Get the free Occupational License Tax

Show details

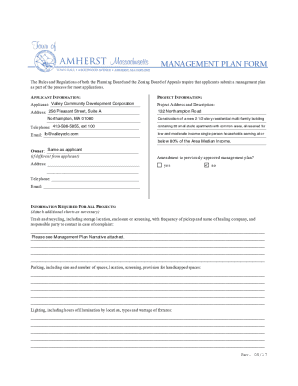

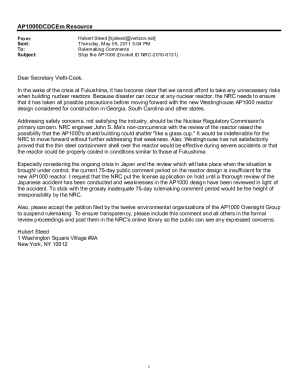

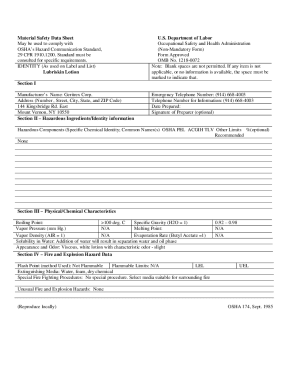

An ordinance relating to the imposition and administration of an occupational license requirement and payment of an occupational license tax for persons and business entities conducting businesses,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occupational license tax

Edit your occupational license tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occupational license tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing occupational license tax online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit occupational license tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occupational license tax

How to fill out Occupational License Tax

01

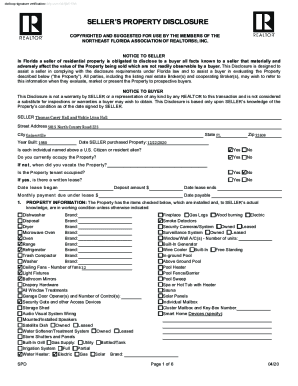

Gather necessary personal and business information, including your name, business name, and address.

02

Determine the type of business activity you are engaging in.

03

Check the local government website or office for the specific Occupational License Tax form.

04

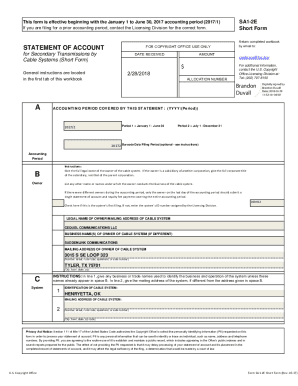

Fill out the form with accurate details about your business, including ownership structure and estimated revenue.

05

Calculate the tax amount based on the rates provided for your type of business.

06

Attach any required documents, such as identification or proof of business registration.

07

Submit the completed form and payment to your local tax authority by the deadline.

Who needs Occupational License Tax?

01

All businesses operating within a locality that generate income or perform services.

02

Freelancers and independent contractors offering services in the area.

03

Any person or entity providing goods or services for profit, including sole proprietors and corporations.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an occupational tax?

For instance, a professional license fee is an occupation tax imposed on individuals who want to practice a particular profession, such as doctors, lawyers, and engineers. The fee generates revenue for the government and helps regulate the profession.

Who pays occupational taxes?

0:02 2:46 Who pays occupation. Tax service providers pay the occupation. Tax not their clients. This meansMoreWho pays occupation. Tax service providers pay the occupation. Tax not their clients. This means professionals like doctors or lawyers bear the cost rather than those who seek their services.

Who has to pay occupational tax?

Occupational Privilege Tax: A tax that is imposed on individuals who work within a particular jurisdiction, regardless of their profession.

What is an occupational license example?

Licensing is intended to ensure that only competent and ethical individuals practice in an occupation. Examples of occupations licensed in many states include: teachers, land surveyors, doctors, lawyers, cosmetologists, nurses, building contractors, counselors, therapists, and electricians.

What is an example of an occupational tax?

For instance, a professional license fee is an occupation tax imposed on individuals who want to practice a particular profession, such as doctors, lawyers, and engineers. The fee generates revenue for the government and helps regulate the profession.

What is the occupational license tax in Kentucky?

The Lexington-Fayette Urban County Government assesses an occupational license fee of 2.25%. The fee applies to an individual's compensation and a business's net profits.

Who pays occupational taxes in KY?

Every person, association, corporation, or other business entity engaging in an occupation, business, trade, or profession is required to file and pay occupational license tax. Business activity includes rental property, sole proprietorships, partnerships, and corporations.

What is the difference between occupational tax and income tax?

Unlike earned income tax, B&O taxes are typically levied on wages from employees who are performing sales or services within the jurisdiction, not simply residing there. This tax can sometimes be called occupational privilege tax or workplace tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Occupational License Tax?

Occupational License Tax is a fee imposed by local governments on individuals or businesses for the privilege of conducting business within their jurisdiction.

Who is required to file Occupational License Tax?

Any individual or business that operates or intends to operate within a locality is generally required to file for an Occupational License Tax.

How to fill out Occupational License Tax?

To fill out the Occupational License Tax, typically you need to complete a specific application form provided by the local government, include any required documentation, and submit it along with the applicable fee.

What is the purpose of Occupational License Tax?

The purpose of Occupational License Tax is to regulate businesses, generate revenue for local governments, and ensure that businesses comply with local regulations.

What information must be reported on Occupational License Tax?

Required information usually includes the business name, address, type of business, owner's personal information, estimated gross receipts, and any other specific details as required by the locality.

Fill out your occupational license tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occupational License Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.