GA Hampton Tax and Financial Services Rental Property Income & Expense Worksheet 2022-2026 free printable template

Show details

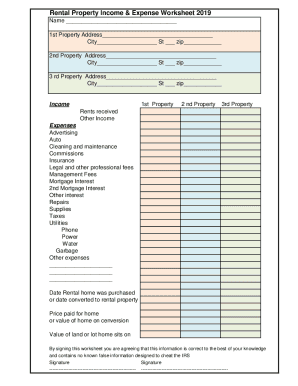

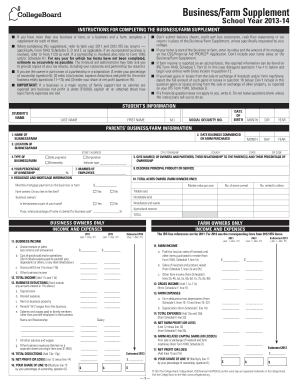

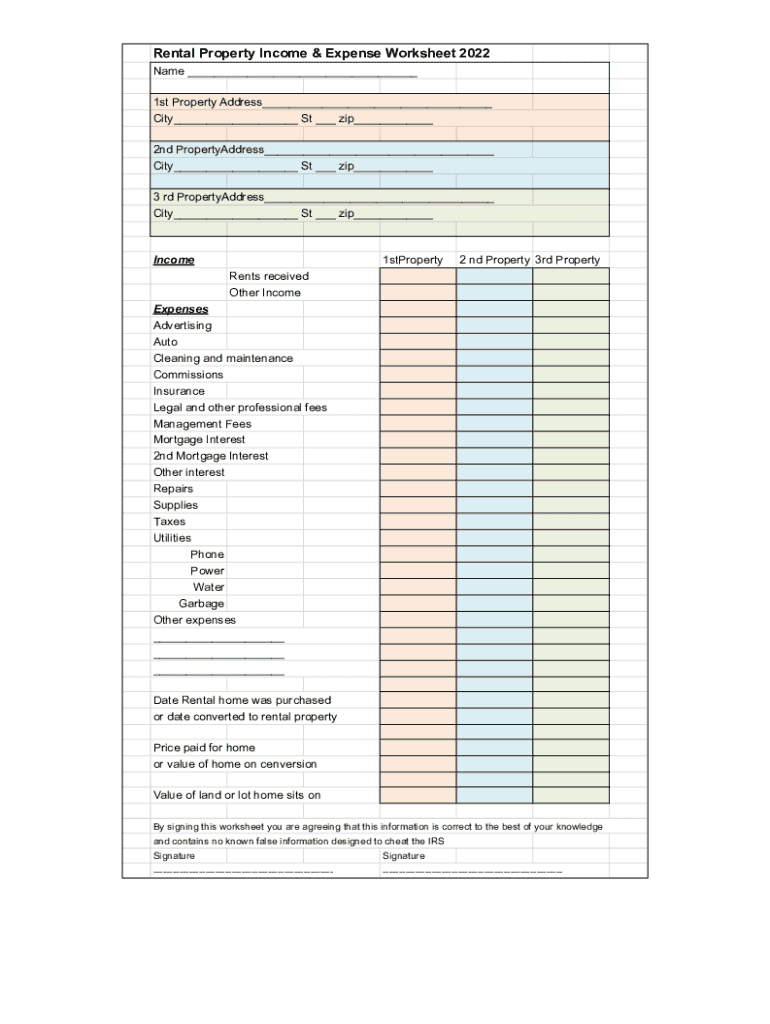

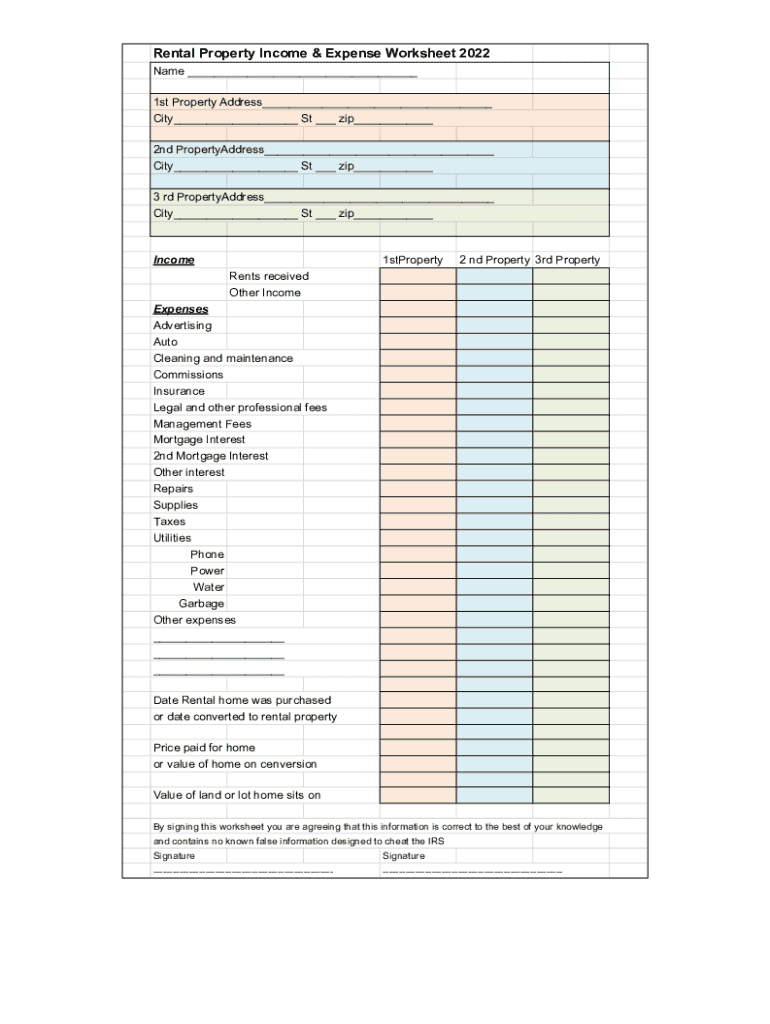

Rental Property Income & Expense Worksheet 2022 Name ___ 1st Property Address___ City___ St ___ zip___ 2nd PropertyAddress___ City___ St ___ zip___ 3rd PropertyAddress___ City___ St ___ zip___Income1stProperty2

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rental income and expense worksheet form

Edit your ato rental property worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA Hampton Tax and Financial Services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA Hampton Tax and Financial Services online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit GA Hampton Tax and Financial Services. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Hampton Tax and Financial Services Rental Property Income & Expense Worksheet Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (170 Votes)

4.1 Satisfied (73 Votes)

How to fill out GA Hampton Tax and Financial Services

How to fill out GA Hampton Tax and Financial Services Rental

01

Gather all necessary documentation related to your rental property, including income and expenses.

02

Obtain the GA Hampton Tax and Financial Services Rental form from their website or office.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Report your rental income in the designated section, ensuring to include all sources of income.

05

Itemize your expenses, such as mortgage interest, property taxes, repairs, and management fees, in the appropriate sections.

06

Double-check all entries for accuracy and completeness before submitting.

07

Submit the completed form along with any required supporting documentation by the specified deadline.

Who needs GA Hampton Tax and Financial Services Rental?

01

Property owners who rent out residential or commercial properties.

02

Individuals looking to maximize their tax deductions related to rental income.

03

Real estate investors seeking professional assistance with tax filing and planning.

Fill

form

: Try Risk Free

People Also Ask about

Does rental income get reported to IRS?

All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned.

How does the IRS know if I have rental income?

Ways the IRS can find out about rental income include routing tax audits, real estate paperwork and public records, and information from a whistleblower. Investors who don't report rental income may be subject to accuracy-related penalties, civil fraud penalties, and possible criminal charges.

How do you calculate income and expenses of a rental property?

The 50% Rule states that normal operating expenses – excluding the mortgage payment – for a rental property can be estimated to be about one-half of the gross rental income. If the gross rental income is $1,000 per month then the estimated operating expenses could be $500 per month.

How does IRS find unreported income?

The IRS receives information from third parties, such as employers and financial institutions. Using an automated system, the Automated Underreporter (AUR) function compares the information reported by third parties to the information reported on your return to identify potential discrepancies.

How do you prepare a rental income statement?

What is included on a rental property income statement? Gross Rental Income should include: Operating Expenses. Net Operating Income. Monthly income expense statement. Year-to-date (YTD) Year-end. Trailing 12 months (T-12 statement) Cap rate.

How do I record income from rental property?

If you rent real estate such as buildings, rooms or apartments, you normally report your rental income and expenses on Form 1040 or 1040-SR, Schedule E, Part I. List your total income, expenses, and depreciation for each rental property on the appropriate line of Schedule E. See the Instructions for Form 4562 to figure

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my GA Hampton Tax and Financial Services directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your GA Hampton Tax and Financial Services and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit GA Hampton Tax and Financial Services straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing GA Hampton Tax and Financial Services, you can start right away.

How do I complete GA Hampton Tax and Financial Services on an Android device?

On Android, use the pdfFiller mobile app to finish your GA Hampton Tax and Financial Services. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is GA Hampton Tax and Financial Services Rental?

GA Hampton Tax and Financial Services Rental is a financial service that provides tax preparation and advisory services specifically for rental property owners, helping them navigate their tax obligations and optimize their tax situations.

Who is required to file GA Hampton Tax and Financial Services Rental?

Individuals or businesses that own rental properties and earn income from them are required to file GA Hampton Tax and Financial Services Rental if they need to report rental income and associated expenses on their tax returns.

How to fill out GA Hampton Tax and Financial Services Rental?

To fill out GA Hampton Tax and Financial Services Rental, one should gather all relevant financial documents, including rental income statements, expense receipts, and depreciation schedules, then follow the provided instructions to accurately report income and deductions.

What is the purpose of GA Hampton Tax and Financial Services Rental?

The purpose of GA Hampton Tax and Financial Services Rental is to assist rental property owners in accurately reporting their rental income and expenses, ensuring compliance with tax regulations, and maximizing tax benefits.

What information must be reported on GA Hampton Tax and Financial Services Rental?

Information that must be reported includes total rental income received, expenses related to property maintenance, management fees, property taxes, insurance, and any other relevant costs associated with the rental activity.

Fill out your GA Hampton Tax and Financial Services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA Hampton Tax And Financial Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.