CA FA-2656C 2014-2026 free printable template

Show details

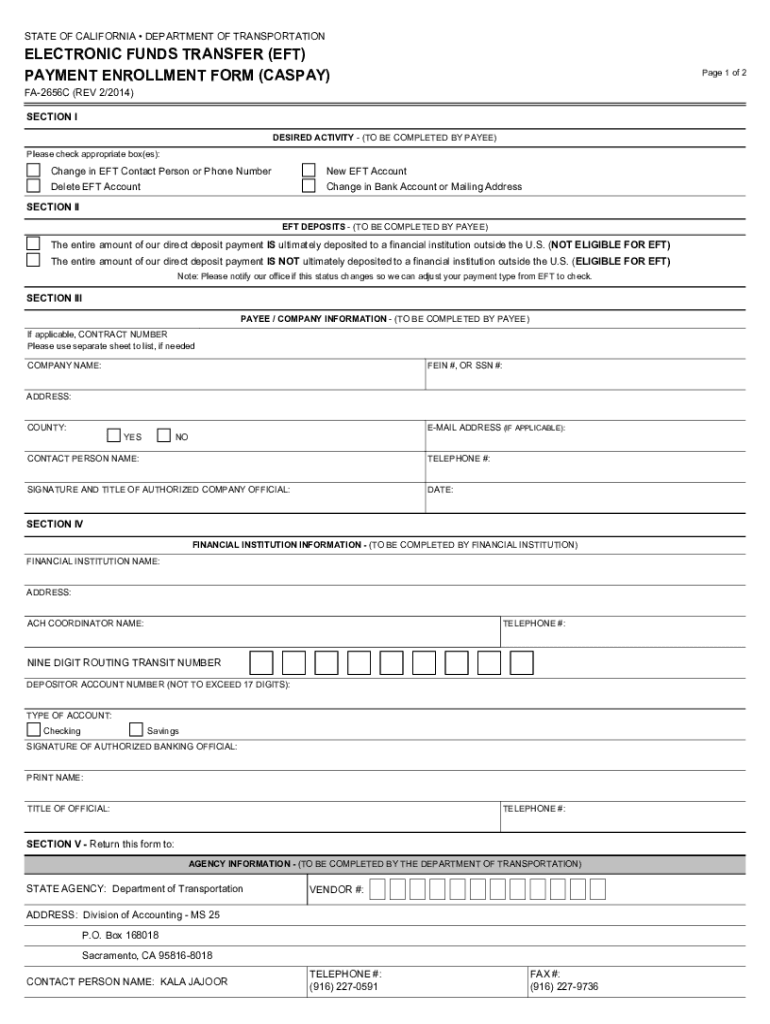

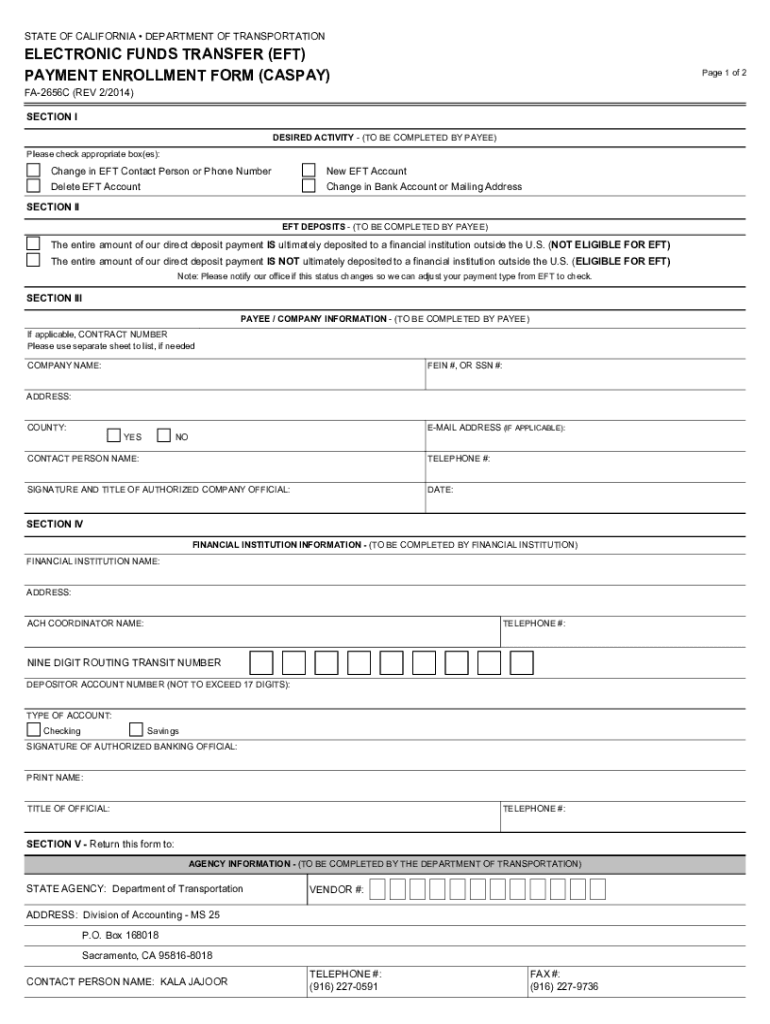

STATE OF CALIFORNIA DEPARTMENT OF TRANSPORTATIONELECTRONIC FUNDS TRANSFER (EFT) PAYMENT ENROLLMENT FORM (CASPAR)Page 1 of 2FA2656C (REV 2/2014) SECTION I DESIRED ACTIVITY (TO BE COMPLETED BY PAYEE)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FA-2656C

Edit your CA FA-2656C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FA-2656C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FA-2656C online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA FA-2656C. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FA-2656C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FA-2656C

How to fill out CA FA-2656C

01

Download the CA FA-2656C form from the official website.

02

Fill in your basic information at the top of the form, including your name, address, and contact information.

03

Indicate the type of application you are submitting.

04

Provide detailed information about your financial situation in the sections provided.

05

Attach any necessary documentation that supports your financial claims.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the form according to the instructions provided, either by mail or electronically.

Who needs CA FA-2656C?

01

Individuals applying for financial assistance in California.

02

Those seeking to report changes in their financial circumstances.

03

Applicants for specific programs that require the CA FA-2656C form as part of the application process.

Fill

form

: Try Risk Free

People Also Ask about

What do you need for an electronic funds transfer?

In order to receive an EFT, you need to share your banking details with the person sending you one, including your institution number, your branch number and account number, and your transit number.

How do I set up an electronic funds transfer?

How to send an EFT payment Determine if this is a one-time or recurring payment. Collect the necessary permissions and banking information. Enter the amount owing and debit date. Make the payment. Vendor receives the payment.

How to fill out EFT authorization form?

What you need Electronic Funds Transfer Form. Providers must complete the authorized-signature (and date) field on the EFT form. Include the following documentation: Voided check. Bank letter that includes the bank name, provider name, bank account number, and routing number. Bank statement from the designated account.

What is an electronic funds transfer authorization form?

The Electronic Funds Transfer Authorization Form contains a form that may be used to gather information from your employees that is needed to establish an electronic funds transfer program.

What is required for electronic funds transfer?

EFTs require both the sender and recipient to have bank accounts. The accounts do not have to be at the same financial institution to transfer funds. Both individuals and businesses can make EFT payments over the computer, using card readers, or over phones.

Is there a fee for electronic funds transfer?

$0. 1-3 business days; 3 or more business days for transfers initiated at the bank where the funds should arrive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA FA-2656C online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your CA FA-2656C to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out CA FA-2656C on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your CA FA-2656C. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit CA FA-2656C on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share CA FA-2656C on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is CA FA-2656C?

CA FA-2656C is a form used in California for the reporting of foreign trusts and foreign gifts for tax purposes.

Who is required to file CA FA-2656C?

Individuals who receive foreign gifts exceeding a certain threshold or have interests in foreign trusts are required to file CA FA-2656C.

How to fill out CA FA-2656C?

To fill out CA FA-2656C, individuals should provide their personal information, detail foreign gifts received or foreign trust interests, and comply with the instructions provided by the California tax authorities.

What is the purpose of CA FA-2656C?

The purpose of CA FA-2656C is to ensure transparency in foreign financial transactions and to enable California tax authorities to monitor foreign gifts and trusts for tax compliance.

What information must be reported on CA FA-2656C?

CA FA-2656C requires reporting of the amount of foreign gifts received, descriptions of the foreign trusts, and any related financial details necessary for tax assessment.

Fill out your CA FA-2656C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FA-2656c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.