Get the free California Exempt Organization Annual Information Return

Show details

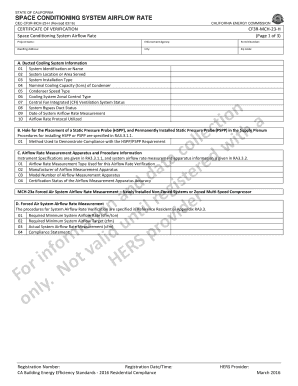

This document is an annual information return filed by California exempt organizations to report their gross receipts, expenses, and other financial information to the Franchise Tax Board for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california exempt organization annual

Edit your california exempt organization annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california exempt organization annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california exempt organization annual online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit california exempt organization annual. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california exempt organization annual

How to fill out California Exempt Organization Annual Information Return

01

Obtain the correct form: Download the California Form 199 from the California Franchise Tax Board website.

02

Fill in basic information: Provide the organization's name, address, and Employer Identification Number (EIN).

03

Complete the year information: Indicate the fiscal year and the date it began.

04

Report income and expenses: Fill in the revenue, expenses, and any applicable deduction details. Be precise with each amount.

05

Provide additional disclosures: If necessary, complete any required additional schedules related to your organization's activities.

06

Review for accuracy: Double-check all entries for correctness and completeness.

07

Sign and date the return: The organization's authorized representative must sign and date the form.

08

Submit the return: File the completed form with the California Franchise Tax Board by the due date, either electronically or by mail.

Who needs California Exempt Organization Annual Information Return?

01

California Exempt Organization Annual Information Return is required for tax-exempt organizations operating in California, including 501(c)(3) charities, foundations, and other nonprofit entities.

Fill

form

: Try Risk Free

People Also Ask about

Why would I be receiving a letter from the California franchise tax board?

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

What forms do nonprofits have to file in California?

California Nonprofit Filing Requirements IRS Form 990N. CA Franchise Tax Board Form 199N. CA Attorney General Form RRF-1. CA Secretary of State's Statement of Information.

How often does a nonprofit have to file statement of Information California?

A Statement of Information must be filed either every year for California stock, cooperative, credit union, and all qualified out-of-state corporations or every two years (only in odd years or only in even years based on year of initial registration) for California nonprofit corporations and all California and

Why am I getting a letter from the Franchise Tax Board?

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Do nonprofits have to file statements of information in California?

All nonprofits must file the Statement of Information (Form SI-100) every two years – with the Secretary of State. The form may be filed electronically and has a fee of $20.

Why did I receive a franchise tax?

The franchise tax is a kind of tax that is imposed by state law on businesses or corporations chartered within that state. The states charge this tax for the right of the business or corporation to exist as a legal entity and to do business within a particular state.

How do I respond to my Franchise Tax Board notice?

To respond to your notice: Register or log in to MyFTB and send FTB a message. Mail your response to the address on your notice. If available, fax your response to the number on your notice.

Who needs to file a California statement of Information?

Who must file an SOI? Corporations, LLCs, and other business entities must file a Statement of Information in California. This includes “domestic" companies (those registered to do business within California) and “foreign” companies (those from other states that are registered to do carry out business in California).

What is an exempt organization return?

State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

Why would I owe money to the Franchise Tax Board?

You filed your tax returns late. This is by far the most common reason you may still owe money. People don't realize that late filing, even by one day, will incur a late filing penalty. Late filing will cost you a 5% penalty plus ½ of 1% for each month the unpaid taxes aren't paid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Exempt Organization Annual Information Return?

The California Exempt Organization Annual Information Return is a form that tax-exempt organizations in California are required to file annually with the state. It provides essential information about the organization's financial status, activities, and governance.

Who is required to file California Exempt Organization Annual Information Return?

All tax-exempt organizations operating in California, including nonprofit organizations and charities that qualify under IRS Section 501(c), are required to file the California Exempt Organization Annual Information Return unless they meet specific exemption criteria.

How to fill out California Exempt Organization Annual Information Return?

Filling out the California Exempt Organization Annual Information Return involves collecting the necessary financial data, following the instructions provided by the California Franchise Tax Board, completing the required form accurately, and submitting it by the appropriate deadline.

What is the purpose of California Exempt Organization Annual Information Return?

The purpose of the California Exempt Organization Annual Information Return is to ensure transparency and accountability among tax-exempt organizations. It helps the state monitor compliance with tax laws and assess the organization's financial health and fundraising practices.

What information must be reported on California Exempt Organization Annual Information Return?

The California Exempt Organization Annual Information Return requires reporting information such as the organization's mission, program services, financial statements, sources of revenue, expenses, and details about governance and board members.

Fill out your california exempt organization annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Exempt Organization Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.