Get the free International Fuel Tax Agreement (IFTA) in B.C. - Gov.bc.ca

Show details

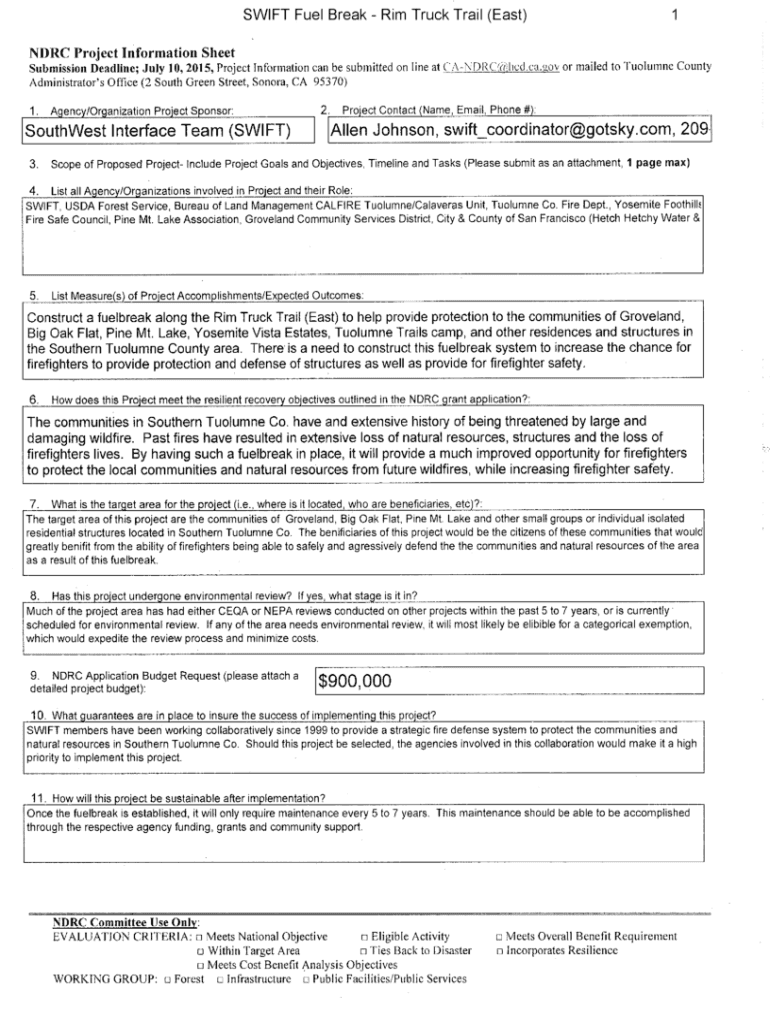

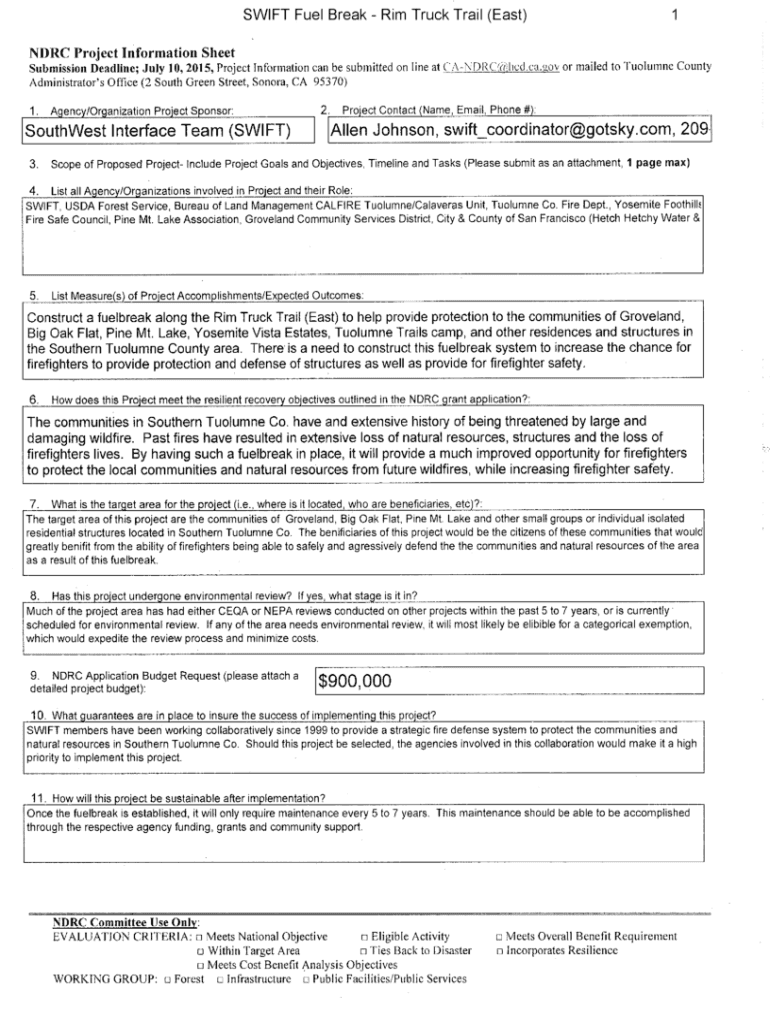

SW IT Fuel Break Rim Truck Trail (East)1NDRC Project Information SheetSubmission Deadline; July 10, 2015, Project Information can be submitted online at CA N D Cynic .ca.gov or mailed to County Administrators

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international fuel tax agreement

Edit your international fuel tax agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international fuel tax agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing international fuel tax agreement online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit international fuel tax agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international fuel tax agreement

How to fill out international fuel tax agreement

01

Obtain an International Fuel Tax Agreement (IFTA) license from the jurisdiction where your vehicles are registered.

02

Keep accurate records of all fuel purchases and usage for each vehicle, including date, gallons purchased, seller, price, and vehicle ID number.

03

Calculate the total miles traveled in each jurisdiction and the total gallons of fuel consumed in each jurisdiction for each reporting period.

04

Complete the IFTA quarterly fuel tax return with the required information, including fuel purchases, miles traveled, and fuel consumed in each jurisdiction.

05

Submit the completed fuel tax return and pay any taxes owing to the jurisdiction where your vehicles are registered by the deadline.

Who needs international fuel tax agreement?

01

Companies or individuals operating qualified motor vehicles that cross state or provincial lines in the United States or Canada need to have an International Fuel Tax Agreement (IFTA).

02

This agreement helps simplify reporting and payment of fuel taxes for vehicles operating in multiple jurisdictions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit international fuel tax agreement online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your international fuel tax agreement and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit international fuel tax agreement in Chrome?

international fuel tax agreement can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the international fuel tax agreement in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your international fuel tax agreement and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is international fuel tax agreement?

The International Fuel Tax Agreement (IFTA) is an agreement among U.S. states and Canadian provinces that simplifies the reporting and payment of motor fuel taxes for inter-jurisdictional carriers.

Who is required to file international fuel tax agreement?

Carriers who operate qualified motor vehicles in more than one jurisdiction are required to file IFTA.

How to fill out international fuel tax agreement?

To fill out IFTA, carriers must report the total miles traveled and gallons of fuel purchased in each jurisdiction, and calculate the fuel tax owed.

What is the purpose of international fuel tax agreement?

The purpose of IFTA is to streamline the reporting and payment of fuel taxes for carriers operating across state or provincial lines.

What information must be reported on international fuel tax agreement?

Carriers must report total miles traveled, gallons of fuel purchased, and tax rates for each jurisdiction.

Fill out your international fuel tax agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Fuel Tax Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.