Get the free Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels - ta...

Show details

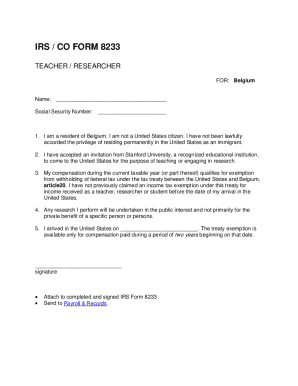

The document outlines the tax credits, refunds, and incentives available in Kansas for alternative fuels, specifically focusing on the Agricultural Ethyl Alcohol Producers Incentive and the biodiesel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kansas perspective on tax

Edit your kansas perspective on tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas perspective on tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas perspective on tax online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit kansas perspective on tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kansas perspective on tax

How to fill out Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels

01

Review the guidelines provided by the Kansas Department of Revenue regarding tax credits for alternative fuels.

02

Gather all necessary documentation, including proof of purchase for alternative fuel and any relevant invoices.

03

Complete the required forms carefully, ensuring that all information is accurate and legible.

04

Calculate the eligible amount for tax credits or refunds based on your use of alternative fuels.

05

Attach any supporting documents and forms as specified in the instructions.

06

Submit the completed forms and documentation by the designated deadline to avoid delays in processing.

Who needs Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels?

01

Individuals or businesses that use alternative fuels in Kansas seeking financial incentives.

02

Tax preparers or accountants assisting clients with tax credit applications.

03

Policy makers or advocates aiming to promote the use of alternative fuels through financial incentives.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between tax credit and subsidy?

Tax credits refer to reductions in the amount of tax owed by an individual or corporation, while subsidies involve direct payments from government agencies to specific industries or groups. The purpose of these incentives is to promote economic growth, reduce poverty, and support sustainable development.

What is the EV incentive in Kansas?

The state of Kansas offers corporations a one-time tax credit for new alternative fuel vehicles (AFVs), including EVs, worth up to 40% of the vehicle's cost, with limits based on the vehicle's gross vehicle weight rating (GVWR): EVs with a GVWR of 10,000 pounds or less can qualify for a maximum credit of up to $2,400.

What's the difference between a tax and subsidy?

Subsidy. While a tax drives a wedge that increases the price consumers have to pay and decreases the price producers receive, a subsidy does the opposite. A subsidy is a benefit given by the government to groups or individuals, usually in the form of a cash payment or a tax reduction.

What is an example of a subsidy?

A premium tax credit – often referred to as a premium subsidy – is a tax credit that offsets some or all of the amount that policyholders would otherwise have to pay to purchase individual or family health insurance.

Is subsidy the same as tax credit?

A subsidy is a benefit offered to an individual or group, usually from a governing body. They can come in the form of direct payments, like a cash payment, or indirect payments like a tax credit.

Is credit for federal tax on fuels refundable?

Businesses get a refundable credit for fuel used in a specific work-related activity with the Fuel Tax Credit. To qualify, you must: Own or operate a business. Meet certain requirements, such as running a farm or purchasing aviation gasoline.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels?

Kansas offers various tax credits, refunds, and incentives to promote the use of alternative fuels in order to reduce reliance on fossil fuels, lower emissions, and support the development of clean energy initiatives.

Who is required to file Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels?

Individuals and businesses that utilize alternative fuels and seek to benefit from tax credits, refunds, or incentives must file the appropriate documentation to demonstrate their eligibility.

How to fill out Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels?

To fill out the form, applicants should provide pertinent details about their alternative fuel usage, including the type of fuel, the quantity used, and any supporting documentation regarding the purchase or installation of related equipment.

What is the purpose of Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels?

The purpose is to encourage the adoption of alternative fuels by providing financial incentives that make it more economically viable for consumers and businesses to transition away from traditional fossil fuels.

What information must be reported on Kansas Perspective on Tax Credits, Refunds and Incentives for Alternative Fuels?

The information required includes identification details of the taxpayer, type and amount of alternative fuel used, the purpose of usage, and any applicable receipts or documentation supporting the claim.

Fill out your kansas perspective on tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Perspective On Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.