LA R-10606 2023-2025 free printable template

Show details

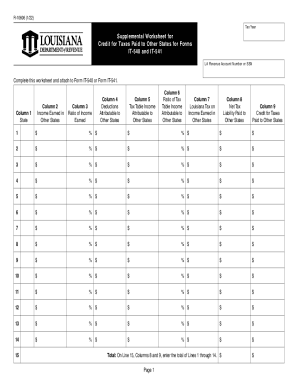

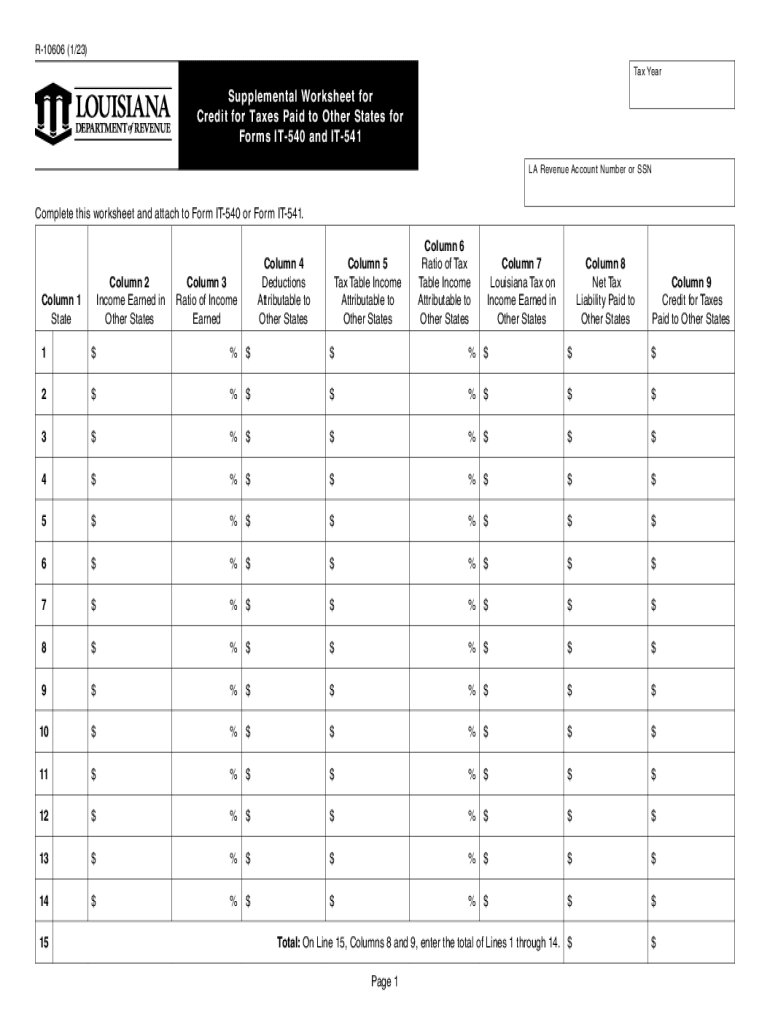

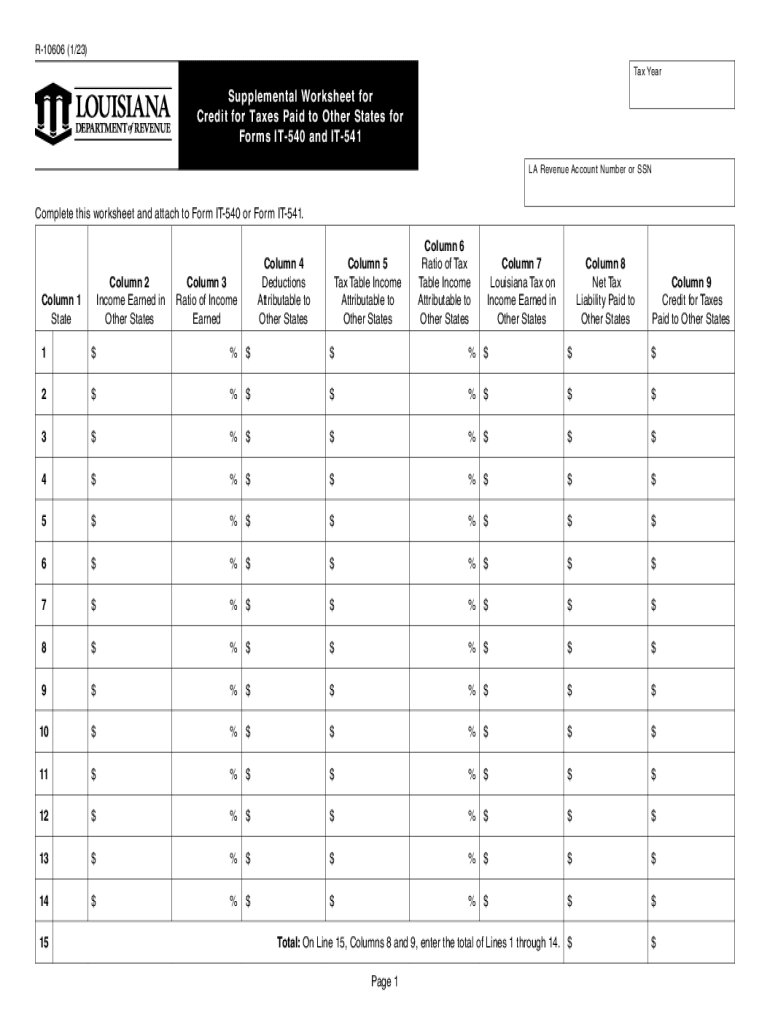

R10606 (1/23)

Tax YearSupplemental Worksheet for

Credit for Taxes Paid to Other States for

Forms IT540 and IT541

LA Revenue Account Number or Incomplete this worksheet and attach to Form IT540 or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign louisiana r 10606 form

Edit your r 10606 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your r10606 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing r 10606 2023-2025 form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit r 10606 2023-2025 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA R-10606 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out r 10606 2023-2025 form

How to fill out LA R-10606

01

Start by obtaining the LA R-10606 form from the appropriate state agency or website.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide any additional required information related to the purpose of the form, as indicated in the instructions.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form by mail or electronically, according to the guidelines provided.

Who needs LA R-10606?

01

Individuals or businesses required to report specific information to the state.

02

Anyone who needs to comply with state regulations related to the subject matter of LA R-10606.

03

Taxpayers who are reporting particular details that the LA R-10606 addresses.

Fill

form

: Try Risk Free

People Also Ask about

How much state tax should be withheld in Louisiana?

The state income tax rates for the 2021 tax year range from 2.0% to 6.0%, and the sales tax rate is 4.45%.

What is a Form R 10606?

R-10606 (1/21) Supplemental Worksheet for. Credit for Taxes Paid to Other States for Forms.

How to fill out Louisiana state tax form?

0:13 2:17 Form IT 540 Individual Income Return Resident - YouTube YouTube Start of suggested clip End of suggested clip Step 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on lineMoreStep 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on line 8b. Then subtract the ladder from the former enter the difference on line 8c.

Where can I get Louisiana state tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

Do I have to file a Louisiana state tax return?

Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my r 10606 2023-2025 form in Gmail?

r 10606 2023-2025 form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send r 10606 2023-2025 form to be eSigned by others?

r 10606 2023-2025 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in r 10606 2023-2025 form?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your r 10606 2023-2025 form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is LA R-10606?

LA R-10606 is a tax form used in Louisiana for reporting various types of income and adjustments for the state's tax purposes.

Who is required to file LA R-10606?

Individuals and businesses that have income subject to Louisiana state income tax or who are claiming certain tax credits may be required to file LA R-10606.

How to fill out LA R-10606?

To fill out LA R-10606, one must provide accurate financial information, including income details and applicable deductions or credits, ensuring all sections of the form are completed correctly.

What is the purpose of LA R-10606?

The purpose of LA R-10606 is to report income and calculate tax liabilities for individuals and businesses in Louisiana, thereby helping the state assess and collect taxes.

What information must be reported on LA R-10606?

LA R-10606 requires the reporting of taxable income, adjustments, applicable deductions, tax credits, and any other relevant financial data necessary for accurately determining state tax obligations.

Fill out your r 10606 2023-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

R 10606 2023-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.