Canada REG3392 - Alberta 2005 free printable template

Show details

Phone: (780) 435-7800 Fax: (780) 436-1000 e-mail: info ersregistry.com http://www.ersregistry.com Unit #1, 9109-39 avenue Edmonton, AB Canada :: T6E5Y2 Print Form Notarized Request for Personal Driving

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada REG3392 - Alberta

Edit your Canada REG3392 - Alberta form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada REG3392 - Alberta form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada REG3392 - Alberta online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada REG3392 - Alberta. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada REG3392 - Alberta Form Versions

Version

Form Popularity

Fillable & printabley

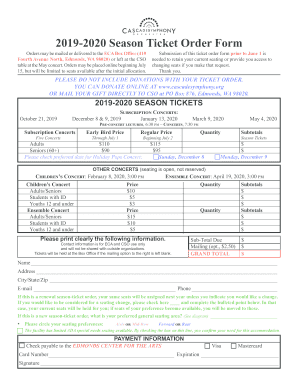

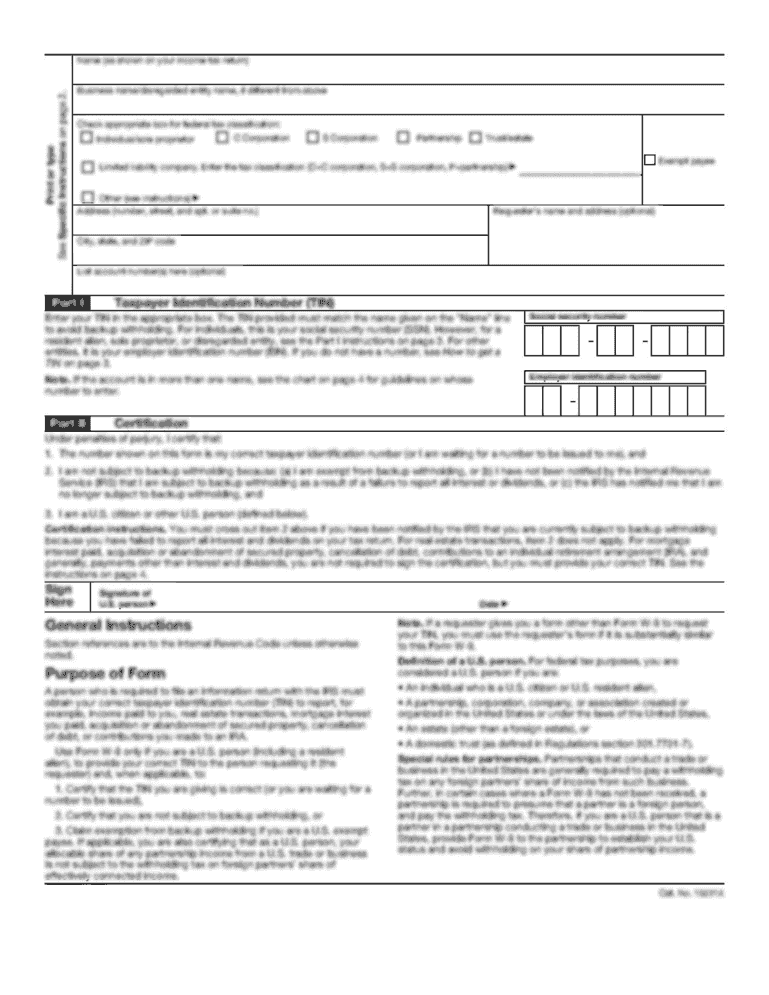

How to fill out Canada REG3392 - Alberta

How to fill out Canada REG3392 - Alberta

01

Obtain the Canada REG3392 - Alberta form from the official Canada Revenue Agency website or a local office.

02

Fill in your personal details, including your name, address, and contact information.

03

Complete the sections related to your business activities, including your business number and description of services or products.

04

Provide information on your sales tax collection, including the total amount of tax collected during the reporting period.

05

Fill out any relevant financial information, such as your total sales and any exempt sales.

06

Review the completed form for accuracy and ensure all required fields are filled out.

07

Sign and date the form to certify that the information provided is true and complete.

08

Submit the form according to the provided instructions, either online or by mail.

Who needs Canada REG3392 - Alberta?

01

Any business operating in Alberta that is required to report and remit the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST).

02

Businesses that have collected GST/HST from customers and need to report it to the Canada Revenue Agency.

03

New businesses registering for a GST/HST account may also need to complete Canada REG3392 - Alberta.

Fill

form

: Try Risk Free

People Also Ask about

How much is a vehicle registration in Alberta?

Renew your vehicle registration online to download your digital vehicle registration certificate. Licence plate expiry stickers are no longer required as of January 1, 2021. Price: starts at $93.00 per vehicle inclusive of service charge.

How long can you drive a new car without registration in Alberta?

You can use your existing licence plate and vehicle registration on another vehicle for up to 14 days. You must also carry your proof of ownership document and insurance until you transfer the registration and licence plate.

Can you register a car in Alberta online?

The online site can only be used if you are renewing your registration without changes. If you require any changes to your registration, for example a name or address change, you must apply for the renewal in person at a registry agent office.

What is required to register a vehicle in Alberta?

To register a vehicle, you must go to a registry agent with the following: proof of ownership document, such as a lease, bill of sale, probated will or letters of administration. proof of valid insurance for the vehicle that includes the name(s) of the person(s) requesting the registration. acceptable identification.

Can I register my vehicle online in Alberta?

The online site can only be used if you are renewing your registration without changes. If you require any changes to your registration, for example a name or address change, you must apply for the renewal in person at a registry agent office.

How much does it cost to transfer a license plate in Alberta?

The cost to transfer a plate from one vehicle to another is $28, provided the plate registration is still valid. You may be able to save this fee if you extend your registration at the same time. Please ask your clerk at the start of the service.

Can a car be registered in 2 names Alberta?

In the Province of Alberta, it is possible for a single vehicle to hold more than one registration certificate within the same time period. This is the Dual Registration Program.

How much does it cost to register a car in Alberta?

How much does it cost to register a car in Alberta? The cost of passenger vehicles is $84.45 for one year and $159.45 for two years. If you register a vehicle for the first time, it will be prorated based on your expiry month. The same fees apply to renewals.

Are Alberta registries open on weekends?

Open Saturdays and Sundays to Serve You We are here to help. Please contact us with questions about any of our services!

How long do you have to register a vehicle in Alberta?

Vehicle Registration FAQs How Long Do I Have to Transfer My Registration After Buying a Car? You have six days to register the vehicle from the time of the sale.

What do you need to register a vehicle in Alberta?

To register a vehicle, you must go to a registry agent with the following: proof of ownership document, such as a lease, bill of sale, probated will or letters of administration. proof of valid insurance for the vehicle that includes the name(s) of the person(s) requesting the registration. acceptable identification.

What do I need to re register my car in Alberta?

To renew in person, you will need: driver's licence. proof of insurance ('pink card') vehicle registration certificate (optional)

Can I register my vehicle at AMA?

As one of Alberta's most trusted brands, you can rely on AMA to register your vehicle quickly and easily. In-person or online, our 150 registries experts are here to answer any of your questions and get you back on the road again.

How long does it take to register a car in Alberta?

You have six days to register the vehicle from the time of the sale.

Can a car be registered in one name and insured in another in Alberta?

No. You must show proof of insurance for the vehicle you want to register in your name, along with proof of ownership and an acceptable form of identification. If you bought a used vehicle outside of Alberta, you may also have to get it inspected before you can register it.

How much does it cost to get a custom license plate in Alberta?

The cost is $220.55 which must be paid in full at the time of ordering. It usually takes 4-6 weeks for a personalized plate to arrive to your home after it is ordered in our office. Once the plate arrives, you will need to visit our office and pay a $28 plate transfer fee to have the plate registered to your vehicle.

Do you need an Alberta driver's license to register a car?

If you do not have a valid Alberta license you must provide proof of Alberta Residency Documents (PDF) and provide a valid piece of government issued photo ID. Scans, emails or photo copies will not be accepted.

Can someone else register my car in Alberta?

If you can't go to a registry office, another person can apply for a vehicle registration, renewal, cancellation or transfer on your behalf. The person requesting the service on your behalf must bring: your proof of ownership document, proof of valid insurance, and their ID.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada REG3392 - Alberta from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including Canada REG3392 - Alberta, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send Canada REG3392 - Alberta for eSignature?

When you're ready to share your Canada REG3392 - Alberta, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get Canada REG3392 - Alberta?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the Canada REG3392 - Alberta in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

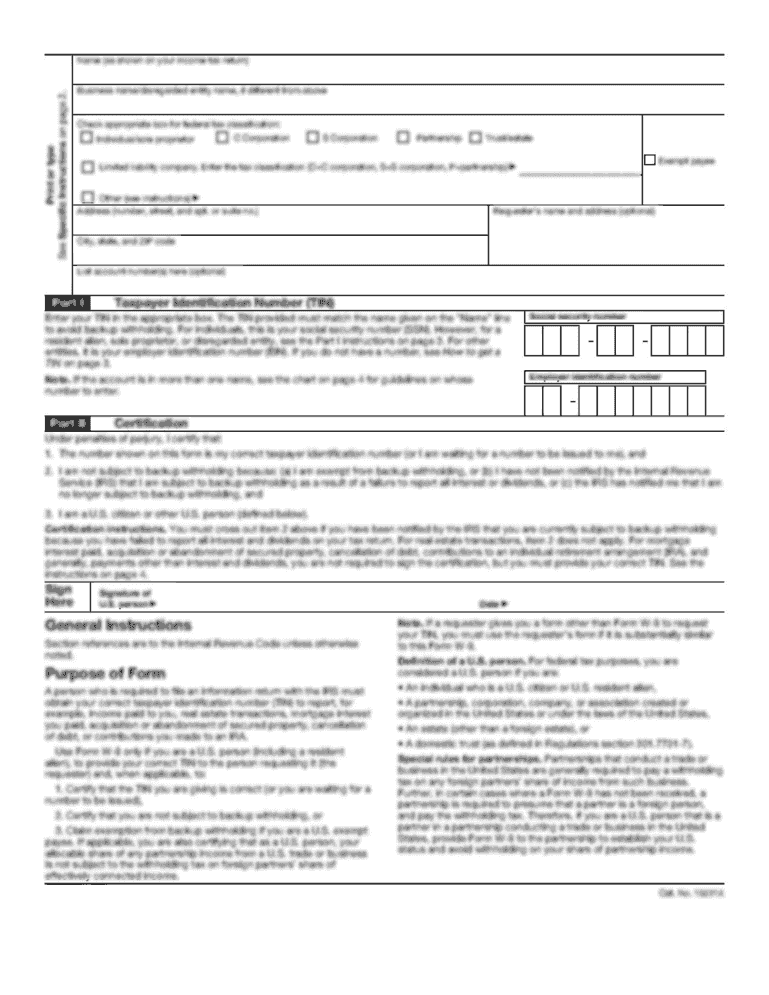

What is Canada REG3392 - Alberta?

Canada REG3392 - Alberta is a tax form used by businesses operating in Alberta to report sales tax information to the provincial government.

Who is required to file Canada REG3392 - Alberta?

Businesses in Alberta that are registered for the collection of the provincial sales tax (PST) are required to file Canada REG3392.

How to fill out Canada REG3392 - Alberta?

To fill out Canada REG3392, businesses must provide their registration number, report total sales, exempt sales, and net tax collected, and follow the instructions provided on the form.

What is the purpose of Canada REG3392 - Alberta?

The purpose of Canada REG3392 - Alberta is to ensure compliance with provincial sales tax regulations and facilitate the proper collection and remittance of sales tax.

What information must be reported on Canada REG3392 - Alberta?

Information required on Canada REG3392 includes the business's registration number, total taxable sales, total exempt sales, and the amount of sales tax collected.

Fill out your Canada REG3392 - Alberta online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada reg3392 - Alberta is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.