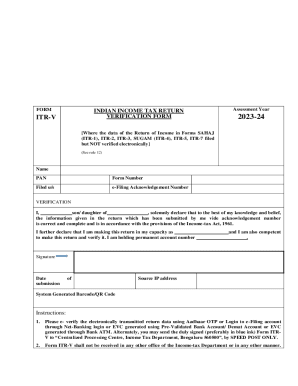

India ITR-V 2022 free printable template

Show details

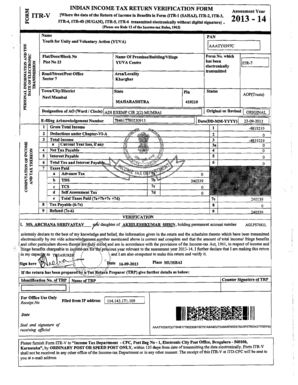

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year Where the data of the Return of Income in Benefits in Form ITR-1 SAHAJ ITR-2 ITR-3 ITR-V ITR-4 ITR-4S SUGAM ITR-5 ITR-6 transmitted electronically without digital signature. 2013 - 14 Please see Rule 12 of the Income-tax Rules 1962 Name DILIP P MANNA PAN AAAPM7223P Flat/Door/Block No 10 21 MAHINDRA BHAWAN 2ND FLOOR FOFAL WADI Road/Street/Post Office Town/City/District Form No. which has been electronically transmitted Name Of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign India ITR-V

Edit your India ITR-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India ITR-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing India ITR-V online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit India ITR-V. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India ITR-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India ITR-V

How to fill out India ITR-V

01

Visit the official income tax e-filing website of India.

02

Log in using your credentials or register if you don't have an account.

03

Select the option to 'Download ITR-V' relevant to your income tax return.

04

Fill out your personal information, such as name, address, and PAN.

05

Ensure all income details and deductions are accurately filled in the ITR form.

06

Cross-check all entries for correctness before submitting.

07

Generate the ITR-V acknowledgment after submission.

08

Print the ITR-V form and sign it.

09

Send the signed ITR-V to the Centralized Processing Center (CPC) in Bangalore by post within 120 days of e-filing.

Who needs India ITR-V?

01

Individuals who have filed their income tax returns electronically.

02

Taxpayers who need to confirm their income tax return filing.

03

Those who want to complete the process of e-filing by sending a signed acknowledgment.

Fill

form

: Try Risk Free

People Also Ask about

What is the password for income tax Acknowledgement PDF?

Password for Opening ITR Acknowledgment Form: The password is unique for every taxpayer. The password is a combination of the taxpayer's PAN number and Date of Birth (DoB). It is obtained by entering the PAN number in the lower case and the birth date in the 'DDMMYYYY' format without any space between the two.

How do I open my income tax acknowledge?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

How can I get my ITR Acknowledgement number?

You can check your acknowledgement number from your ITR-V received on your registered email after e-Filing your return.

How can I download ITR without login?

Step 1: A taxpayer has to visit the e-filing portal of the income tax department. The feature 'e-Verify Return' can be accessed on the home page of the portal under 'Our Services'. Step 2: Enter your PAN, select the relevant Assessment Year, enter Acknowledgment Number of the ITR filed and Mobile Number and Continue.

How can download my ITR Acknowledgement online?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

How do I get an e-filing Acknowledgement?

How to get the acknowledgement number or download ITR-V of Income-tax Return filed? Step 1: Sign in to the Income-tax Department website. Step 2 : Click on View Filed returns under e-File tab. Step 3: You will get the acknowledgement number under the relevant AY and also the option to download an ITR-V copy (receipt).

How can I know my ITR Acknowledgement?

You can check your acknowledgement number from your ITR-V received on your registered email after e-Filing your return.

How can I check my ITR Acknowledgement online?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

How do I download an e-filing Acknowledgement?

Below is a step by step process to download ITR acknowledgement: log in to the Income-tax portal. Click here : Click on View Filed returns under the e-file tab : e-File >> Income Tax Returns >> View Filed Returns. Click on Download Receipt : Your acknowledgement will be downloaded : That's it. You are done.

How to generate acknowledgement for ITR?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Is there Acknowledgement of filing the return of income?

ITR – V is the acknowledgement of filing the return of income.

How can I get my ITR Acknowledgement online?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my India ITR-V in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your India ITR-V and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete India ITR-V online?

With pdfFiller, you may easily complete and sign India ITR-V online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete India ITR-V on an Android device?

On an Android device, use the pdfFiller mobile app to finish your India ITR-V. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is India ITR-V?

India ITR-V, or Income Tax Return Verification form, is a document that taxpayers in India must submit to the Income Tax Department to confirm the authenticity of their electronically filed income tax returns.

Who is required to file India ITR-V?

Any individual, Hindu Undivided Family (HUF), or firm that files their income tax return electronically without a digital signature is required to file India ITR-V.

How to fill out India ITR-V?

To fill out India ITR-V, download the ITR-V form from the Income Tax Department's website, fill in the necessary details accurately, print the form, sign it, and send it to the specified address of the Income Tax Department within 120 days of e-filing the return.

What is the purpose of India ITR-V?

The purpose of India ITR-V is to serve as a verification document for taxpayers, demonstrating that they have filed their income tax return electronically and providing proof that it is complete and accurate.

What information must be reported on India ITR-V?

India ITR-V must report information such as the taxpayer's name, address, PAN (Permanent Account Number), acknowledgement number of the e-filed return, and details regarding income, tax paid, and any other relevant financial information.

Fill out your India ITR-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India ITR-V is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.