Get the free Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Pa...

Show details

Este folleto contiene información sobre el Plan de Contribución del Empleador para Empleados Excluidos del Programa Savings Plus en California, incluyendo instrucciones para la solicitud de pago

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign savings plus program excluded

Edit your savings plus program excluded form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your savings plus program excluded form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit savings plus program excluded online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit savings plus program excluded. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out savings plus program excluded

How to fill out Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet

01

Start by gathering all necessary personal and employment information.

02

Review the booklet to understand the requirements and sections to be completed.

03

Complete the identification section with your name, address, and employee details.

04

Fill in the contribution amounts as applicable for the 401(k) plan.

05

Provide any requested information regarding beneficiary designations.

06

Sign and date the form where indicated.

07

Double-check all entries for accuracy before submission.

08

Submit the completed booklet to the designated employer representative or department.

Who needs Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet?

01

Employees who are part of the Savings Plus Program but are excluded from certain contributions.

02

Individuals seeking to understand their 401(k) benefit payments under the plan.

03

HR representatives or auditors managing the 401(k) plan documentation.

Fill

form

: Try Risk Free

People Also Ask about

Is 7% good for retirement?

The Appeal of the 7 Percent Rule This approach is particularly attractive for individuals who: Plan to retire early: The 7% rule allows for a potentially higher standard of living in the earlier years of retirement, which might be more desirable for those retiring before the traditional age.

Is 6% too low for 401k?

At a minimum, you should aim to contribute enough to your 401(k) to receive the full employer match. Failing to do so is akin to leaving free money on the table. For example, if your employer offers a 50% match up to 6% of your salary, you should contribute at least 6% to get the maximum match.

Is 7% 401k contribution good?

Aim for 15% ing to Fidelity, investors should aim to save 15% of their pre-tax income annually, including any match. 1 A common rule of thumb is to set aside at least 10% of your gross earnings.

Is a 7% 401k match good?

Only a few companies offer more than 6%, with the top employers offering up to 25%. While this is a fair increase from the 3.5% average in 2015, it hasn't changed much since 2020. So if you're getting at least 4% to 6% in 401k employer matching in 2025, it's considered a “good” 401k match.

Is 7% return on 401k good?

The average rate of return for a typical 401(k) over several decades is between 5% and 8%.

How do I access my 401k account?

Single-tier formula: The employer matches the same amount for each dollar that you contribute, up to a certain percentage of your income. Example A: Your employer matches 50% of the first 6% of your contributions. In this case, you need to contribute at least 6% per-pay-period to earn your full match.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

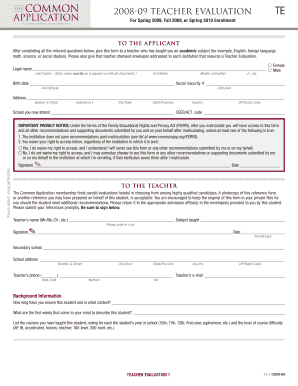

What is Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet?

The Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet is a document that outlines the procedures and benefits of the 401(k) plan for employees who are excluded from certain employer contributions, detailing how they can manage their retirement funds.

Who is required to file Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet?

Employees participating in the Savings Plus Program who are also excluded from employer contributions are required to file the Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet in order to access their benefits.

How to fill out Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet?

To fill out the booklet, employees should provide their personal information, account details, and any required documentation, making sure to follow the instructions provided in the booklet closely.

What is the purpose of Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet?

The purpose of the booklet is to provide employees with information about their 401(k) benefits, guide them in making informed decisions about their retirement savings, and specify the procedures for accessing these benefits.

What information must be reported on Savings Plus Program Excluded Employees Employer Contribution 401(k) Plan Benefit Payment Booklet?

The information that must be reported includes personal identification data, employment details, account number, contribution election choices, and any other necessary information as guided by the booklet instructions.

Fill out your savings plus program excluded online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Savings Plus Program Excluded is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.