Get the free twc quarterly report pdf

Show details

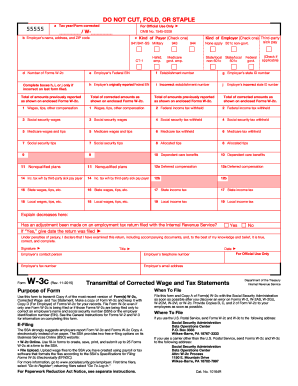

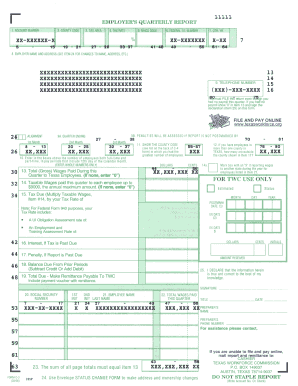

January 28, 2010, TWC Employer s Quarterly Report (Form C-3) **Texas Only** If you are eligible to submit your Employer s Quarterly Report as a paper copy, you should mail your form to: Texas Workforce

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign twc quarterly report form

Edit your texas workforce commission employer login quarterly report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas quarterly wage report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas workforce commission quarterly report online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit twc report form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out twc quarterly report pdf

How to fill out twc employer s quarterly:

01

Obtain the twc employer s quarterly form from the Texas Workforce Commission (TWC) website or an authorized source.

02

Fill in the employer's information, including name, address, and contact details.

03

Provide the reporting period for which the form is being filled out.

04

Report the total number of employees during the reporting period, including both full-time and part-time workers.

05

Specify the total wages paid to employees during the reporting period.

06

Determine the amount of unemployment taxes owed based on the provided wage information.

07

Calculate any adjustments or credits that may apply, such as experience-rated tax, if applicable.

08

Complete the certification section, confirming the accuracy of the information provided.

09

Sign and date the form before submitting it to the TWC.

Who needs twc employer s quarterly:

01

Employers in Texas who have paid wages to employees during the reporting period.

02

Businesses or organizations subject to unemployment taxes in Texas.

03

Entities that employ individuals in Texas and are required to report wages and pay unemployment taxes to the TWC.

Fill

form

: Try Risk Free

People Also Ask about

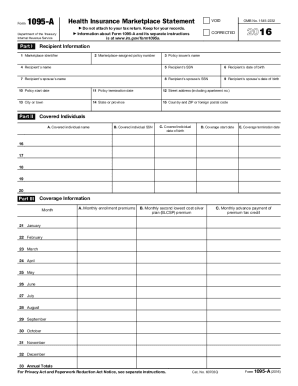

What is 1099g Texas?

An IRS Form 1099-G (1099-G) is a federal tax form that lists the total amount of benefits TWC paid to a claimant the previous calendar year. Reported payments may include: Unemployment benefits; Federal income tax withheld from unemployment benefits; and.

What is the Texas unemployment tax form?

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including: Unemployment benefits (both regular and federal extended benefits) Federal income tax withheld from unemployment benefits, if any.

What is Texas unemployment tax called?

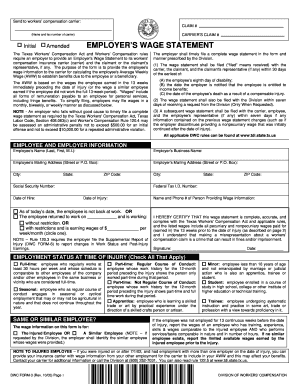

Unemployment taxes are not deducted from employee wages. Most employers are required to pay Unemployment Insurance ( UI ) tax under certain circumstances. The Texas Workforce Commission uses three employment categories: regular, domestic and agricultural. Employer tax liability differs for each type of employment.

What quarterly reports are due in Texas?

Due Dates for Employer's Quarterly Reports & Payments For Wages Paid DuringCalendar Quarter EndsDueJan, Feb, MarMarch 31April 1Apr, May, JunJune 30July 1Jul, Aug, SepSeptember 30October 1Oct, Nov, DecDecember 31January 1

What is the employment training assessment tax in Texas?

The tax rates for experienced employers range from 0.23% to 6.23% and include a 0.13% replenishment tax as well as a 0.1% employment training and investment assessment, ing to the website. The state's bond obligation assessment and deficit tax are not in effect for 2023.

What is the obligation assessment tax rate in Texas?

The obligation assessment – to collect the amount needed to repay interest due from Title XII loans. This tax is set to 0.01 percent. The employment and training investment assessment – a flat tax of 0.1 percent, paid by all employers.

What is the employment and training assessment rate in Texas?

The average tax rate for experience-rated employers is 0.89%. The maximum UI tax rate, paid by 4.2% of Texas employers, will be 6.23%, down 0.08 percentage points from CY 2022 at 6.31%.

What is Texas Workforce Commission Form C 3?

The Payment Voucher (Form C-3V) is used by employers or their representatives to submit unemployment tax payments by check or money order to the Texas Workforce Commission ( TWC ).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit twc quarterly report pdf from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like twc quarterly report pdf, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I edit twc quarterly report pdf on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing twc quarterly report pdf, you can start right away.

How do I complete twc quarterly report pdf on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your twc quarterly report pdf, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is twc employer s quarterly?

TWC Employer's Quarterly refers to the Texas Workforce Commission's report that employers are required to file every quarter, detailing wages paid and unemployment insurance tax owed.

Who is required to file twc employer s quarterly?

All employers in Texas who are liable for unemployment insurance taxes must file the TWC Employer's Quarterly report.

How to fill out twc employer s quarterly?

To fill out the TWC Employer's Quarterly, employers need to provide their federal employer identification number, report wages paid to each employee, calculate the unemployment tax owed, and submit the form by the due date.

What is the purpose of twc employer s quarterly?

The purpose of the TWC Employer's Quarterly is to ensure that employers report accurate wages and pay the appropriate unemployment insurance taxes to support the state's unemployment benefits system.

What information must be reported on twc employer s quarterly?

Employers must report total wages paid, individual employee wages, federal employer identification number (FEIN), tax rates, and any adjustments or corrections from previous filings on the TWC Employer's Quarterly.

Fill out your twc quarterly report pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Twc Quarterly Report Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.