Get the free BUSINESS DEBT SCHEDULE - NSDC

Show details

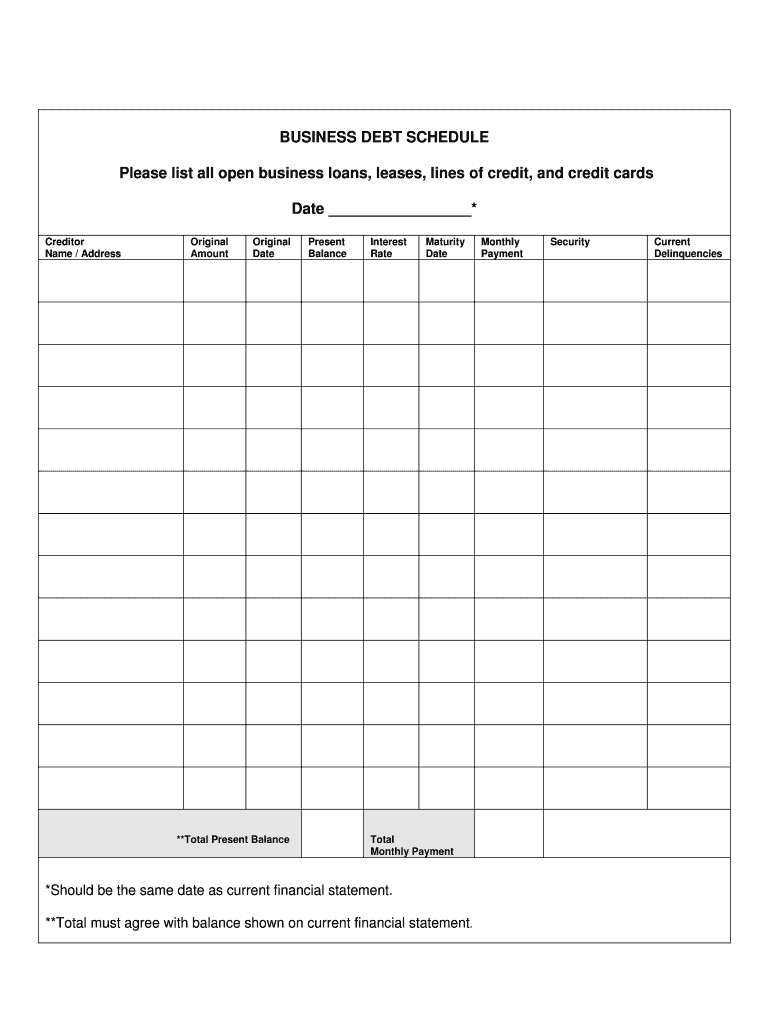

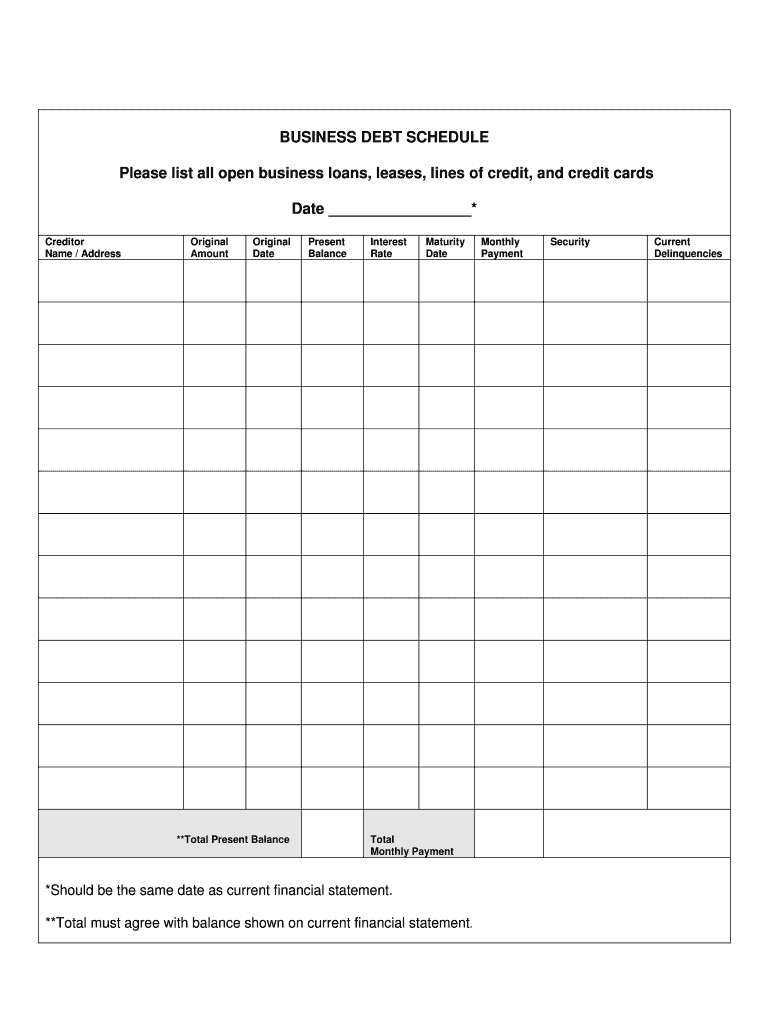

BUSINESS DEBT SCHEDULE Please list all open business loans, leases, lines of credit, and credit cards Date * Creditor Name / Address Original Amount Original Date **Total Present Balance Interest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business debt schedule

Edit your business debt schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business debt schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business debt schedule online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business debt schedule. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business debt schedule

How to fill out business debt schedule:

01

Start by gathering all the necessary information about your business debts, including the name of the creditor, the remaining balance, the interest rate, and the monthly payment amount.

02

Create a spreadsheet or use a template to organize and document this information. Include columns for each of the necessary details mentioned above.

03

List each business debt separately in rows, with a separate row for each creditor or loan.

04

Enter the name of the creditor in the first column of each row.

05

In the remaining columns, input the relevant details for each debt, such as the remaining balance, the interest rate, and the monthly payment amount.

06

Use formulas or calculations to determine the total amount of debt, the average interest rate, and the total monthly debt payment. These calculations can help provide a comprehensive overview of your business's outstanding debt.

07

Update the debt schedule regularly to ensure accuracy and to reflect any changes in your debts, such as paying off a loan or taking on new debt.

08

Use the business debt schedule as a tool to monitor your debt and make informed financial decisions for your business.

Who needs a business debt schedule:

01

Small business owners: A business debt schedule is essential for small business owners who want to have a clear picture of their outstanding debts. It helps them understand their financial obligations and make informed decisions related to their debts.

02

Financial advisers: Professionals who offer financial advice to businesses can benefit from a business debt schedule as it helps them assess a company's financial health and provide appropriate recommendations to manage and reduce debt.

03

Lenders and investors: Lenders and investors often require a business debt schedule when considering funding a business. It allows them to evaluate the company's existing debts and assess its ability to repay any additional financial obligations.

04

Auditors and accountants: Auditors and accountants rely on accurate and up-to-date business debt schedules to perform financial analysis, prepare financial statements, and ensure compliance with accounting regulations.

Overall, a business debt schedule is a useful tool for anyone involved in managing or evaluating a business's financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business debt schedule online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your business debt schedule to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit business debt schedule on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing business debt schedule right away.

How do I edit business debt schedule on an iOS device?

Create, modify, and share business debt schedule using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is business debt schedule?

Business debt schedule is a document that outlines the debts owed by a business, including the amount owed, interest rates, and payment terms.

Who is required to file business debt schedule?

Businesses that have taken on debts and loans are required to file a business debt schedule.

How to fill out business debt schedule?

To fill out a business debt schedule, gather all information on debts owed by the business and organize it in a clear and detailed manner.

What is the purpose of business debt schedule?

The purpose of a business debt schedule is to provide a comprehensive overview of the debts owed by a business, helping to manage and monitor debt payments.

What information must be reported on business debt schedule?

Information such as the name of the creditor, outstanding balance, interest rate, and payment terms must be reported on a business debt schedule.

Fill out your business debt schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Debt Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.