Get the free Portsmouth Elderly Exemption Qualification Sheet

Show details

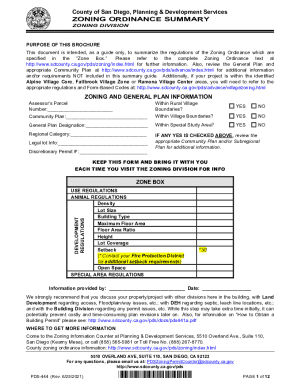

This form is intended for elderly residents of New Hampshire applying for the Optional Adjusted Elderly Tax Exemption. It includes guidelines on income, assets, and age requirements, as well as instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign portsmouth elderly exemption qualification

Edit your portsmouth elderly exemption qualification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your portsmouth elderly exemption qualification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing portsmouth elderly exemption qualification online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit portsmouth elderly exemption qualification. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out portsmouth elderly exemption qualification

How to fill out Portsmouth Elderly Exemption Qualification Sheet

01

Begin by obtaining the Portsmouth Elderly Exemption Qualification Sheet from the local municipality's website or office.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide your date of birth to confirm your eligibility as an elderly applicant.

04

Indicate any other required information, such as income levels or property details, as specified on the form.

05

Attach any necessary documentation proving age, residency, or income (e.g., copies of identification, income statements).

06

Review the completed form for accuracy and ensure all required fields are filled.

07

Submit the completed Qualification Sheet to the designated department, either in person or via mail, before the deadline.

Who needs Portsmouth Elderly Exemption Qualification Sheet?

01

Individuals aged 65 and older who own property in Portsmouth and seek a property tax exemption.

02

Residents who meet specific income criteria as outlined by the local municipality.

03

Elderly individuals looking for financial relief regarding property taxes.

Fill

form

: Try Risk Free

People Also Ask about

Which states have no property tax on homes?

States Without Property Tax Sadly for investors, the answer is no, there are no states without property tax. Related: Best US Cities to Invest In Rental Properties Today. Louisiana. Hawaii. Alabama. Delaware. District of Columbia. West Virginia.

What states give property tax breaks to seniors?

The following states offer partial exemption on property taxes for seniors and people over 65. Hawaii. In Hawaii, if you're 65 or older, you could knock $160,000 off your home's assessed value, reducing your property tax liability. Louisiana. Alaska. New York. Washington. Mississippi. Florida. South Dakota.

Which state has the best tax breaks for seniors?

South Dakota is one of the most tax-friendly states for U.S. retirees. It does not levy state income tax, so retirement income and income from dividends and interest are tax-free. South Dakota does not charge inheritance or estate taxes and has fairly low sales taxes.

At what age do you stop paying property taxes in USA?

Instead, property tax relief for seniors varies significantly depending on where you live. Most states and many local jurisdictions offer some form of property tax exemption, deferral, or credit program specifically designed for older residents, typically starting between the ages of 65 and 75.

Who is exempt from Portsmouth NH elderly tax?

The City exempts $375,000 from the assessed valuation of the primary home of residents ages 65 through 74, $450,000 for residents ages 75-79, and $525,000 for those 80 and older. Residents must have lived in New Hampshire for the past three years to claim this exemption.

What age in Virginia do you stop paying property taxes?

However, most Virginia cities, counties, and towns offer some form of personal property tax relief to homeowners age 65 and older, and to homeowners with disabilities. This relief may be in the form of a tax exemption, tax deferral, or both, and we provide an overview of these types of benefits below.

How much is the Colorado senior property tax exemption?

Often referred to as the Senior Homestead Exemption, qualifying individuals receive a 50% discount on the first $200,000 of value of the home, if they have lived in the home for 10 years.

At what age do you stop paying property tax in NH?

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Portsmouth Elderly Exemption Qualification Sheet?

The Portsmouth Elderly Exemption Qualification Sheet is a form used to determine the eligibility of elderly residents for property tax exemption benefits in Portsmouth.

Who is required to file Portsmouth Elderly Exemption Qualification Sheet?

Any elderly resident in Portsmouth seeking to qualify for property tax exemptions must file the Portsmouth Elderly Exemption Qualification Sheet.

How to fill out Portsmouth Elderly Exemption Qualification Sheet?

To fill out the Portsmouth Elderly Exemption Qualification Sheet, residents must provide personal information, income details, and property information as required by the form.

What is the purpose of Portsmouth Elderly Exemption Qualification Sheet?

The purpose of the Portsmouth Elderly Exemption Qualification Sheet is to assess the eligibility of elderly residents for property tax reductions or exemptions, thereby assisting them with financial relief.

What information must be reported on Portsmouth Elderly Exemption Qualification Sheet?

The information required includes the applicant's name, age, income, property address, and any other financial details that illustrate their eligibility for the exemption.

Fill out your portsmouth elderly exemption qualification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Portsmouth Elderly Exemption Qualification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.