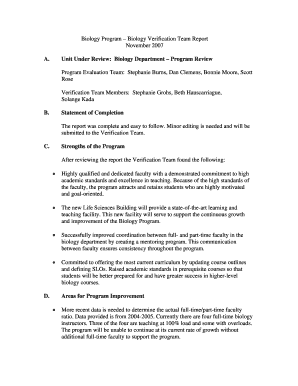

Get the free Employee HSA Payroll Deduction Form

Show details

This form is used by employees to authorize payroll deductions for their Health Savings Account (HSA) contributions, including employer contributions and catch-up contributions for eligible individuals.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee hsa payroll deduction

Edit your employee hsa payroll deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee hsa payroll deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee hsa payroll deduction online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employee hsa payroll deduction. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee hsa payroll deduction

How to fill out Employee HSA Payroll Deduction Form

01

Obtain the Employee HSA Payroll Deduction Form from your HR department or company's website.

02

Fill in your personal information, including your name, employee ID, and department.

03

Specify the amount you wish to contribute to your HSA from each paycheck.

04

Indicate whether the contribution is pre-tax or post-tax.

05

Review any employer contributions and enter them if applicable.

06

Sign and date the form to confirm your authorization.

07

Submit the completed form to your HR department or payroll administrator.

Who needs Employee HSA Payroll Deduction Form?

01

Employees who wish to contribute to a Health Savings Account (HSA) through payroll deductions.

02

Individuals who are eligible for an HSA and want to take advantage of tax benefits and savings for healthcare costs.

Fill

form

: Try Risk Free

People Also Ask about

Are employee HSA contributions subject to payroll taxes?

These payroll deductions are not subject to federal income tax, Social Security or Medicare (FICA) taxes or most state income taxes. Generally, employees can start, modify or stop HSA contributions at any time during a year. Employers can make contributions directly to their employees' HSAs.

Can an employer deduct HSA contributions?

Employer contributions are tax-deductible as the IRS considers them a business expense. Employers avoid the comparability rules for HSA contributions.

How do I get my HSA deduction?

File Form 8889 to: Report health savings account (HSA) contributions (including those made on your behalf and employer contributions). Figure your HSA deduction. Report distributions from HSAs.

How to get HSA deducted from paycheck?

Payroll deduction allows you to have contributions taken directly from your paycheck. The funds are deducted pre-tax through your employer's Section 125 Plan. You may change or stop your contribution amount at any time through your employer.

How is HSA taken out of paycheck?

Your annual contribution will be divided into equal amounts and deducted from your payroll before taxes. Direct contributions can also be made from your personal checking account and can be deducted on your personal income tax return.

What form is HSA employee deduction?

File Form 8889 to: Report health savings account (HSA) contributions (including those made on your behalf and employer contributions). Figure your HSA deduction.

Can I change my HSA payroll deduction?

Yes - Most benefit plans only allow midyear changes if you have a qualifying event, but HSAs are different. If you need to change your HSA contribution amount at any point during 2025, you can do so by submitting an HSA Contribution Change event in Workday.

Why am I not getting a deduction for my HSA contributions?

If you contribute money to your HSA through your paycheck, you can not deduct the contributions on your tax return. However, if you contribute dollars to the account directly — meaning, without going through your employer's payroll department — you can deduct the contributions on your tax return for the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee HSA Payroll Deduction Form?

The Employee HSA Payroll Deduction Form is a document that allows employees to request payroll deductions to be contributed to their Health Savings Account (HSA).

Who is required to file Employee HSA Payroll Deduction Form?

Employees who wish to make contributions to their HSA directly from their payroll are required to file the Employee HSA Payroll Deduction Form.

How to fill out Employee HSA Payroll Deduction Form?

To fill out the Employee HSA Payroll Deduction Form, employees need to provide their personal information, specify the amount they wish to contribute per pay period, and sign the form to authorize the deduction.

What is the purpose of Employee HSA Payroll Deduction Form?

The purpose of the Employee HSA Payroll Deduction Form is to facilitate the automatic contribution of funds to the employee's HSA from their paycheck, simplifying the process of saving for qualified medical expenses.

What information must be reported on Employee HSA Payroll Deduction Form?

The information that must be reported on the Employee HSA Payroll Deduction Form includes the employee's name, Social Security number, payroll deduction amount, contribution frequency, and the employee's signature.

Fill out your employee hsa payroll deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Hsa Payroll Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.