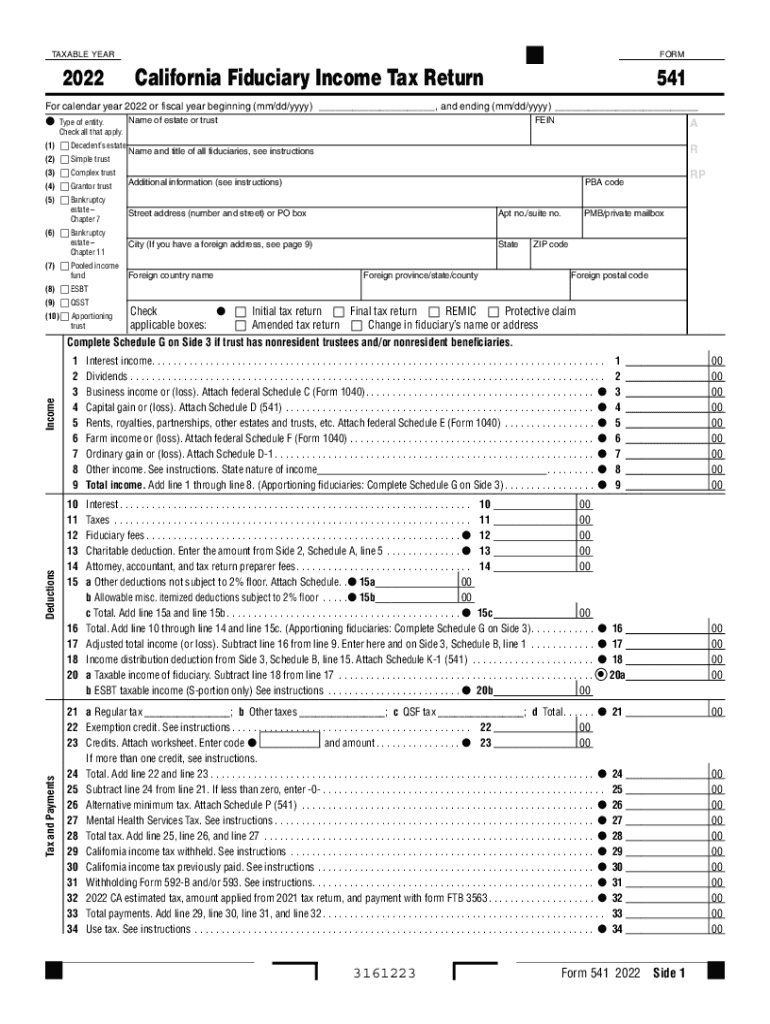

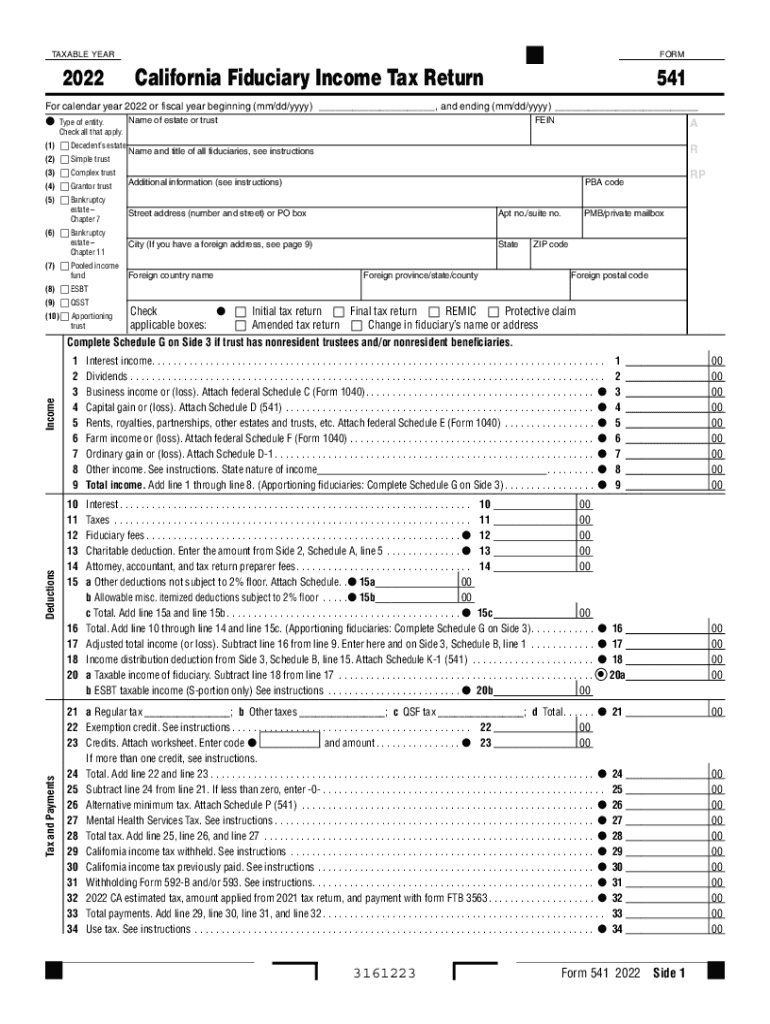

CA FTB 541 2022 free printable template

Get, Create, Make and Sign ca form 541

Editing california fiduciary income tax return online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 541 Form Versions

How to fill out california fiduciary return form

How to fill out CA FTB 541

Who needs CA FTB 541?

Video instructions and help with filling out and completing california trust tax rates

Instructions and Help about ftb 541

In this week's bleach the fig ranges reveals the horrible truth to Chico so bleach chapter 541 the blade in me to begins with Chico recalling the first time he met Auerbach and feeling like he was summoned, and he can't believe he was never reminded of someone it starts to rain in the inner world as usual when Chico gets depressed and just gets who say it's true that he is not ranges, but he's also not really Auerbach just the manifestation of his Quincy powers Chico doesn't handle the news very well he explains how whenever he taught Chico to use his zanpakuto he always used the hold, and it was always the hollow not him who saves him when his life was in danger did you graduated from the game mm University of death he tried to suppress Chico's potential to become a Shinigami in hopes of becoming his main source of power only ever wanted was to protect Chico from getting involved in fights that would cause him to suffer he then pulls out a flaming sword and declares each girl must not become a Shinigami for if he does, he will be forced to kill him it's on bitch however fake ranges says that's only how he used to feel Chico became a Shinigami despite the difficult path that took him down his heart wavered and instead of preventing him from becoming Shinigami his heart told him to help Chico in his path there could you be more gay he begins to disappear as he is happy with how strong Chico has become he sheds a final tear as he vanishes leaving the flaming sword behind he tells Chico to take it for it will unlock the rest of his power and become the real ranges awesome I bet the final page is what the zanpakuto was gonna look like could you please take me to a grease monkey because I like to get lubed up before I guess I really did like this chapter it was pretty much what I expected as it was the fake ranges pleading his case with Chico we learned that he is just the Quincy powers manifested in the form of Auerbach when I asked last week why he would help each go with the Shinigami training I pretty much got my answer he didn't every time Chico trained to learn more about ranges he really fought his hollow not him now some of you were probably thinking that doesn't make sense because what about when he helped Chico in his banzai training well this goes back to my theory from last week when I said I believe jihad gets who was trying to make him weaker by giving him a false version of his zanpakuto and in a way I was right because he does say he tried to suppress Chico's potential it did get very emotional towards the end and I didn't mind it at the end of chapter 540 I think we all wanted to kill this fake ranges because he's been lying to Chico the entire time, and he looks like Auerbach but when he starts telling Chico that he's fine with him becoming a Shinigami and starts to disappear I felt kind of sorry for him, I don't think this is the last we're going to see him because as long as Chico has the ability to use Quincy powers he'll be...

People Also Ask about california fiduciary tax

What is Form 541 used for?

Can Form 541 be filed electronically?

What is California Schedule K 1 Form 541?

Do I need to file if I made less than 5000?

What is Form 541?

What is a form 541 in California?

Who must file California partnership return?

What is Form 541 Schedule J?

What is CA Form 541 Schedule K 1?

Who must file California Form 541?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ca form 541 instructions from Google Drive?

How do I complete california fiduciary income return on an iOS device?

How do I fill out ca 541 form on an Android device?

What is CA FTB 541?

Who is required to file CA FTB 541?

How to fill out CA FTB 541?

What is the purpose of CA FTB 541?

What information must be reported on CA FTB 541?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.