NM TRD RPD-41285 2003 free printable template

Show details

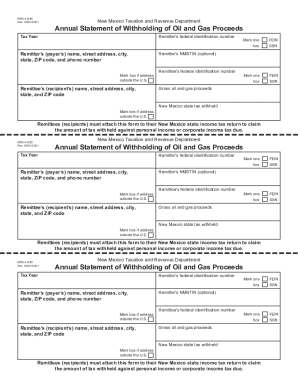

RPD-41285 INT. 10/2003 New Mexico Taxation and Revenue Department Annual Statement of Withholding of Oil and Gas Proceeds Taxable Year Payer s federal identification number Payer s name street address city state ZIP code and telephone number Payer s CRS identification number Recipient s identification number Recipient s name street address city state ZIP code Gross oil and gas proceeds New Mexico state tax withheld Recipients must attach this form to the New Mexico state income tax return to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41285

Edit your NM TRD RPD-41285 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41285 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD RPD-41285 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NM TRD RPD-41285. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41285 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41285

How to fill out NM TRD RPD-41285

01

Obtain the NM TRD RPD-41285 form from the New Mexico Taxation and Revenue Department's website or office.

02

Carefully read the instructions accompanying the form to ensure proper understanding.

03

Fill out your personal information, including your name, address, and tax identification number.

04

Provide detailed information regarding your income sources and deductions as required by the form.

05

Review the entries for accuracy and completeness before finalizing the form.

06

Sign and date the form where indicated.

07

Submit the completed form to the designated office either by mail or in person, following any additional submission instructions provided.

Who needs NM TRD RPD-41285?

01

Individuals or businesses in New Mexico who need to report certain types of income or claim deductions for tax purposes.

02

Taxpayers seeking to comply with state tax regulations and fulfill their filing requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is NM withholding?

Employers must withhold a part of the employee's wages for payment of income tax. New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return.

At what age do seniors stop paying property taxes in New Mexico?

All New Mexico seniors at least 65 years old may claim a special exemption.

What is a RPD 41359 form?

Owners must attach this form to the New Mexico state income tax return to claim the amount of tax withheld against personal income or corporate income tax due. Tax Year. New Mexico net income of the owner from the pass-through. entity. RPD-41359.

What is a NM compensating tax return?

Compensating tax is imposed when a business or an individual uses tangible property, a service, a license or a franchise that was acquired as a result of a transaction with a person located outside the state that would have been subject to gross receipts tax if the seller had nexus in New Mexico.

Does New Mexico require you to file a tax return?

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico. You must also file a New Mexico return if you want to claim: a refund of New Mexico state income tax withheld from your pay, or.

Is New Mexico tax friendly for retirees?

New Mexico is a moderately tax-friendly state for retirees. The state recently enacted a law that exempts social security from taxation up to $100,000 for individuals or $150,000 for couples. This exemption became effective in 2022.

What is a pass-through entity withholding?

Pass-Through Entity Annual Withholding Return A Pass-Through Entity (PTE) is generally an entity that passes its income or losses through to its owners instead of paying the related tax at the entity level. A PTE can be any of the following: Estates. Trusts. S corporations.

What is NM RPD 41072?

Form RPD-41072 is used to reconcile the total amounts shown as withheld on annual statement of withholding information returns furnished to recipients (Federal Form W2) with the total tax withheld and paid to New Mexico on CRS-1 returns.

Which states allow composite returns?

State Involvement States that do allow composite returns include: Alabama, Connecticut, Delaware, Idaho, Wisconsin, South Carolina, Massachusetts, Michigan, North Dakota, New Hampshire, Tennessee, Texas, Nebraska, Oklahoma, Utah, Arizona, New York and Vermont, as well as the District of Columbia.

What is a composite tax return?

Composite return overview Simply stated, a composite return is filed by a pass-through entity and reports the state income of all non-resident owners as one group. If a non-resident owner participates in a composite return, that non-resident is not required to file an individual income tax return.

What is an Annual Statement of pass-through entity withholding?

Pass-Through Entity Annual Withholding Return A Pass-Through Entity (PTE) is generally an entity that passes its income or losses through to its owners instead of paying the related tax at the entity level.

Does an LLC pay taxes in New Mexico?

S-corporations, limited liability companies and other pass-through entities doing business in the state must file a New Mexico income tax return.

Is New Mexico a good state for retirement?

New Mexico has become a popular retirement destination, and it's easy to see why. The state has plenty of characteristics that attract retirees, including its low cost of living, warm climate, rich culture, and many amenities.

Does New Mexico have a composite tax return?

Alternatively, effective on January 1, 2022, pass-through entities may file a composite tax return for electing non-resident owners. See NMSA 1978 § 7-3-14.

What is annual withholding tax?

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4.

What is a composite return?

A Michigan Composite Individual Income Tax Return (Form 807) is a collective individual income tax filing for two or more participating nonresident members filed by the flow-through entity (FTE). This form is used to report and pay individual income tax under Part 1 of Public Act 281 of 1967, as amended.

Does a pass-through entity have to file a tax return?

Each pass-through entity owner reports and pays tax on their share of business income on personal tax Form 1040.

What is pass through withholding in Wisconsin?

A pass-through entity is required to make quarterly withholding tax payments on a nonresident member's share of income attributable to Wisconsin. The pass-through entity must make quarterly payments of withholding tax on or before the 15th day of the 3rd, 6th, 9th, and 12th month of the taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NM TRD RPD-41285 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NM TRD RPD-41285 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit NM TRD RPD-41285 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NM TRD RPD-41285 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit NM TRD RPD-41285 on an Android device?

You can make any changes to PDF files, such as NM TRD RPD-41285, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NM TRD RPD-41285?

NM TRD RPD-41285 is a form used by the New Mexico Taxation and Revenue Department for reporting certain tax information.

Who is required to file NM TRD RPD-41285?

Entities or individuals who engage in specific business activities or transactions that require reporting to the New Mexico Taxation and Revenue Department are required to file NM TRD RPD-41285.

How to fill out NM TRD RPD-41285?

To fill out NM TRD RPD-41285, one must provide accurate information regarding the taxpayer's identification, the specific transactions or business activities being reported, and any other relevant details as required by the form.

What is the purpose of NM TRD RPD-41285?

The purpose of NM TRD RPD-41285 is to ensure compliance with New Mexico tax laws by collecting necessary information from businesses and individuals regarding their taxable activities.

What information must be reported on NM TRD RPD-41285?

NM TRD RPD-41285 requires reporting of the taxpayer's name, address, taxpayer identification number, details of the transactions or activities, and any other information specified by the New Mexico Taxation and Revenue Department.

Fill out your NM TRD RPD-41285 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41285 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.