OR Form 735-9002t 2023-2026 free printable template

Show details

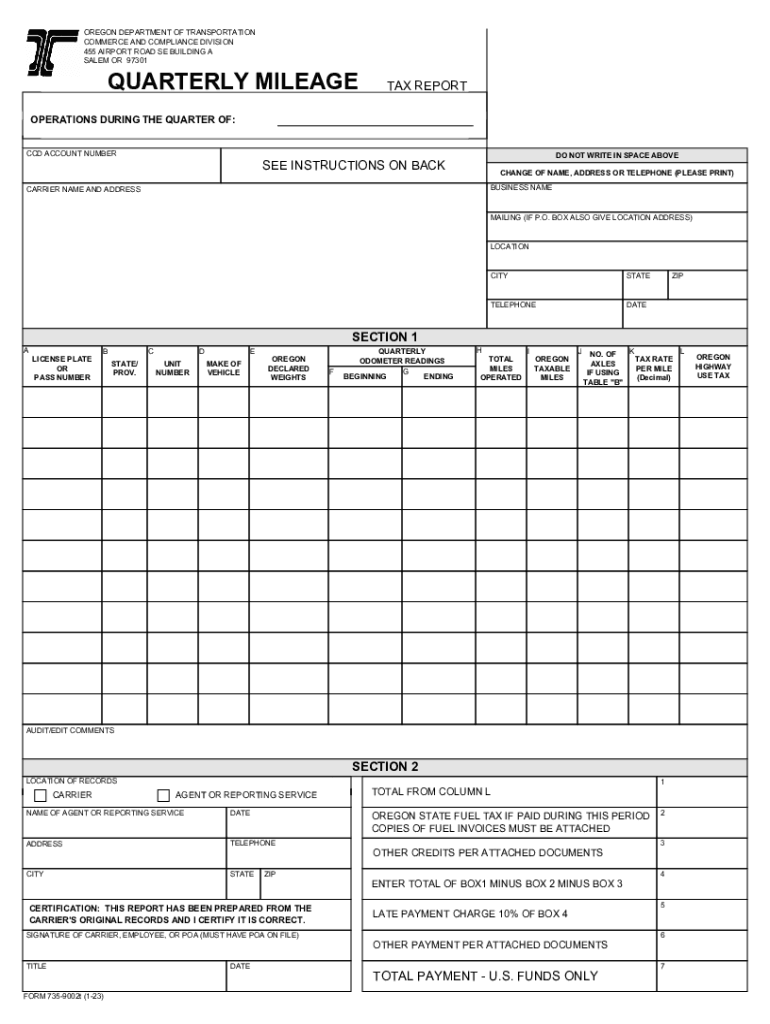

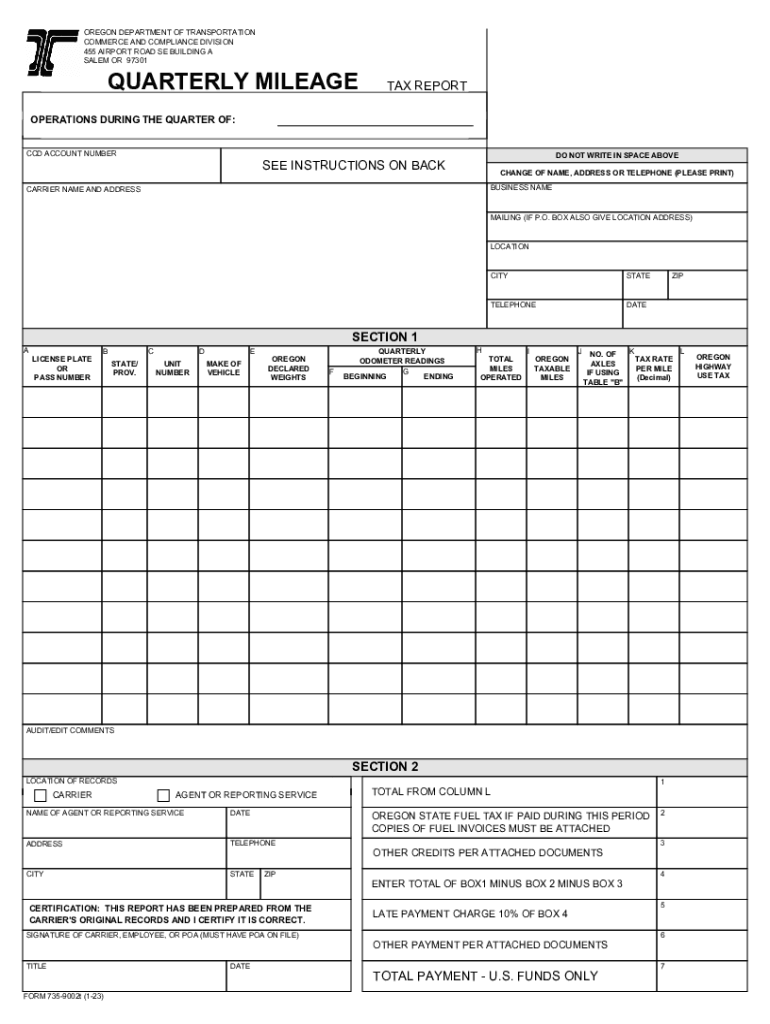

RESETPRINTOREGON DEPARTMENT OF TRANSPORTATION

COMMERCE AND COMPLIANCE DIVISION

455 AIRPORT ROAD SE BUILDING A

SALEM OR 97301QUARTERLY MILEAGE REPORTOPERATIONS DURING THE QUARTER OF:

CCD ACCOUNT NUMBER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR Form 735-9002t

Edit your OR Form 735-9002t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR Form 735-9002t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR Form 735-9002t online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OR Form 735-9002t. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR Form 735-9002t Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR Form 735-9002t

How to fill out OR Form 735-9002t

01

Obtain the OR Form 735-9002t from the official website or local office.

02

Read the instructions carefully to understand the required information.

03

Fill in your personal information in the designated fields, including your name, address, and contact information.

04

Provide details related to the purpose of the form, such as specific inquiries or requests.

05

Attach any necessary documentation that supports your application or request.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form according to the provided submission guidelines (online, mail, or in-person).

Who needs OR Form 735-9002t?

01

Individuals applying for a specific state service or assistance.

02

Businesses seeking permits or regulatory approvals.

03

Organizations that require information from state agencies.

04

Anyone looking to communicate formal requests to the relevant authorities.

Fill

form

: Try Risk Free

People Also Ask about

Does Oregon participate in IFTA?

International Fuel Tax Agreement (IFTA) Oregon issues the following tax credentials to approved IFTA applicants: One IFTA license, and. A pair of IFTA decals for each qualified motor vehicle in the fleet requested.

How does the Oregon mileage tax work?

OReGO participants pay 1.9 cents for each mile they drive on Oregon roads. That money goes into the State Highway Fund for construction, maintenance, and preservation of roads and bridges. Participants sign up with an account manager, select a mileage reporting option, and receive a bill for reported miles.

What is Oregon IFTA fuel tax?

Oregon State Fuel Taxes Gasoline $0.38 per gallon. Aviation Gasoline $0.11 per gallon. Jet Fuel $0.03 per gallon. Use Fuel $0.38 per gallon.

What is an Oregon weight distance permit?

Motor carriers need this permit if: The vehicle's gross weight is over 26,000 pounds and\or has 3 axles. The vehicle(s) does not have registration (expired or no plates).

Who is exempt from weight-mile tax in Oregon?

Keep your records for at least three years. Commercial vehicles with a weight of 26,000 pounds or less are exempt from weight-mile tax. They meet their Oregon tax obligation by paying tax on all fuel purchases at the pump.

How much is mileage tax on electric vehicle in Oregon?

Legislation cuts fees for OReGO drivers But if they are enrolled in OReGO, electric and high-mpg vehicle owners do not have to pay the registration fee increases. Instead, they pay just the base registration ($43 per year) plus the road charge of 1.9 cents per mile.

How do I file Oregon weight-mile tax?

File Weight-Mile Tax Reports Quarterly Complete the Application to File Quarterly Weight-Mile Tax Reports (form 9030). Return this form to us by December 31, 2022. Submit completed forms to CCD Tax Help by email or fax 503-378-3736.

What is the Oregon fuel tax credit?

How do fuel tax credits work? Oregonians with fuel-powered vehicles pay an automatic 38 cents per gallon fuel tax. OReGO participants receive a credit for fuel tax they pay. Fuel consumption is reported by their in-car device or computed by the account manager based on average miles-per-gallon and miles driven.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the OR Form 735-9002t in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your OR Form 735-9002t in seconds.

Can I edit OR Form 735-9002t on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share OR Form 735-9002t from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out OR Form 735-9002t on an Android device?

On Android, use the pdfFiller mobile app to finish your OR Form 735-9002t. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is OR Form 735-9002t?

OR Form 735-9002t is a form used in the state of Oregon for the reporting of certain tax information, particularly related to vehicle use and transactions.

Who is required to file OR Form 735-9002t?

Anyone who engages in specific vehicle transactions, including businesses and individuals who purchase, sell, or transfer vehicles, is required to file OR Form 735-9002t.

How to fill out OR Form 735-9002t?

To fill out OR Form 735-9002t, you should provide accurate details concerning the vehicle, such as VIN, make, model, and the buyer and seller information, along with any applicable fees.

What is the purpose of OR Form 735-9002t?

The purpose of OR Form 735-9002t is to ensure the accurate and timely reporting of vehicle transactions to the state, aiding in tax collection and vehicle registration processes.

What information must be reported on OR Form 735-9002t?

The information required includes the vehicle identification number (VIN), year, make and model of the vehicle, purchaser and seller details, transaction date, and any applicable fees or taxes.

Fill out your OR Form 735-9002t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR Form 735-9002t is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.