Get the free 403(b)(7) Custodial Account Beneficiary Form

Show details

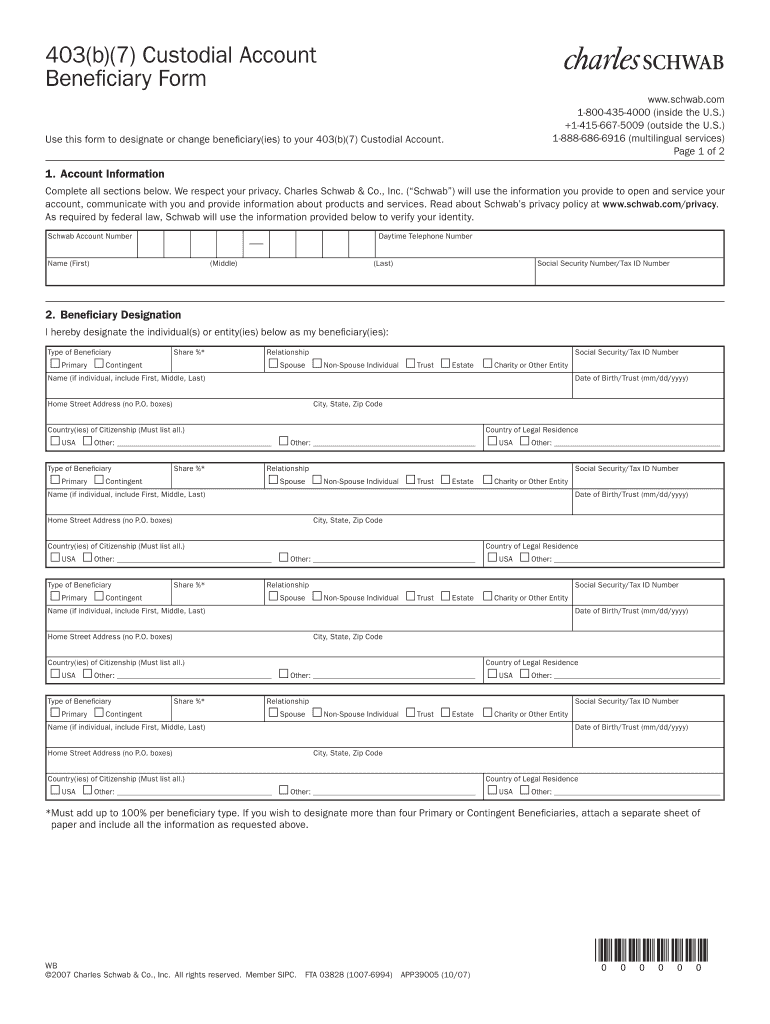

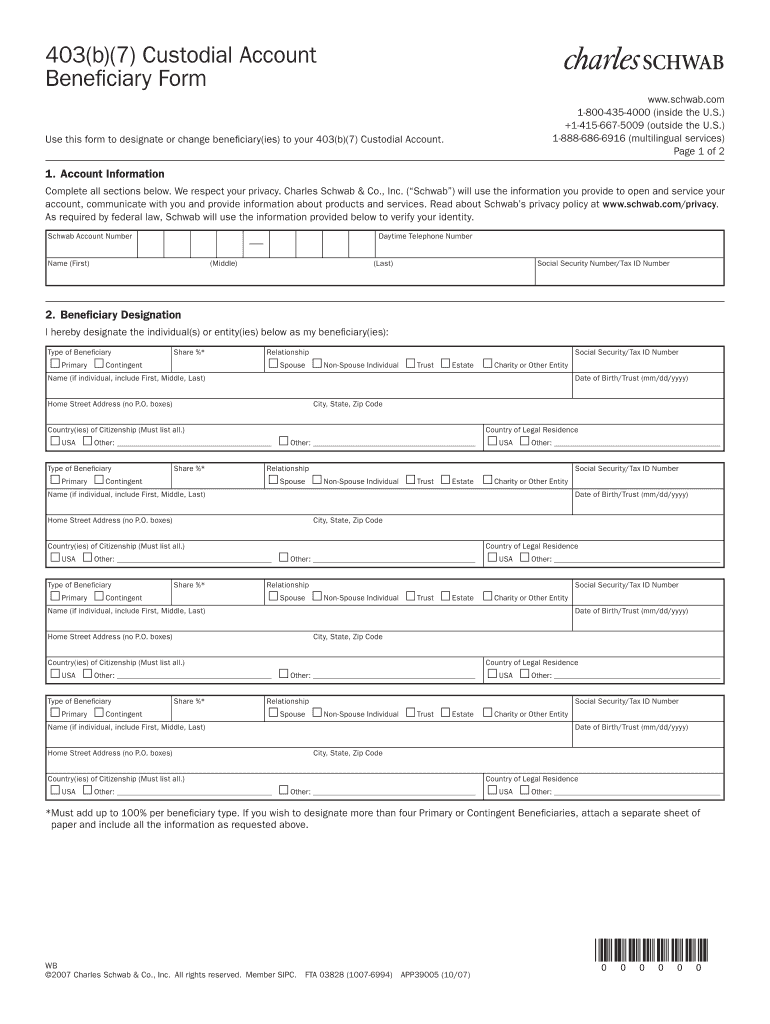

Use this form to designate or change beneficiary(ies) to your 403(b)(7) Custodial Account. Completed forms can be submitted by mail or in-person at a Schwab branch.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b7 custodial account beneficiary

Edit your 403b7 custodial account beneficiary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b7 custodial account beneficiary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 403b7 custodial account beneficiary online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 403b7 custodial account beneficiary. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b7 custodial account beneficiary

How to fill out 403(b)(7) Custodial Account Beneficiary Form

01

Obtain the 403(b)(7) Custodial Account Beneficiary Form from your plan provider or financial institution.

02

Fill out your personal information, including your name, address, and account number.

03

Identify the primary beneficiary by providing their name, relationship to you, date of birth, and Social Security number, if applicable.

04

If you want to name secondary beneficiaries, complete their information in the designated section.

05

Review the form for accuracy and ensure that all required fields are completed.

06

Sign and date the form at the bottom.

07

Submit the completed form to your plan provider or financial institution as instructed.

Who needs 403(b)(7) Custodial Account Beneficiary Form?

01

Individuals who have a 403(b)(7) account and want to specify beneficiaries for their account in case of death.

02

Anyone looking to ensure that their retirement savings are distributed according to their wishes.

03

People who are updating their beneficiary information due to life changes such as marriage, divorce, or the birth of a child.

Fill

form

: Try Risk Free

People Also Ask about

How do you fill out a beneficiary paperwork?

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

How to fill out 401k beneficiary form?

How to name a beneficiary on your 401(k) account. If you name a person as your beneficiary, you should provide their full legal name, mailing address, date of birth, and Social Security number. You may also be asked to explain their relationship to you.

How to fill out a 401k beneficiary form?

How to name a beneficiary on your 401(k) account. If you name a person as your beneficiary, you should provide their full legal name, mailing address, date of birth, and Social Security number. You may also be asked to explain their relationship to you.

Who should be the beneficiary of my 403b?

Eligible designated beneficiaries include a surviving spouse, a minor child of the deceased owner, disabled or chronically ill individual or any other person who is not more than 10 years younger than the deceased account holder.

Who should be listed as a beneficiary on a 401k?

Consider Your Options: Consider who you would like to inherit your assets and the manner in which they will receive them. You have the option to designate individuals such as your spouse, children, grandchildren, or other relatives, as well as entities like trusts, charities, or organizations as beneficiaries.

What is a 403 B )( 7 custodial account?

A 403(b)(7) custodial account allows you, as an eligible employee, to save and invest for your own retirement on a tax-deferred basis. You decide how much money you want deducted from your paycheck and deposited to the account.

Should my child be primary or contingent beneficiary?

If you want the kids to be first in line, use primary. The joint account owner will retain ownership before beneficiaries.

How do you write a beneficiary statement?

A complete beneficiary statement includes: the amount of the unpaid balance; the interest rate of the loan; the total of all overdue payments of principal and/or interest; the amounts of any periodic payments; the date the loan is due; the date to which real estate taxes and special assessments have been paid, if known;

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 403(b)(7) Custodial Account Beneficiary Form?

The 403(b)(7) Custodial Account Beneficiary Form is a document used to designate beneficiaries for a 403(b)(7) custodial retirement account, which is a type of tax-advantaged retirement savings account for employees of public schools and certain tax-exempt organizations.

Who is required to file 403(b)(7) Custodial Account Beneficiary Form?

Individuals who own a 403(b)(7) custodial account and wish to establish or update their beneficiary designations are required to file the 403(b)(7) Custodial Account Beneficiary Form.

How to fill out 403(b)(7) Custodial Account Beneficiary Form?

To fill out the form, you typically need to provide your personal information, details of your 403(b)(7) account, and the names and contact information of your intended beneficiaries. Ensure to follow any specific instructions provided by the custodian of the account.

What is the purpose of 403(b)(7) Custodial Account Beneficiary Form?

The purpose of the form is to clearly define who will receive the assets in the 403(b)(7) custodial account upon the account holder's death, thereby facilitating the smooth transfer of funds to beneficiaries.

What information must be reported on 403(b)(7) Custodial Account Beneficiary Form?

The information typically required includes the account holder's name and identification details, the account number, the beneficiaries' names, their relationship to the account holder, and their contact information. Additional instructions based on the specific custodian may also be included.

Fill out your 403b7 custodial account beneficiary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403B7 Custodial Account Beneficiary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.