UK Halifax INT0035 2020-2026 free printable template

Show details

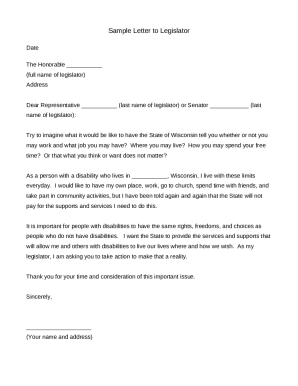

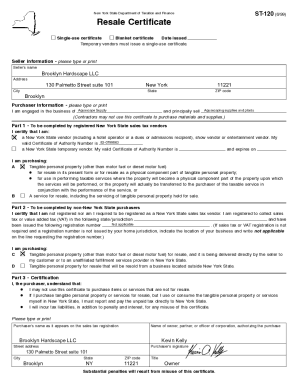

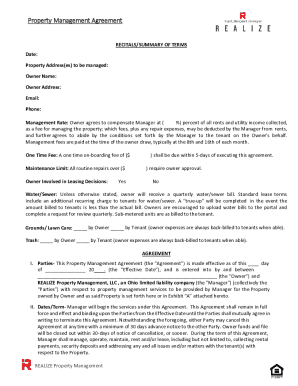

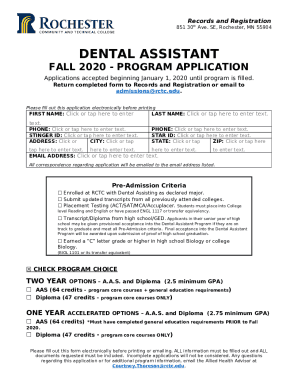

Valuation appeal form The below form should be completed where an appeal of a property valuation is required as a result of evidence from the sale of comparable properties. An appeal can be made for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Halifax INT0035

Edit your UK Halifax INT0035 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Halifax INT0035 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Halifax INT0035 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK Halifax INT0035. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Halifax INT0035 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Halifax INT0035

How to fill out property tax appeals when

01

Research the assessment process in your area to understand the guidelines and deadlines for filing a property tax appeal.

02

Gather evidence to support your appeal, such as recent sales of similar properties or documentation of needed repairs.

03

Fill out the necessary forms provided by your local tax assessor's office, including details about your property and the reasons for your appeal.

04

Submit your appeal before the deadline, making sure to include all required documentation and follow the instructions provided.

Who needs property tax appeals when?

01

Property owners who believe their property has been over-assessed and therefore are paying more in property taxes than they should be.

02

Individuals who have made improvements to their property that have not been reflected in the assessed value.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a mortgage offer after valuation Halifax?

They can keep track of your application and arrange a valuation of the property you're buying. Your lender will then make you a formal mortgage offer, based on all the information you've given them. The process only takes between three and six weeks.

Does Halifax charge valuation fees?

The valuation fee will be based on the valuation figure, not on the amount you are paying for the property, even if it is for a discounted price.

Does Halifax charge for valuation?

A building survey will give you a customised report based on the agreement between you and the surveyor. We will still need to complete a mortgage valuation, which you will need to pay for. We need this to help us make a decision on whether we will lend you the money to buy the property.

What to do if you disagree with a valuation?

Appeal. Some mortgage lenders will give you the opportunity to appeal the valuation. If you decide to do this you'll need evidence of why you disagree with their figure – for example, records of how much similar properties in the area have sold for recently.

How much is a valuation fee?

The short answer is nothing at all! Valuations provided by estate agents are usually free because they know it's a great time to view the property, pitch their services and sell themselves to you. It's called customer contact time, and it's a key part of the estate agent business model.

Do banks charge for valuation?

Costs vary, but you can expect to pay from $200 to $600, although the bank may cover the valuation on your behalf.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UK Halifax INT0035 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including UK Halifax INT0035. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send UK Halifax INT0035 to be eSigned by others?

Once your UK Halifax INT0035 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the UK Halifax INT0035 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your UK Halifax INT0035 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is property tax appeals when?

Property tax appeals happen when a property owner disagrees with the assessed value of their property and wants to challenge it.

Who is required to file property tax appeals when?

Property owners who believe that the assessed value of their property is incorrect are required to file property tax appeals.

How to fill out property tax appeals when?

Property owners can fill out property tax appeals by submitting the necessary forms and supporting documentation to the appropriate tax assessment office.

What is the purpose of property tax appeals when?

The purpose of property tax appeals is to provide property owners with a mechanism to challenge the assessed value of their property and potentially lower their property tax liability.

What information must be reported on property tax appeals when?

Property owners must report details about their property, recent comparable sales data, and any other relevant information that supports their claim.

Fill out your UK Halifax INT0035 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Halifax int0035 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.